Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

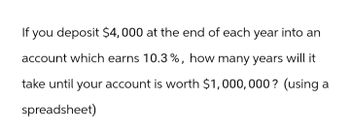

Transcribed Image Text:If you deposit $4,000 at the end of each year into an

account which earns 10.3%, how many years will it

take until your account is worth $1,000,000? (using a

spreadsheet)

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- You deposit $2000 in an account that pays 7% interest compounded semiannually. After 2 years, the interest rate is increased to 7.52% compounded quarterly. What will be the value of the account after a total of 4 years? i Click the icon to view some finance formulas. The value of the account will be $ (Round to the nearest dollar as needed.)arrow_forwardYou would like to contribute to a savings account over the next three years in order to accumulate enough money to take a trip to Europe. Assume an interest rate of 20%, compounded quarterly. How much will accumulate in three years by depositing $560 at the beginning of each of the next 12 quarters? Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (EV of $1. PV of $1. EVA of $1. PVA of $1. FVAD of $1 and PVAD of $1) Table, Excel, or calculator function Payment: Future Value: n= FVAD of $1 $ 560 12 5.0%arrow_forwardIf you save $1298 per year for the next 17 years and earn 7.2% interest on your savings, how much will you expect to have at the end of 17 years? Assume deposits are made at the beginning of each year. Give your answer in dollars to the nearest one dollar.arrow_forward

- You would like to have 950,000 when you retire in 30 years. How much should you invest each quarter if you can earn a rate of 4.8% compounded quarterly? How much should you deposit each quarter? How much total money will you put into the account? How much total interest will you earn?arrow_forwardYou just opened a brokerage account, depositing $4,500. You expect the account to earn an interest rate of 8.57 % . You also plan on depositing $3,000 at thenend of years 5 through 10. What will be the value of the account at the end of 20 years, assuming you earn your expected rate of return?arrow_forwardSuppose you want to save $220,000 for retirement. You will do so by putting monthly deposits into an account that gets 5% interest compounded monthly for 30 years. What should your monthly deposits be? Round your answer to the nearest cent and include units. Make sure you show the formula you used and the values you filled in.arrow_forward

- if your bank pays you 1.5% interest and you deposit $700 today, what will be your balance in 5 years? (round to the nearest cent)please show step by steparrow_forwardYour bank offers a savings account that pays 2.5% interest, compounded annually. If you invest $1,000 in the account, then how much will it be worth at the end of 25 years?arrow_forwardHow much would be in your savings account in 12 years if you deposited $1,500 today? Assume the bank pays 5 percent per year.arrow_forward

- At the end of each of the next 8 years, you planto put $25,000 of your annual salary in thebank. If the annual interest rate is 3%, what isthe present value of this planned savingsstream? What will the balance in your bankaccount be at the end of the 8 year period?arrow_forwardIf you deposit some money into a bank account today, to the nearest year, how long will it take to triple your deposit if it earns 32% annually? note: calculate to the nearest decimal. For example, if the answer is 12.56 years, then input your answer as 12.6arrow_forwardYou invest $24,050.85 in a savings account today at 5% annual interest. How much will be in your account in 15 years. Round to the nearest dollar and use the $ symbol. use a comma if applicablearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education