PAYROLL ACCT.,2019 ED.(LL)-TEXT

19th Edition

ISBN: 9781337619783

Author: BIEG

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

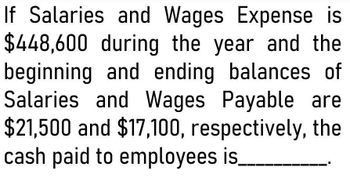

The cash paid to employees is

Transcribed Image Text:If Salaries and Wages Expense is

$448,600 during the year and the

beginning and ending balances of

Salaries and Wages Payable are

$21,500 and $17,100, respectively, the

cash paid to employees is.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In the space provided below, prepare the journal entry to record the November payroll for all employees assuming that the payroll is paid on November 30 and that Joness cumulative gross pay (cell I13) is 85,000.arrow_forwardFor the year ended December 31, Lopez Company implements an employee bonus program based on company net income, which the employees share equally. Lopez’s bonus expense is computed as $14,563. 1. Prepare the journal entry at December 31 to record the bonus due the employees. 2. Prepare the later journal entry at January 19 to record payment of the bonus to employees.arrow_forwardFor the year ended December 31, Lopez Company implements an employee bonus program based on company net income, which the employees share equally. Lopez’s bonus expense is computed as $50,000. 1. & 2. Prepare the journal entries at December 31 to record the bonus due and later on January 19 to record payment of the bonus to employees.arrow_forward

- In a recent pay period, Blue Company employees have gross salaries of $18,960. Total deductions are: CPP $886, EI $348, and income taxes $4,480. What is Blue Company’s total payroll expense for this pay period? Ignore vacation benefits and workers’ compensation premiums.arrow_forwardThe totals from the first payroll of the year are shown below. TotalEarnings FICAOASDI FICAHI FITW/H StateTax UnionDues NetPay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the adjustment for accrued wages for the following Monday, which is the end of the accounting period. The gross payroll for that day is $7,475.arrow_forwardThe totals from the first payroll of the year are shown below. TotalEarnings FICAOASDI FICAHI FITW/H StateTax UnionDues NetPay $36,195.10 $2,244.10 $524.83 $6,515.00 $361.95 $500.00 $26,049.22 Journalize the adjustment for accrued wages for the following Monday, which is the end of the accounting period. The gross payroll for that day is $7,475.arrow_forward

- In recording the payroll, the debit to an expense represents: Group of answer choices deductions gross pay net pay earnings over the calendar year for each employeearrow_forwardAn employee receives a bi-weekly gross salary of $2,000. The employee’s deductions include income tax of $218, CPP of $99, EI of $36, and union dues of $50. The employer’s share of the deductions includes CPP of $139 and EI of $36. What is the total amount of salaries and employee benefits expense that X Corp. would record on its income statement as a result of the employee's bi-weekly salary? answers a. $1,597 b. $1,772 c. $2,000 d. $2,175arrow_forwardAn employee receives a bi-weekly gross salary of $2,000. The employee's deductions include income tax of $218, CPP of $99, El of $36, and union dues of $50. The employer's share of the deductions includes CP of $139 and El of $36. What is the total amount of salaries and employee benefits expense that X Corp. would record on its income statement as a result of the employee's bi-weekly salary?arrow_forward

- The annual accounting period ends December 31. On December 31, calculated the payroll, which indicates gross earnings for wages ($100,000), payroll deductions for income tax ($10,000), payroll deductions for FICA ($7,500), payroll deductions for American Cancer Society ($3,750), employer contributions for FICA (matching), and state and federal unemployment taxes ($875). Employees were paid in cash, but payments for the corresponding payroll deductions have not yet been made and employer taxes have not yet been recorded. Collected rent revenue of $6,375 on December 10 for office space that Lakeview rented to another business. The rent collected was for 30 days from December 12 to January 10 and was credited in full to Deferred Revenue.Prepare the journal entries to record payroll on December 31, the collection of rent on December 10 and adjusting journal entry on December 31. Show how any of the liabilities related to these items should be reported on the company's balance sheet at…arrow_forwardSandler Company completed the following two transactions. The annual accounting period endsDecember 31.a. On December 31, calculated the payroll, which indicates gross earnings for wages ($260,000),payroll deductions for income tax ($28,000), payroll deductions for FICA ($20,000), payrolldeductions for United Way ($4,000), employer contributions for FICA (matching), and stateand federal unemployment taxes ($2,000). Employees were paid in cash, but payments for thecorresponding payroll deductions have not been made and employer taxes have not yet beenrecorded.b. Collected rent revenue of $1,500 on December 10 for office space that Sandler rented toanother business. The rent collected was for 30 days from December 11 to January 10 and wascredited in full to Unearned Revenue.Required:1. Give the entries required on December 31 to record payroll.2. Give ( a ) the journal entry for the collection of rent on December 10 and ( b ) the adjusting journal entry on December 31.3. Show how any…arrow_forwardQuestion 2 With the following data, compute the NET FUTA Tax. $6,750 Gross FUTA Tax DUE Credit against FUTA (assume $3,100 applicable) O $3,650 O $7,000 O $3,100 $6,750 MacBook Air 80 F3 F2 F4 F5 F6 F7 FB F9 3 4. 5 7 8 9. E T Y D G < 6 F.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning