Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

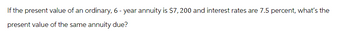

Transcribed Image Text:If the present value of an ordinary, 6- year annuity is $7,200 and interest rates are 7.5 percent, what's the

present value of the same annuity due?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- What is the future value of an 8%, 5-year ordinary annuity that pays $350 each year? Do not round intermediate calculations. Round your answer to the nearest cent. 2$ If this were an annuity due, what would its future value be? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardWhat are the annual cash flows (in $) of an annuity for 19 years, which costs $48,783 today, if the discount rate is 7.76 percent? Answer to two decimals.arrow_forwardWhat is the present value of an ordinary annuity of 2,200 per year for 15 years discounted back to the present at 16 percent?arrow_forward

- Suppose you are going to receive $14,500 per year for five years. The appropriate interest rate is 8 percent. a-1. What is the present value of the payments if they are in the form of an ordinary annuity? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. a-2. What is the present value of the payments if the payments are an annuity due? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b-1. Suppose you plan to invest the payments for five years. What is the future value if the payments are an ordinary annuity? Note: Do not round intermediate..arrow_forward9. Examine the time line for Now the annuity shown. 250 (1.015) 250 (1.015) 250 (1.015) E 250 (1.015)23 250 (1.015) a) What is the duration of this annuity? How can you tell? b) Determine the annual rate of interest and the number of compounding periods per year. c) Determine the present value of this annuity. d) Determine the total interest earned. ANSWER 9. a) 6 years b) 6%; 4 compounding periods per year c) $5007.60 d) $992.40 Time (3-month periods) 1 2 250 250 250 250 250 3 23 24 H-Harrow_forwardA perpetuity of $1 each year, with the first payment due immediately, has a present value of $25 at an annual effective rate of i%. The owner exchanges it for another perpetuity with the first payment due immediately and subsequent payments due at two year intervals. What should the payment of the second perpetuity be, in order to keep the same interest rate, i%, and the same present value? A B с D E Less than $1.90 At least $1.90, but less than $1.94 At least $1.94, but less than $1.98 At least $1.98, but less than $2.02 $2.02 or morearrow_forward

- 5) Consider a whole life annuity-due of 46,000 per year issued to a life age 65. Calculate the probability that the sum of total undiscounted benefit payments is greater than the expected present value of the annuity at issue. Use the SULT with 5% interest.arrow_forwardIf the present value of an ordinary, 6-year annuity is $6400 and interest rates are 2.5 percent, what’s the present value of the same annuity due? (Round your answer to 2 decimal places.) Present value $arrow_forwardWhat is the PV of a 6-year, $149 annuity due if the annual interest rate is 5% ?arrow_forward

- An annuity that pays $12,500 a year at an annual interest rate of 5.45 percent costs $150,000 today. What is the length of the annuity time period?arrow_forwardIf the future value of an ordinary, 6-year annuity is $5,900 and interest rates are 7.5 percent, what is the future value of the same annuity due? (Round your answer to 2 decimal places.)arrow_forwardAn annuity that pays $13,000 a year at an annual interest rate of 4.42 percent costs $140,000 today. What is the length of the annuity time period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education