FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

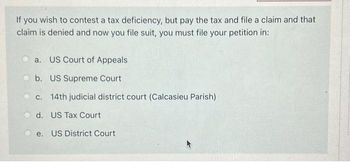

Transcribed Image Text:If you wish to contest a tax deficiency, but pay the tax and file a claim and that

claim is denied and now you file suit, you must file your petition in:

a. US Court of Appeals

b. US Supreme Court

c. 14th judicial district court (Calcasieu Parish)

d. US Tax Court

e. US District Court

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. The secondary authority should be cited in the analysis section of a tax file memo. Is true or false? 2. What is the title of Section 152? a.Dependent defined b.Allowance of deductions for personal exemptions (151) c.Allowance for deductions (161) d.None of the above 3.(True/False) Letter rulings are a source of tax law.arrow_forwardTax return preparers should be aware of which of the following? A) Taxpayers who have more than one Form W-2 B) Taxpayers without a state driver's license C) Taxpayers with more than two dependents D) Taxpayers with a non-standard or altered Form W-2arrow_forwardDoes a sole trader have to register the business with the IRD for tax purposes in NewZealand? – explain your answer.arrow_forward

- In what circumstances can a taxpayer challenge an assessment outside the ordinary appeal process. Discussion should be strictly based on statutory and common law. Explain briefly.arrow_forward1. Establishes the tax differences between individuals and corporations in the United States. 2. Explains Form M-1 and what it is used for. 3. Explains Form 1125-A and what it is used for.arrow_forwardI am stuck on the Self-Study Problem 2.9 in 2019 Income Tax Fundamentals. I am suppose to on #1 enter the amount from form 1040, line 10. However, if you are filing form 2555 or 2555-ez (relating to foreign earned income), enter the amount from line 3 of the foreign earned income tax worksheet. There is not a line #10 on the 1040 provided in the book???arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education