FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

don't need to explain just give me correct answer within 10 mins I'll give you multiple upvote

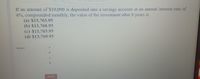

Transcribed Image Text:If an amount of $10,000 is deposited into a savings account at an annual interest rate of

4%, compounded monthly, the value of the investment after 8 years is

(a) $13,763.95

(b) $13,768.95

(c) $13,765.95

(d) $13,769.95

Answer

A

В

C

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please correct answer and step by step solutionarrow_forwardSafari File Edit View History Bookmarks Window Help Inbox (3,222) - tonygonzalez0100@g... learn-us-east-1-prod-fleet02-xythos.content.blackboardcdn.com Bb Welcome, Tony - Blackboard Learn The Effect of Compounding 4. Use the TVM Calculator to fill in the following table given that the APR is 6%. Round to 2 decimal places as needed. PV = PMT = FV = APR = Periods = CHANGES Compounding: CHANGES Bb NCBM 0222/MATD 0485 Unit 4 Conte... DEC 7 Principal Compounding Periods Annually $1,000 $1,000 $1,000 $1,000 $1,000 Semiannually tv Monthly Weekly Bb https://learn-us-east-1-prod-fleet02-x... Daily If we summarize the effect seen in the table, we see that more compoundings per year means that you will have more money in the account, but the amount of increase will eventually level off. Most Screenshot publish the APY, or Annual Percentage Yield, instead of the APR to account for this effect. Amount after 1 year A 5 32 4/ Ơ Wed Dec 7 12:11 AM b Success Confirmation of Question Sub... t PM PM . PM…arrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forward

- Question is attached in the screenshot greatly appreciate the help 13ylp14y1pl4hp2lhtplhpt3lh3ptlh35bzarrow_forwardAutoSave Off File Home Insert Page Layout ch04_p24_build_a_model v Search Data Review View Automate Formulas 10 AA =1 Arial Paste BIU v Clipboard Z BA Font v General $%90-00 2 Alignment E Number [ M64 fx A B C D E F G H 79 80 Help H Insert く Delete Formatting Conditional Format as Cell Table Styles Format Styles Cells 81 f. Now assume the date is 10/25/2021. Assume further that a 12%, 10-year bond was issued on 7/1/2021, pays 82 interest semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bond's 83 84 Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the 85 price of a bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below: 86 87 Basic info: J K Σ WE◊ David N M << Z ANSE So Filt Ed 88 Settlement (today) 89 Maturity 90 Coupon rate 91 Current price (% of par) 92 Redemption (% of par value) 93 Frequency (for semiannual) 94 Basis…arrow_forwardC Home Insert Draw Page Layout 4 Cut [Copy ✓ AutoSave 12345 Paste A Format B Calibri (Body) B I U v Ready Initial cost Square feet occupied IT labor hours used C V V Formulas Data Review View X Update Available We've made some fixes and improvements. To complete the process, the app needs to restart. A1 : fx Function: SUM; Formulas: Add; Multiply; Divide; Cell Referencing Enter Answer + 12 D 1 Function: SUM; Formulas: Add; Multiply; Divide; Cell Referencing Accessibility: Investigate Support Departments Maintenance V V A^ A 2,000 1,000 E14.2a - Using Excel to Allocate Support Department Costs Using the Direct Method PROBLEM 5 The Screamin' Eagles Company makes wheels and wings for ground transport vehicles and drones. In 6 addition to the key manufacturing departments, Screamin' Eagles needs two key support services, provided 7 by its Maintenance and IT departments. The Maintenance costs are allocated to other departments based on 8 the square footage of space each department occupies.…arrow_forward

- AutoSave On Exam 2 ch 14-16.xlsx - Saved - O Search Rolando Borjas Jr. 困 File Home Insert Page Layout Formulas Data Review View Help A Share P Comments E A I AutoSum - Fill v X Cut - A A° 22 Wrap Text Calibri 11 General B Copy Paste BIU v A v EEE E E E Merge & Center $ • % 9 8 -98 Conditional Format as Cell Insert Delete Format Sort & Find & Ideas Sensitivity S Format Painter Formatting v Table v Styles v O Clear v Filter v Select v Clipboard Font Alignment Number Styles Cells Editing Ideas Sensitivity AG28 fe P R S V Y AA АВ AC AD AE AF AG АН Al AJ AK AL AM AN AO AP AQ AR AS 16 The Annapolis Corporation's stockholders' equity accounts have the following balances as of January 1, 2016: 12% preferred stock, cumulative, $50 par, 10,000 shares issued and outstanding $ 500,000 5 Common stock, $10 par (100,000 shares issued and outstanding) 1,000,000 Additional paid-in capital: common 1,000,000 6 1,000,000 7 Retained earnings 3,750,000 8 Total stockholders' equity 6,250,000 9 10 Annapolis…arrow_forwardplease help with parts a,b, and carrow_forwardMy Drive - Google Drive X 4 My Drive - Google Drive Front Desk Operations 2020 - Go X + ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress%3Dfalse Tp Netflix 0z TVCC Email P My Math Lab Log In to Canvas X Mathway | Calculus.. N Netflix Cengage Login * Login Readin- Darby Company, operating at full capacity, sold 114,800 units at a price of $108 per unit during the current year. Its income statement is as follows: Sales $12,398,400 Cost of goods sold 4,392,000 Gross profit $8,006,400 Expenses: Selling expenses $2,196,000 Administrative expenses 1,332,000 Total expenses 3,528,000 Income from operations $4,478,400 The division of costs between variable and fixed is as follows: Variable Fixed Cost of goods sold 60% 40% Selling expenses 50% 50% Administrative 30% 70% expenses Management is considering a plant expansion program for the following year that will permit an increase of $972,000 in yearly sales. The expansion will increase fixed costs by…arrow_forward

- 25 )arrow_forwardPlease solve max please in 15-22 minutes and no reject thank u. Im needed please no rejectarrow_forwardFile Home Insert Page Layout Formulas Data Review View Automate Help Analytic Solver Comments Share Paste Clipboard E9 A B Arial BIU 10 - Α' Α' A Font Alignment Б Insert Σ General Delete $-% 08-08 Number Conditional Format as Cell Formatting Table Styles Styles Format Sort & Find & Filter Select Sensitivity Add-ins Analyze Data Cells Editing Sensitivity Add-ins Show ToolPak Commands Group D E F G H M N 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Problems 1. Build a data table to explore potential total savings based on annual contributions from $2,000 to $10,000 in $2,000 increments, using interest rates from 3.0% to 8.0% in 1.0% increments. Use 30 years as the term. Retirement Savings Four-for-Four Doubles Calculator Credit Score 100% Ready Accessibility: Good to goarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education