ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

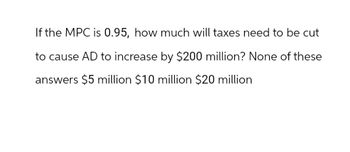

Transcribed Image Text:If the MPC is 0.95, how much will taxes need to be cut

to cause AD to increase by $200 million? None of these

answers $5 million $10 million $20 million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose that the economy is experiencing a recession with an estimated recessionary gap of $15 billion. Congress is considering the use of fiscal policy to ease the recession, but due to current political sentiments, it has determined that the maximum spending increase the government is willing to support is $2 billion. It wants to make up the remainder of the recessionary gap using tax cuts. If a spending increase of $2 billion is approved and the MPC is 0.8, by how much will taxes need to be reduced to close the remainder of the recessionary gap? Instructions: Round your answer to 2 decimal places. 5 billionarrow_forwardWhat is the effect on savings of a tax cut of $15 billion? Is this inflationary or deflationary? Assume that the MPC is 0.9.arrow_forwardin another economy, the MPC = 4/5, government needs to increase expenditures $20 to complete a project, but it does not want to increase debt so it increases taxes $20 also. What, if any, will be the change in output generated by this balanced - budget expenditure scenario?arrow_forward

- ?arrow_forwardThe recent economic recession was brought about by the Covid-19 pandemic. The pandemic brought along mitigation efforts such as stay-at home/shelter in place orders, cancelling of large gathering, social distancing, etc,. What impact have these mitiation efforts likely had on the MPC and the multiplier in the U.S. economy? What does this imply about the effectiveness and level of fiscal policy needed to bring the U.S. economy out of the recession.arrow_forwardAssuming that the MPC is 0.80, calculate the value of the government expenditures multiplier.arrow_forward

- In the equation AE = $2,000 + 0.8Y, autonomous expenditures are equal to 80 percent of income. [True or False] and EXplain WHYarrow_forwardSuppose, government is undertaking expansionary fiscal policy because of recessionary concerns. How will the effectiveness of the policy be affected if public is feeling cautious and not spending much? Present your arguments in 100 words or less. (Hint: think about the size of the multiplier effect).arrow_forwardCalculate the fiscal multiplier if the marginal propensity to save is 0.2.arrow_forward

- Suppose that the MPC in North Laurasia is 0.6. a. What is the spending multiplier for the North Laurasian economy? Instructions: Round your answer to one decimal place. b. If the government spends an extra $1,000, by how much with the economy grow? Instructions: Enter your answer with a whole number.arrow_forwardSuppose MPS=0.68 and MPI=0.17 19. What is the spending multiplier? 20. What is the level of real GDP if the government increases spending by 300 million dollars? 21. What is the level of real GDP if the government decreases spending by 350 million dollars?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education