Advanced Engineering Mathematics

10th Edition

ISBN: 9780470458365

Author: Erwin Kreyszig

Publisher: Wiley, John & Sons, Incorporated

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:& MORE & MORE T-SHIRT - Twice X

+

n120.acellus.com/StudentFunctions/Interface/acellus_engine.html?ClassID=163947859#

uTube

Translate

New Tab

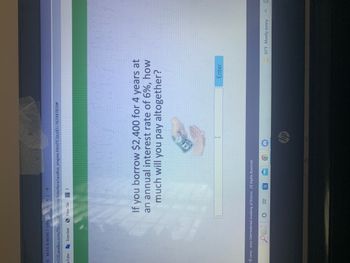

If you borrow $2,400 for 4 years at

an annual interest rate of 6%, how

much will you pay altogether?

Enter

3

2003-2022 International Academy of Science. All Rights Reserved.

3:0

@

I

hp

92

H

92°F Mostly sunny ^ @

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Small Business Administration offers business loans at 5.8% interest compounded monthly for 8 years. If the owner of a restaurant can afford monthly payments of $550, what is the maximum amount the owner can borrow?arrow_forwardA loan of 18,000 is made at 4.5% interest, compound annually. After how many years will the amount due reach 24,000 or more?arrow_forwardI want to be able to withdraw $40,000 each year for 20 years. My account earns 4% interest compounded monthly. How much do I need in my account at the beginning? How much total money will I pull out of the account? How much of that money is interest?arrow_forward

- You have a $8,000 credit card debt, and you plan to pay it off through monthly payments of $200. If you are being charged 15% interest per year, how long (to the nearest 0.5 years) will it take you to repay your debt? yrarrow_forwardHow much interest (to the nearest dollar) would be saved on the following loan if the condominium were financed for 15 rather than 30 years? A $253,000 condominium bought with a 30% down payment and the balance financed for 30 years at 5.05%arrow_forwardSuppose you deposit $500 at the end of each quarter into an account that pays 3% annual interestcompounded quarterly. How much do you have after 8 years?arrow_forward

- "On his tax return this year, Steve reports $575 income from interest. Assuming an interest rate of about 4.6%, about how much does Steve have invested?"arrow_forwardJasica Parker would like to have $26,000 to buy a new car in 7 years. To accumulate $26,000 in 7 years, how much should she invest monthly in a sinking fund with 3% interest compounded monthly? The monthly invested payment is $ (Round up to the nearest cent.)arrow_forwardFind the amount of simple interest on a loan of $3,500 at 9 1/2% interest for 14 years.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated

Advanced Engineering MathematicsAdvanced MathISBN:9780470458365Author:Erwin KreyszigPublisher:Wiley, John & Sons, Incorporated Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education

Numerical Methods for EngineersAdvanced MathISBN:9780073397924Author:Steven C. Chapra Dr., Raymond P. CanalePublisher:McGraw-Hill Education Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY

Introductory Mathematics for Engineering Applicat...Advanced MathISBN:9781118141809Author:Nathan KlingbeilPublisher:WILEY Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Mathematics For Machine TechnologyAdvanced MathISBN:9781337798310Author:Peterson, John.Publisher:Cengage Learning,

Advanced Engineering Mathematics

Advanced Math

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:9780073397924

Author:Steven C. Chapra Dr., Raymond P. Canale

Publisher:McGraw-Hill Education

Introductory Mathematics for Engineering Applicat...

Advanced Math

ISBN:9781118141809

Author:Nathan Klingbeil

Publisher:WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:9781337798310

Author:Peterson, John.

Publisher:Cengage Learning,