Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

How do I write the formula to compute which proposal to select? The sample answer is given next to it. I need to write an “IF” statement and be able to drag that “IF” statement down to the other cells and for it to be correct.

Transcribed Image Text:7

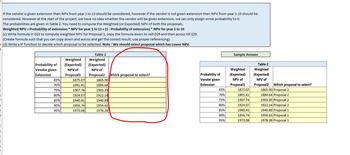

If the vendor is given extension then NPV from year 1 to 13 should be considered, however if the vendor is not given extension then NPV from year 1-10 should be

considered. However at the start of the project, we have no idea whether the vendor will be given extension, we can only assign some probability to it.

The probabilities are given in Table 2. You need to compute the Weighted (or Expected) NPV of both the proposals.

Weighted NPV = Probability of extension * NPV for year 1 to 13+ (1 - Probability of extension) * NPV for year 1 to 10

(c) Write formula in D23 to compute weighted NPV for Proposal 1, copy the formula down to cell D29 and then across till E29.

(Create formula such that you can copy down and across and get the correct result, use proper referencing)

(d) Write a IF function to decide which proposal to be selected. Note: We should select proposal which has Lower NPV.

Probability of

Vendor given

Extension

65%

70%

75%

80%

85%

90%

95%

Weighted

(Expected)

NPV of

Proposal1

1875.07

1891.41

1907.74

1924.07

1940.41

1956.74

1973.08

Table 2

Weighted

(Expected)

NPV of

Proposal2

1865.90

1884.64

1903.39

1922.14

1940.89

1959.63

1978.38

Which proposal to select?

Probability of

Vendor given

Extension

65%

70%

75%

80%

85%

90%

95%

Sample Answer

Weighted

(Expected)

NPV of

Proposal1

1875.07

1891.41

1907.74

1924.07

1940.41

1956.74

1973.08

Table 2

Weighted

(Expected)

NPV of

Proposal2 Which proposal to select?

1865.90 Proposal 2

1884.64 Proposal 2

1903.39 Proposal 2

1922.14 Proposal 2

1940.89 Proposal 1

1959.63 Proposal 1

1978.38 Proposal 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1. Which of the following would be designed to estimate a numerical measurement of a population, such as monetary value?* A. Sampling for variables B. Sampling for attributes C. Sequential sampling D. Discovery sampling E. None of themarrow_forwardSuppose you're given a data set that classifies each sample unit into one of four categories: A, B, C, the data as A = 1, B=2, C = 3, and D=4. Are the data consisting of the classifications A, B, C, and D or quantitative? Are the data consisting of the classifications A, B, C, and D qualitiative or quantitative? OA. Qualitative, because they are measured on a naturally occuring numerical scale. B. Quantitative, because they are measured on a naturally occuring numerical scale. C. Quantitative, because they can only be classified into categories. D. Qualitative, because they can only be classified into categories. *** After the data are input as 1, 2, 3, or 4, are they qualitative or quantitative? OA. Qualitative, because they cannot be meaningfully added, subtracted, multiplied, or divided. B. Qualitative, because they are measured on a naturally occurring numerical scale. OC. Quantitative, because they are measured on a naturally occurring numerical scale. OD. Quantitative, because…arrow_forwardGive an example where researchers have used an event study and what did they find? Was it consistent with the EMH?arrow_forward

- What are the two major types of tests that have been performed totest the validity of the CAPM? (beta stability; slope of the SML)Explain their results.arrow_forwardb. Convert the Data available into a Table and choose a Design of your choice.c. Obtain the Mean, Median, Standard Deviation, Variance, Quartiles (Q1, Q2, Q3, Q4), IQRfor the entire data (1895-1998), using ONLY Excel Functions (not using the Analysis ToolPak Add-In)d. Use the Statistical measurements generated from the Analysis Toolpak (Add-In) andcompare the values obtained in (c). Comment on your findings.arrow_forwardWhat is the criteria for judging the quality of research designs?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education