ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

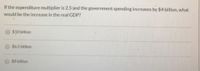

Transcribed Image Text:If the expenditure multiplier is 2.5 and the government spending increases by $4 billion, what

would be the increase in the real GDP?

$10 billion

$6.5 billion

$8 billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 1. If imports are $2 trillion, exports are $1.9 trillion, consumption is $3.8 trillion, investment is $700 billion, and government spending is $1.1 trillion, how much is GDP? 2. If consumption is $2.5 trillion, investment is $900 billion, government spending is $700 billion, imports are $1.2 trillion and exports are $1.4 trillion, how much is GDP? Example: If GDP rises from $6 trillion in 1994 to $8 trillion in 1999 and the GDP deflator in 1999 is 110, find real GDP in 1999 and find the percentage increase in real GDP between 1994 and 1999. First, we are asked to find real GDP in 1999. To do this we divide the nominal GDP, which is $8 trillion ($8,000 billion), by the GDP deflator for 1999, which is 110. This then is multiplied by 100. Real GDP in 1999 is $7,273 billion or $7.2 trillion. To find the percent change you must find the difference of real GDP between 1999 and 1994. Change in GDP = 7,232 – 6,000 = 1,232 You then take this difference and divide it by GDP in…arrow_forwardWhat can we predict about the effect on consumption of an increase in government spending? A) Consumption will increase by an amount equal to the MPC times the change in real GDP. B) Consumption will increase by an amount equal to the MPC times the change in government spending. C) Consumption will increase by the amount of the government spending. D) Consumption will not rise as government spending risearrow_forwardIn an economy the change in income is $2300 and change in investment is $700 What will be the multiplierarrow_forward

- Q3. Real GDP Consumption Planned Investment Government Purchases Net Exports $5,000 $4,500 $500 $325 -125 6,000 5,300 $500 $325 -125 7,000 6,100 $500 $325 -125 8,000 6,900 $500 $325 -125 Answer the questions based on the table below. The values are in millions of dollars. What is the equilibrium level of real GDP? What is the MPC? If potential GDP is $7,000 million, is the economy at full employment? If not, what is the condition of the economy? If the economy is not at full employment, by how much should government spending increase so that the economy can move to the full employment level of GDP?arrow_forwardReal GDP Consumption Planned Investment Government Purchases Net Exports $5,000 $4,500 $500 $325 -125 6,000 5,300 $500 $325 -125 7,000 6,100 $500 $325 -125 8,000 6,900 $500 $325 -125 3 A Answer the questions based on the table below. The values are in millions of dollars. What is the equilibrium level of real GDP? What is the MPC? If potential GDP is $7,000 million, is the economy at full employment? If not, what is the condition of the economy? If the economy is not at full employment, by how much should government spending increase so that the economy can move to the full employment level of GDP?arrow_forwardIf the MPC is 0.9 what will happen to GDP if the government cut spending bt $2.arrow_forward

- Income and Expenditure — End of Chapter Problem An economy has a marginal propensity to consume of 0.5, and Y*, the income-expenditure equilibrium GDP, equals $500 billion. Given an autonomous increase in planned investment of $10 billion, answer the following questions. a. What is the value of the multiplier? Value of the multiplier = b. What would you expect the total change in Y* to be based on the multiplier formula? Change in Y* based on the multiplier = billion c. What is the total change in real GDP after the 10 rounds? It may be beneficial to make a table on a separate sheet of paper to calculate the change in real GDP for each of the rounds, and then add up the values. Total change in real GDP (10 rounds) = billion d. How do your answers to the change in GDP and Y compare? The answer to total change in GDP after 10 rounds and the change in Y* based on the multiplier formula arearrow_forwardIf consumption expenditures are $1800 million, gross investment is $450 million, imports are $350 million, exports are $180 million, government expenditure on goods and services is $120 million, and government transfer payments are $180 million and net taxes are $250 million; a) Calculate the GDP. b) Is there budget deficit or surplus? Calculate. c) How much is the private (household) saving? d) How much is the disposable income?arrow_forwardAggregate expenditure is 790. Income is 730 and consumption is 720, income increases to 750 and consumption increases to 736. There is an increase in consumer spending of 3. What will the MPC be What will the MPS be What will the multiplier be What will the new level of aggregate expenditure be You must show all work you must take all steps and it must be done in a neat well organized easy to follow manner.arrow_forward

- Mexico's real GDP fell from 4.5 trillion pesos to 3.8 trillion pesos over the first part of 2020. In that same time, its consumer spending fell from 3.1 trillion pesos to 2.5 trillion pesos. Assume that real GDP represents disposable income. Using these values, what is the size of the government spending multiplier?arrow_forwardUse the information in the table to answer the following questions. All numbers are in billions of 2012 dollars. Planned Investment (1) Real GDP (Y) $14,000 $15,000 $16,000 $17,000 $18,000 The equilibrium level of GDP is $ The MPC is billion. Consumption (C) $11,000 $11,750 $12,500 $13,250 $14,000 $1,500 $1,500 $1,500 $1,500 $1,500 (enter your response to two decimal places). Suppose that net exports increase by $400 billion. Using the multiplier formula, determine the new level of GDP. A $400 billion increase in net exports leads to a change in spending of $ billion, so the new level of GDP will be $ billion. Government Purchases (G) $2,500 $2,500 $2,500 $2,500 $2,500 Net Exports (NX) - $500 - $500 - $500 - $500 - $500arrow_forwardSuppose the government increases expenditures by $100 billion and the marginal propensity to consume is 0.50. By how will equilibrium GDP change? The change in equilibrium GDP is: $ billion. (Round your solution to one decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education