Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

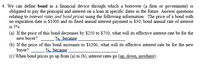

Transcribed Image Text:4. We can define bond as a financial device through which a borrower (a firm or government) is

obligated to pay the principal and interest on a loan at specific dates in the future. Answer questions

relating to interest rates and bond prices using the following information: The price of a bond with

no expiration date is $1000 and its fixed annual interest payment is $50; bond annual rate of interest

is 5%.

(a) If the price of this bond decreases by $250 to $750, what will its effective interest rate be for the

new buyer? %, because

(b) If the price of this bond increases to $1200, what will its effective interest rate be for the new

buyer?

(c) When bond prices go up from (a) to (b), interest rates go (up, down, nowhere).

%, because

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A bond is currently selling for $880. This indicates that this bond is _____, and you would expect that the coupon rate would be _____ than the current market rate. Attractive; greater than Attractive; less than Unattractive; greater than Unattractive; less thanarrow_forwardPICK ONE: Explain why YOU: Suppose that 6 months after you purchase the bond, the market rate for interest on this type of bond falls to 7.00%. This will cause the (coupon / market price / par value) to (fall / rise). From the issuer’s perspective, the lower interest rate means that he or she would be (worse / better) off issuing new bonds at this lower rate than continuing to pay you 9%.arrow_forwardIllustrate your answers by graphing bond prices versus time to LO 2 19. Interest Rate Risk Both Bond Bill and Bond Ted have 5.8 percent coupons, make semiannual payments, and are priced at par value. Bond Bill has 5 years to maturity, whereas Bond Ted has 25 years to maturity. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of Bond Bill? Of Bond Ted? Both bonds have a par value of $1,000. If rates were to suddenly fall by 2 percent instead, what would the percentage change in the price of Bond Bill be then? Of Bond Ted? Illustrate your answers by graphing bond prices versus YTM. What does this problem tell you about the interest rate risk of longer-term bonds?arrow_forward

- i. Suppose at t = 0 you think that G - Sec 10-year maturity on - the run bond is under-priced, and you bet that its price will increase in the future. You don't have the bond in your hand, but you know there is a repo-market where you can take your position. Let the price of the bond is Rs. 97.85. Let the repo - dealer charges a hair - cut of Rs. 0.25. Say after time t = 10 days, the price of the bond becomes Rs. 98.25. Find the realized return of the bond. (Use n/360 notation). ii. What if the price reaches 98.25 after t = 180 days. Can you still make profit?arrow_forwardK Using the formula given below: F-P P if the market price of a $1,000-face-value discount bond changes from $925 to $950, the yield to maturity decreases by%. (Round your response to two decimal places.) Rbonds =arrow_forwardWhich statements is INCORRECT? Treasury bonds (T-bond) have maturities up to 30 years A coupon bond is called a discount bond when its market price is less than its fair price A bond's yield to maturity (YTM) is the return an investor earns if holding the bond until its maturity Treasury bills (T-bill) have maturities up to one yeararrow_forward

- The rise and fall of a bond's price has a direct inverse relationship to its yield to maturity, or interest rate. As prices go up, the yield declines and vice versa. For example, a $1,000 bond might carry a stated annual yield, known as the coupon of 8%, meaning that it pays $80 a year to the bondholder. If that bond was bought for $870, the actual yield to maturity would be 9.2% ($80 annual interest on $870 of principal). Do you agree with this analysis? Briefly explain.arrow_forwardSuppose the current price of the bond is $95, the YTM is 4%, and the duration of the bond is 9. If YTM decrease from 4% to 3.9%, approximate the change in price using duration of the bond. Price would increase by ____%arrow_forwardWhat is the current value of a 30-year bond making semi-annual coupon payments that has a face value of $1,000 and a coupon rate of 8%, if the YTM is 4%, how much does the bond currently sell for? Does the bond sell at a discount, premium, or at face value? Reference the below formulas when solving the problem above: PV = FV / (1+r)^t FV = PV(1+r)^t FVA = PMT(((1+r)^t) -1) / r FVA = PMT((1+(r/12)^t(12))-1)/(r/12) PVA = PMT(((1-(1+r)^-t) / r)) PVA = PMT((1-(1+(r/12))^-t(12)))/(r/12) Bo = PMT ((1-(1+r/2)^-t(2))) / r/2 + FV / (1+r/2)^t(2)arrow_forward

- klp.3arrow_forward4. Suppose that the market rate of interest is 12 per cent on a government bond with a perpetuity payment, which is a coupon value (annual payment) of £6 per year indefinitely. The face value of the loan is £100. a) Define and calculate the price of the bond? Answers.. b) At what yield (or rate) will the loan be trading at par? Explain whether it is trading above or below par in a). Answers... c) Assume that the rate of interest is 'expected' to drop to 3 per cent, derive and calculate the rate of capital gain (or loss)? Answers . d) Derive and explain the expression for the number of bonds held representing the amount of money spent on bonds (B) with the corresponding mean rate of return (HR). Answers.. e) Imagine that W = £40,000, what is the amount spend on bonds, B', if the standard deviation (SD) of earnings (s) is equal to 0.10 with a 3,000,the SD of the total return on bonds, SR. What is the money holding, which is M*? Answers.. Find the mean return on bonds with u = 1. Answer..arrow_forwardBond J has a coupon rate of 4.2 percent. Bond K has a coupon rate of 14.2 percent. Both bonds have ten years to maturity, a par value of $1,000, and a YTM of 9.4 percent, and both make semiannual payments. a. If interest rates suddenly rise by 2 percent, what is the percentage change in the price of these bonds? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. If interest rates suddenly fall by 2 percent instead, what is the percentage change in the price of these bonds? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a. Percentage change in price b. Percentage change in price Bond J % % Bond K do do % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education