FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

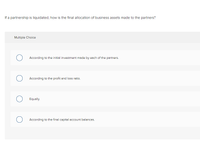

Transcribed Image Text:If a partnership is liquidated, how is the final allocation of business assets made to the partners?

Multiple Choice

According to the initial investment made by each of the partners.

According to the profit and loss ratio.

Equally.

According to the final capital account balances.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In a partnership liquidation, the final cash payment to the partners should be made in accordance with the*a. balance of partners' capital accounts.b. partner's profit and loss sharing ratio.c. ratio of the capital contributions by partners.d. safe payment computations.arrow_forwardAccounting for the admission of a new partner by purchase of a partner's interest will a b C O d not affect total assets, liabilities, and capital. increase total assets and total capital. increase total capital. decrease total capital.arrow_forwardAn analysis of the accounts of Williams Company reveals the following manufacturing cost data for the month ended September 30, 2017. Inventories Beginning Ending Raw materials $12,000 $11,300 Work in process 7,500 5,000 Finished goods 10,000 12,000 Costs incurred: raw materials purchase $62,500, direct labor $51,000, manufacturing overhead $25,650. The specific overhead costs were: indirect labor $6,500, factory insurance $5,000, machinery depreciation $6,000, machinery repairs $2,800, factory utilities $3,600, miscellaneous factory costs $1,750. Assume that all raw materials used were direct materials. Instructions (a) Prepare the cost of goods manufactured schedule for the month ended September 30, 2017. (b) Show the presentation of the ending…arrow_forward

- When a partner withdraws from a partnership, why is the final distribution often based on the appraised value of the business rather than on the book value of the capital account balance?arrow_forwardNet income for a partnership has to be allocated based on stated ratios. Question 2 options: True Falsearrow_forwardHow does a newly formed partnership handle the contribution of previously depreciated assets?arrow_forward

- Blue and Grey are discussing how income and losses should be divided in a partnership they plan to form. What factors should be considered in determining the division of net income or net loss?arrow_forwardIn admitting new partners, assets contributed by partners are recorded at their replacement value. Why is that?arrow_forwardThe basis of a partner's interest in a partnership, particularly a trading partnership, is always the same as the partner's capital account balance. True O Fabearrow_forward

- How do the asset and liability sections of the balance sheet differ for a partnership versus other forms of businesses (corporation, sole proprietorship)? Question 1 options: The equity section reports a separate capital account for each partner. The assets and liability sections do not differ between partnerships and other forms of business. The assets and liabilities are assigned to the individual partners. The assets tend to be higher and the liabilities tend to be lower for a partnership.arrow_forwardThe book states "a partnership balance sheet is a document that is used to keep track of the relationship of the partnership to the partners and the partners to each other, both from a tax perspective and a economic perspective." What is meant by economic perspective (focus at point of formation)?arrow_forwardAssess the truth of this statement: One of the rules of debits and credits and account balances for a partnership is that assets increase as debits. Group of answer choices This statement is true. This statement is false. There is not enough information to determine whether or not this statement is true. This statement is not applicable to accounting concepts.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education