FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

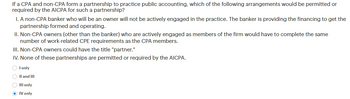

Transcribed Image Text:If a CPA and non-CPA form a partnership to practice public accounting, which of the following arrangements would be permitted or

required by the AICPA for such a partnership?

I. A non-CPA banker who will be an owner will not be actively engaged in the practice. The banker is providing the financing to get the

partnership formed and operating.

II. Non-CPA owners (other than the banker) who are actively engaged as members of the firm would have to complete the same

number of work-related CPE requirements as the CPA members.

III. Non-CPA owners could have the title "partner."

IV. None of these partnerships are permitted or required by the AICPA.

‣ I only

II and III

O III only

→ IV only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Some accountants argue that they should be allowed to invest in a company's stock as long as they themselves aren't involved in working on the company's audit or consulting. What do you think of this idea?arrow_forwardWhen a public accounting firm audits FUND-A in a mutual fund complex that has sisterfunds FUND-B and FUND-C, independence for the audit of FUND-A is not impaired whena. Managerial-level professionals located in the office where the engagement audit partneris located but who are not on the engagement team own shares in FUND-B, which is notan audit client.b. The wife of the FUND-A audit engagement partner owns shares in FUND-C (an auditclient of another of the firm’s offices), and these shares are held through the wife’semployee benefit plan funded by her employer, the AllSteelFence Company.c. Both (a) and (b).d. Neither (a) nor (b).arrow_forwardA private accountant is an accountant whose services may be hired on a fee basis by individuals or business firms.; True or Falsearrow_forward

- A professional corporation form of organization: Multiple Choice may ultimately decrease liability of all partners of a CPA firm. has similar liability requirements to that of a limited liability company form. eliminates personal liability for selected partners.arrow_forwardFor each of the following situations, indicate whether a CPA who is a partner in the one office CPA firm is "Independent" with respect to the client, by choosing "yes" or "no." Individual CPA's situation The CPA's nondependent child owns an immaterial direct financial interest in the client. b. The CPA's spouse owns an immaterial direct financial interest in the client. c. The CPA's brother is the controller of the client. d. The CPA's father is a salesman for the client. e. The CPA's nondependent mother owns an immaterial direct financial interest in the client. f. The CPA's five year old son who lives with her, was given a gift by a friend of 20 shares of stock worth, in total $100, in an audit client of the CPA. The CPA owns an immaterial amount of stock in a firm audit client, she does not work on that audit engagement. h. The CPA owns an immaterial amount of stock in a firm audit client, she works on that audit engagement. 9- i. A CPA's father owns a material investment in a firm…arrow_forwardWrite an e-mail to a client describing situations in which the partnership entity form might be more advantageous (or disadvantageous) than operating as a C corporation. Use subheadings and bullet points to highlight your major thoughts. You may use the following as a template: Dear Mr./Miss Jones, I am in receipt of your question(s) about the advantages or disadvantages of operating an entity (for tax purposes) either as a partnership or a C-Corporation. I will bullet my points below for clarity. Then you may end the email in any professional way you feel appropriate.arrow_forward

- Which of the following is a disadvantage of general partnerships? a) A partner who withdraws from a partnership cannot be held liable for any debts the firm had at the time of withdrawal. b) Compared to the other forms of ownership, the paperwork and costs involved in forming a general partnership are the most extensive. c) All general partners have unlimited liability for the debts and obligations of their business. d) The partners in a general partnership are exposed to double taxation.arrow_forwardWhich of the following statements is most true? a. The liability for other partners’ wrong doings is limited to the amount a particular partner has invested in the partnership. b. Partnerships are formed in accordance with specific guidelines that include the filing of a formal written agreement to the government. c. A fast growing firm would be more probable to establish a partnership as its business form than would a slow growing firm. d.Corporations can easier attract investors than those of the partnership and sole proprietor businesses.arrow_forwardBeamish Incorporated, which produces a single product, has provided the following data for its most recent month of operations: Number of units produced Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative expense Fixed costs: Fixed manufacturing overhead Fixed selling and administrative expense Multiple Choice There were no beginning or ending inventories. The absorption costing unit product cost was: $101 per unit $139 per unit $106 per unit 10,900 $ 51 $ 50 $223 per unit $5 $9 $359,700 $817,500arrow_forward

- Assess the truth of this statement: The normal balance of a partner's capital account is a credit balance. Group of answer choices This statement is true. This statement is false. There is not enough information to determine whether or not this statement is true. This statement is not applicable to accounting concepts.arrow_forwardPlease help with this Accounting type Question: If immediate payment is not made to a partner taking leave from the firm then the due amount is transferred to A. Current account B Loan account C. Reserve account D. None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education