ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

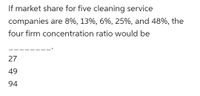

Transcribed Image Text:If market share for five cleaning service

companies are 8%, 13%, 6%, 25%, and 48%, the

four firm concentration ratio would be

27

49

94

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Two local ready-mix cement manufacturers, H and T, have combined demand given by Q = 105 − P. Their total costs are given by TCH = 5QH + 0.5QH^2, and TCT = 5QT + 0.5QT^2. If they successfully collude, what is their maximum joint profits?arrow_forwardIndustry A is composed of three firms. One has an 80% market share, and the other two have a 10% share each. The Herfindahl index for this industry is:arrow_forwardSuppose that the demand in a particular industry is given by Qd = 100 2P. When the market price in the industry is $10 per unit, total demand in the industry is that each of the four largest firms in the industry sell 15 units. Based on this information, the four- Furtrermore, assume firm concentration ratio is Select one: A. 45 units; 0.75 B. 80 units; 1.00 O C. 80 units; 0.75 D. 45 units; 0.25arrow_forward

- Solve both will upvote as they are subparts. Hand written solution is not allowed.arrow_forwardThe following table reports the four firm concentration ratio for five different industries: Part 1: Refer to the table above. In which industry do the four largest firms have the most market power? Part2: Refer to the table above. I'm which industry do the four largest firms have the least market power?arrow_forwardPlz solve this.arrow_forward

- Initially there are six firms producing differentiated products. The demand function for the good produced by firm i, i=1,2..,6, is given by qi = 10-2pi+0.3 summation pj where the sum is taken over the five prices other than firm i. Each firm has the same marginal cost c. The firms choose prices simultaneously; that is, they are differentiated products Bertrand competitors. (a) Solve for the symmetric Nash equilibrium prices. (b) Suppose that you observe each firm to set a price of 4.8. What must c be? (c) Suppose that two of the six firms merge to become a single firm. The firm continues to produce both goods. Using the marginal cost you found in (b), derive the new post-merger Nash equilibrium prices.arrow_forwardThe inverse demand for a homogeneous-product Stackelburg duopoly is P=24000-5Q. The cost structures for the leader and the follower respectively are CL(QL)=3000QL and CF(QF)=4000QF. a) What is the followers reaction function? b) Determine the equilibrium output level for both the leader and the follower. Leader output: Follower output: c) Determine the equilibrium markert price $ d) Determine the profits of the leader and the follower. Leader profits: $ Follower profits: $arrow_forwardOnly typed answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education