ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

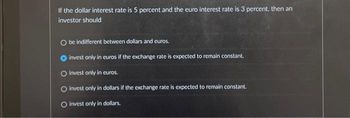

Transcribed Image Text:If the dollar interest rate is 5 percent and the euro interest rate is 3 percent, then an

investor should

O be indifferent between dollars and euros.

invest only in euros if the exchange rate is expected to remain constant.

O invest only in euros.

O invest only in dollars if the exchange rate is expected to remain constant.

O invest only in dollars.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Draw a demand for dollars curve. Label it D. Draw a supply of dollars curve . Label it S. Draw a point at the equilibrium quantity and exchange rate. Draw an arrow between the D and S curves that indicates a price at which there is a shortage of dollars. Label it When there is a shortage of dollars in the foreign exchange market, ------------. A. The demand for Japanese yen will increase so the foreign exchange market can move into equilibrium B. The supply of Japanese yen will increase so the foreign exchange market can move into equilibrium C. The forces of supply and demand pull the foreign exchange market into equilibrium D. Prices in the United States will fall relative to prices in Japan.arrow_forwardA short-run increase in government spending causes the currency to and output to O appreciate; increase O appreciate; decrease O depreciate; increase O depreciate; decreasearrow_forwardSuppose that Japan has adopted a floating exchange rate for its currency, the Japanese Yen. When the Japanese central bank conducts monetary policy that raises interest rates in Japan, the Demand for Japanese Yen will and the Japanese Yen will O increase; appreciate O decrease; appreciate O increase; depreciate O decrease; depreciatearrow_forward

- Equilibrium dollar/euro exchange rate will increase (dollar will depreciate) if Select one: 0 O a. interest rate on euro deposits decreases b. interest rate on dollar deposits increases c. dollar is expected to appreciate in the future d. none of the above HEANDarrow_forwardPlease answer correct calculation a and b pls Don't answer by pen paper plzarrow_forwardIf the exchange rate between the U.S. dollar and the Japanese yen were such that one U.S. dollar equals 100 yen, what would be the price in dollars of a Japanese automobile that cost 2,000,000 yen? A. $100 B. $20,000 C. $120,000 D. $2,000,000arrow_forward

- What is the difference between depreciation and devaluation? O There is no difference. O Depreciation refers to a fixed exchange rate, while devaluation refers to a floating exchange rate. O Depreciation refers to a floating exchange rate, while devaluation refers to a fixed exchange rate.arrow_forwardIn the U.S. balance of payments, foreign purchases of assets in the United States are a O debit, or outpayment. current account item. O foreign currency outflow. O foreign currency inflow.arrow_forwardWhat is the exports effect? The exports effect is the result that the lower the exchange rate, other things remaining the same, the O A. higher are the prices of Canadian-produced goods and services to foreigners and the greater is the volume of Canadian imports O B. lower are the prices of foreign-produced goods and services to Canadians and the greater is the volume of Canadian exports O C. higher are the prices of foreign-produced goods and services to Canadians and the greater is the volume of Canadian imports O D. lower are the prices of Canadian-produced goods and services to foreigners and the greater is the volume of Canadian exports Click to select your answer and then click Check Answer. All parts showing Clear All Check Answer P Type here to search 立arrow_forward

- As the value of the American dollar increases relative to the Mexican peso, we expect that international demand for American corn output relative to Mexican corn may а. increase decrease b. stay the same as international corn demand is independent of the exchange rates С. we cannot tell Od.arrow_forwardQuestion 2 of 25 In which situation is a country most likely to choose a flexible exchange rate for its currency? O A. A country believes that its currency will be in low demand in global markets. B. A country worries that the value of its currency could rise and fall unpredictably. C. A country has a reputation for having a strong and stable economy over time. O D. A country wants to make sure that its currency is stable in all economic situations.arrow_forwardurgent dont chaptgpt answer Appreciation of the real exchange rate A. makes U.S. exports less expensive to foreigners. B. benefits all U.S. producers. C. makesJ.S. exports more expensive to foreigners. makest D. means a basket of U.S. goods would exchange for fewer foreign goods.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education