Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:4

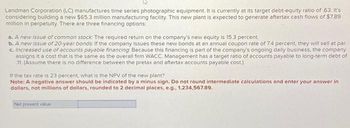

Landman Corporation (LC) manufactures time series photographic equipment. It is currently at its target debt-equity ratio of 63. It's

considering building a new $65.3 million manufacturing facility. This new plant is expected to generate aftertax cash flows of $7.89

million in perpetulty. There are three financing options:

a. A new issue of common stock. The required return on the company's new equity is 15.3 percent.

b. A new issue of 20-year bonds. If the company issues these new bonds at an annual coupon rate of 7.4 percent, they will sell at par

c. increased use of accounts payable financing Because this financing is part of the company's ongoing daily business, the company

assigns it a cost that is the same as the overall firm WACC Management has a target ratio of accounts payable to long-term debt of

11. (Assume there is no difference between the pretax and aftertax accounts payable cost)

If the tax rate is 23 percent, what is the NPV of the new plant?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer in

dollars, not millions of dollars, rounded to 2 decimal places, e.g.. 1,234,567.89.

Net present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Nonearrow_forward6. A machine could be purchased for £800,000; it would be used for 3 years and then sold for £580,000. It would qualify for capital allowances at 18% reducing balance basis with a balancing allowance or charge on disposal. The company pays tax at 20% and has a cost of capital of 10%. What is the present value of the tax cashflow at time 1, to the nearest £100? A £14,700 B £26,200 C £28,800 D £144,000arrow_forward5.2 REQUIRED Study the information provided below and answer the following questions. Ignore taxes. 5.2.1 Compute the Net Present Value. Your answer must include the calculations of the present values as well as the net present values. 5.2.2 Should the new machine be considered for acceptance? Why? 5.2.3 Calculate the Internal Rate of Return (expressed to two decimal places) if the machines have no scrap/resale value. Your answer must include two net present value calculations (using consecutive rates/percentages) and interpolation. INFORMATION Vendit Limited is looking at the possibility of investing in fifty vending machines. The machines would cost R800 000, and its cash operating expenses would total R510 000 per year. The machines are expected to have a useful life of five years. At the end of five years, the machines would be sold for R160 000. On the benefit side, it is estimated that the machines would generate cash revenues of R760 000 per year. The cost…arrow_forward

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment Answer is complete but not entirely correct. a. Total value b. Laputa's equity 1 $ 73 33 40 $ $ 12 19 476 285 Year 2 $93 43 50 15 22 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 60% by equity and 40% by debt. Its cost of equity is 18%, its debt yields 9%, and it pays corporate tax at 30%. 3 $ 108 48 60 18 25 a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole…arrow_forwardSuppose you sell a fixed asset for $115,000 when it's book value is $135,000. If your company's marginal tax rate is 21%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)?arrow_forwardPlease tutor help me with this questionarrow_forward

- Suppose you sell a fixed asset for $125,000 when its book value is $139,000. If your company's marginal tax rate is 30%, what will be the effect on cash flows of this sale (i.e., what will be the after-tax cash flow of this sale)? Group of answer choices a. $120,080 b. $129,200 c. $9,800 d. $14,000arrow_forwardPlease don't provide answer in image format thank youarrow_forwardUse the following information of the next 4 questions: Clayton Enterprise considers investing a total of $40,000 in Al automation. • This $40,000 will be 100% depreciated over the three-year life of the project. • The project will require an initial $10,000 investment in NWC and the tax rate is 20%. • At the end of the project's life, the fixed assets will be worth $20,000, and Clayton Enterprise will recover $8,000 that was tied up in working capital. • The OCF for the next 3 years is $32,000. Calculate the CFFA in Yr 0 O-40000 O-70000 O-60000 O-30000 -50000 Show Transcribed Text Calculate the CFFA in Yr 3: CFFA3 O 59000 O 57000 O 54000 O 56000 O 55000 O 58000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education