ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

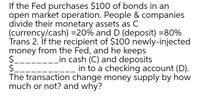

Transcribed Image Text:If the Fed purchases $100 of bonds in an

open market operation. People & companies

divide their monetary assets as C

(currency/cash) =20% and D (deposit) =80%

Trans 2. If the recipient of $100 newly-injected

money from the Fed, and he keeps

$.

$.

The transaction change money supply by how

much or not? and why?

Lin cash (C) and deposits

in to a checking account (D).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 9 If the interest rate................... opportunity cost of holding money decreases, and the quantity demanded of money increases; decreases decreases; increases £0000 increases; also increases does not change; does not change 10 If the total deposits-on-demand in Bank A total $500 mil and the required reserve ratio is 2.5 percent, then required reserves at Bank A equal more than 1,300,000,000 equal to 13,000,000 less than 13,000,000 more than 13,000,000arrow_forwardA banking system has deposits of $1000, loans of $600, bonds of $200 and reserves of $200. The central bank has jus raised the reserve ratio to 0.25. Caiculate the value of bonds banks could sell to the central bank to comply with this change, keeping loans constant. Do not include a dollar sign ($) in your answer and round all money answers to 2 decimal places, if required.arrow_forwardH)arrow_forward

- Chr Out Suppose the reserve requirement is 5 percent. For every $100 on deposit, the bank needs to hold $ as reserves. (Add only a number; the dollar sign has been provided for you.)arrow_forwardPls help with below homework.arrow_forwardWhy are credit cards not included in the money supply even though they can be used easily for transactions? A. Because credit cards are not always 100% reliable. B. Because credit cards are not physical money. C. Because there are other more efficient methods of money supply. D. Because the credit card company is effectively making you a loan..arrow_forward

- The central bank buys $10,000 worth of bonds in the open market from Elaine, who deposits the proceeds in her checking account at MSM Bank. The required reserve ratio is 5%. (a) What is the amount by which MSM Bank’s liabilities have changed? Explain. (b) Calculate the change in required reserves for MSM Bank. Show your work. (c) What is the dollar value of the maximum amount of new loans MSM Bank can initially make as a result of Elaine’s deposit? Explain. (d) Based on the central bank’s open-market purchase of bonds, calculate the maximum amount by which the money supply can change throughout the banking system. Show your work. (e) How will the change in the money supply in part (d) affect aggregate demand and the price level in the short run? Explain.arrow_forwardexplain this statement in details " money is a difficult concept to define, partly because it fufill several function and partly because of other liquid asset that can serve as substitute for money" explainarrow_forwardUse the following values in this T-account to answer the questios below: (use 2 decimal places for any answer that have decimals) ASSETS Reserves Loans Gov. Bonds $1,000 Stocks $1,250 $750 LIABILITIES $10,000 www 1. Assume that the bank only keeps Required Reserves. What is the reserve requirement in this economy? Blank 1% 2. Based on the information provided, how much money would be available for investments by this bank? Blank 2 3. Based on the information provided, how much money does this bank hold in form of loans? Blank 3arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education