ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

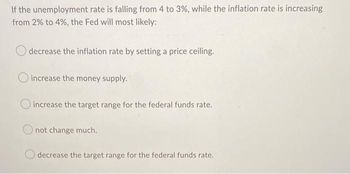

Transcribed Image Text:If the unemployment rate is falling from 4 to 3%, while the inflation rate is increasing

from 2% to 4%, the Fed will most likely:

decrease the inflation rate by setting a price ceiling.

increase the money supply.

O increase the target range for the federal funds rate.

not change much.

decrease the target range for the federal funds rate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- If the Federal Reserve tries to target inflation near 2%, the inflation rate is 3%, and output is 3% below potential GDP, then the target federal funds rate according to the Taylor rule is: Group of answer choices 3%. 4%. 5%. 6%.arrow_forward2. The theory of liquidity preference and the downward-slopingaggregate demand curve The following graph shows the money market in a hypothetical economy. The central bank in this economy is called the Fed. Assume that the Fed fixes the quantity of money supplied. Suppose the price level decreases from 90 to 75. Shift the appropriate curve on the graph to show the impact of a decrease in the overall price level on the market for money. 12 Money Supply 10 Money Demand Money Supply MD1 2 MD2 10 20 30 40 50 60 MONEY (Billions of dollars) INTEREST RATE (Percent)arrow_forwardAccording to the reading, the Fed's mission is to: promote easy access to commodity money. promote maximum employment and stable prices. promote high interest rate for savers. promote an understanding of its role in the economy.arrow_forward

- When the Fed decreases the discount rate, banks are likely to the money supply their lending and A) increase; increases B) increase; decreases C) decrease; increases D) decrease; decreasesarrow_forwardAn increase in the money supply occurs when Question 16 options: the price level falls. the interest rate increases. the Fed makes open-market purchases. money demand increases.arrow_forwardSuppose the economy is experiencing inflation. If the Federal Reserve enacts contractionary monetary policy, interest rates will likely Multiple Choice rise causing prices to decrease. fall causing prices to increase. fall causing prices to decrease. rise causing prices to increasearrow_forward

- Assume the inflation rate is 6% and there is every indication that price levels will continue to rise. The Fed should engage in which policy with respect to open market operations: Buy bonds Sell bonds. Increase reserve ratio Decrease reserve ratioarrow_forwardApplied Problems on Monetary Policy and Interest Rates 1. For each of the following questions, draw the Money Demand curve (MD) and Money Supply curve (MS) and label the equilibrium interest rate as i*. Also show how the MS- MD graph changes due to the given events and as a result how the equilibrium interest rate changes. (In your answer you should clearly state and show what happens to the MS and MD curves and also what happens to the interest rate).arrow_forwardThe primary instrument of monetary policy for the Fed is the discount rate. True Falsearrow_forward

- Suppose that the money supply increases by 20 percent. If there is no inflation, what does the quantity theory of money tell us must happen to real GDP? It must increase by more than 20 percent. It must increase by less than 20 percent. It must increase by exactly 20 percent. None of the above are correct. Which of the following statements is true of the federal funds market? No banks are refused loans in the federal funds market. In the federal funds market, banks with a shortage of reserves borrow funds, while banks with an excess of reserves lend them out. The interbank lending system works more efficiently in periods of financial panic than in periods of financial stability. Although the federal funds market aims to provide liquidity to needy banks, it is not very popular as overnight loans are logistically inefficient for large banks. On a graph with real GDP growth on the x-axis and the unemployment rate on the y-axis, you plot each year's values for the United States as…arrow_forwardAs per the additional reading “Fed’s response to Inflation Data in Oct 2021”, all the following statements are true EXCEPT Group of answer choices Worker’s wages have risen 4.2% compared to last year. Supply chain bottlenecks are likely to persist in 2022. The Federal Reserve is going to raise interest rates immediately. The Federal Reserve also announced a plan to start winding down another effort it undertook to help the economy through the pandemic: its purchases of at least $120 billion worth of bonds each month.arrow_forwardDraw and properly label three graphs of money supply-money demand (in one graph), investment demand, and AD-AS (6%). Then, referring to the graphs in your explanation, use one of the three traditional monetary tools to explain how the monetary transmission mechanism works to close recessionary and also inflationary gaps. (9%)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education