EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Financial accounting

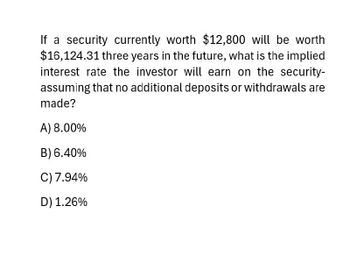

Transcribed Image Text:If a security currently worth $12,800 will be worth

$16,124.31 three years in the future, what is the implied

interest rate the investor will earn on the security-

assuming that no additional deposits or withdrawals are

made?

A) 8.00%

B) 6.40%

C) 7.94%

D) 1.26%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please given answer this general accounting questionarrow_forwardSecurity A pays $100 annually forever, starting at the end of this year. Security B pays $100 annually forever, starting at the end of this year, and grows at a rate (g) of 3% annually. If the interest rate decreases from 10% to 6%, what will happen to the present value of these two securities? The present value of Security B will increase more than the present value of Security A O The present value of Security B will decrease more than the present value of Security A O The present value of Security A will decrease more than the present value of Security B O We do not have enough information O The present value of Security A will increase more than the present value of Security B Question 10 You plan to invest the same amount of dollars in your retirement account for the next 40 years, starting at the end of this year. You think that you will need $1,345,989.12 in your account at that point in time. How much should you invest every year, given that the market offers an interest rate…arrow_forwardQ14. Consider a security with a face value of $100,000 to be repaid at maturity. The maturity of the security is 3 years. The coupon rate is 8% per annum and coupon payments are made annually. The current market rate is 8% p.a. What is the security’s duration (round your answer to two decimals)? a. 1.44 years b. 3 half-years. c. 1.39 years. d. 1.39 half-years e. 2.78 years.arrow_forward

- Which of the following investments that pay will $18,500 in 8 years will have a higher price today? The security that earns an interest rate of 8.50%. The security that earns an interest rate of 12.75%.arrow_forwardQuestion 2: Answer the following Tiwo questions: (CLO-2) 1 a. A two-year Treasury security currently earns 1.94%. Over the next two years, the real risk-free rate is expected to be 1.00% per year and the inflation premium is expected to be 0.50% per year. Calculate the maturity risk premium on the two-year. Answer:arrow_forwardWhat is the present value of a security that will pay $2,000 at the end of each year for 6 years if securities of equal risk pay 5% annually? What if the payments occur at the beginning of each period?arrow_forward

- Find the value of a security that pays $300 one year from today, $500 2 years from today, $150 3 years from today and $50 every year after forever. The interest rate is currently 1.2%arrow_forwardWhat is the present value of a security that will pay $10,000 in 5 years if securities of equal risk pay 3.5% annually? What is the present value of a security that will pay $3,000 in 10 years if securities of equal risk pay 12% annually? What is the present value of a security that will pay $10,000 in 3 years if securities of equal risk pay 5% annually? What is the present value of a security that will pay $5,000 in 20 years if securities of equal risk pay 7% annually? What is the present value of a security that will pay $8,989 in 13 years if securities of equal risk pay 22% annually? What is the present value of a security that will pay $1,989 in 22 years if securities of equal risk pay 13% annually?arrow_forwardA security pays $55 in one year and $133.10 in three years. Present value of this security is $150. The relevant interest rate is %.arrow_forward

- (please type answer)arrow_forwardWhat is the present value of a security that will pay $29,000 in 20 yearsif securities of equal risk pay 5% annually?arrow_forward5) With an interest rate of 10 percent, the present value of a security that pays $1,100 next year and $1,460 four years from now is approximatelyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning