Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

equity in the business must have:??

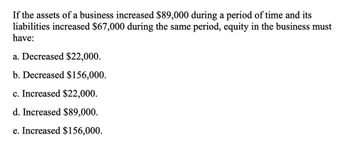

Transcribed Image Text:If the assets of a business increased $89,000 during a period of time and its

liabilities increased $67,000 during the same period, equity in the business must

have:

a. Decreased $22,000.

b. Decreased $156,000.

c. Increased $22,000.

d. Increased $89,000.

e. Increased $156,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A return on assets of 5.15% means that a company is earning: a.a $5.15 return on every $100 invested in long-term assets. b.a $5.15 return on every $100 of total assets. c.a $5.15 return on every $100 of assets minus liabilities. d.a $5.15 return on every $100 of current assets.arrow_forwardA return on assets of 5.15% means that a company is earning: O a. a $5.15 return on every $100 of assets minus liabilities. O b. a $5.15 return on every $100 of total assets. O c. a $5.15 return on every $100 of current assets. O d. a $5.15 return on every $100 invested in long-term assets.arrow_forwardEquity in the business must have?arrow_forward

- Assuming a business entity has a total asset of 25,000,000 its total liabilities is 1/3 of the said amount. How much is the equity? 16,000,000,00 16,666,666.67 13,333,333.33 13,000,000.00arrow_forwardSuppose Isha Corporation reports beginning assets of $55,000, ending assets of $70,000, net sales of $150,000, and net income of $12,500. What is the return on assets?arrow_forwardWhat is the return of assetsarrow_forward

- Subject: general accountingarrow_forwardAccounts payable increase by $500; revenues increase by $500. a. If the assets of a company increase by $100,000 during the year and its liabilities increase by $35,000 during the same year, then the change in equity of the company during the year must have been a(n): b. Increase of $135,000. c. Decrease of $135,000. d. Decrease of $65,000. e. Increase of $65,000.arrow_forwardEquity in the business must have? General accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning