ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

6.

Transcribed Image Text:6.

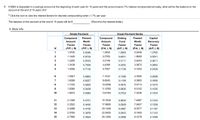

If $500 is deposited in a savings account at the beginning of each year for 15 years and the account earns 7% interest compounded annually, what will be the balance on the

account at the end of 15 years (F)?

5 Click the icon to view the interest factors for discrete compounding when i = 7% per year.

The balance on the account at the end of 15 years will be $

(Round to the nearest dollar.)

5: More Info

Single Payment

Equal Payment Series

Compound

Present

Compound

Sinking

Present

Capital

Recovery

Factor

Amount

Worth

Amount

Fund

Worth

Factor

Factor

Factor

Factor

Factor

(F/P, i, N)

(P/F, i, N)

(F/A, i, N)

(A/F, i, N)

(P/A, i, N)

(A/P, i, N)

1

1.0700

0.9346

1.0000

1.0000

0.9346

1.0700

2

1.1449

0.8734

2.0700

0.4831

1.8080

0.5531

3

1.2250

0.8163

3.2149

0.3111

2.6243

0.3811

4

1.3108

0.7629

4.4399

0.2252

3.3872

0.2952

1.4026

0.7130

5.7507

0.1739

4.1002

0.2439

1.5007

0.6663

7.1533

0.1398

4.7665

0.2098

7

1.6058

0.6227

8.6540

0.1156

5.3893

0.1856

8

1.7182

0.5820

10.2598

0.0975

5.9713

0.1675

9

1.8385

0.5439

11.9780

0.0835

6.5152

0.1535

10

1.9672

0.5083

13.8164

0.0724

7.0236

0.1424

11

2.1049

0.4751

15.7836

0.0634

7.4987

0.1334

12

2.2522

0.4440

17.8885

0.0559

7.9427

0.1259

13

2.4098

0.4150

20.1406

0.0497

8.3577

0.1197

14

2.5785

0.3878

22.5505

0.0443

8.7455

0.1143

15

2.7590

0.3624

25.1290

0.0398

9.1079

0.1098

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 4-1 You have noticed that the price of season tickets to your university’s football matches keeps increasing but the supply of tickets remains the same. Why might supply be unresponsive to changes in price? In the longer term, would it be more responsive? How?arrow_forwardDerive TU Schedule from MU Schedule. Amount Consumed MU (units) (utils) 14 12 3 10 4 6arrow_forwardGood afternoon please help me with how to calculate the the following attatched . Thank you in advancearrow_forward

- 5(ii) Draw & Label a Graph that shows relationship between Cups of Coffee & Amount of Work Hours for the following expression: "The more Coffee I drink, the more Hours I can work."arrow_forward1) https://www.youtube.com/watch?v=u5P8AZRBLac 2) https://www.youtube.com/watch?v=9MpVjxxpExM I need a short summary for these two videos please.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education