FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:rent Attempt in &rogress

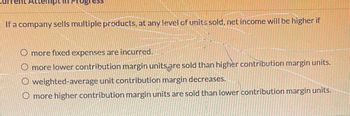

If a company sells multiple products, at any level of units sold, net income will be higher if

O more fixed expenses are incurred.

O more lower contribution margin units are sold than higher contribution margin units.

Oweighted-average unit contribution margin decreases.

O more higher contribution margin units are sold than lower contribution margin units.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Work in process (1/1) Direct materials Raw materials inventory (1/1) Add: Raw materials purchases Total raw materials available for use Less: Raw materials inventory (12/31) Direct materials used Direct labor Manufacturing overhead Indirect labor Factory depreciation Factory utilities Total overhead Total manufacturing costs Total cost of work in process: Less: Work in process (12/31) Cost of goods manufactured Cost of Goods Manufactured Schedule 168,130 27,530 26,260 39,410 78,070 $183,200 143,740 $213,140 87,830 $541,930arrow_forwardWhich of the following equations is true? Multiple Choice Dollar sales for company to break even (Traceable fixed expenses Common fixed expenses) + Overall contribution margin (CM) ratio Dollar sales for company to break even - (Traceable fixed expenses-Common fixed expenses) Overall contribution margin (CM) ratio Dollar sales for company to break even (Traceable variable expenses Traceable fixed expenses) Overall contribution margin (CM) ratio Dollar sales for company to break even (Traceable variable expenses-Common fixed expenses) Overall contribution margin (CM) ratio.arrow_forwardThe contribution margin income statementa. reports expenses based on cost behavior pattern rather than cost function.b. unitizes fixed costs.c. shows contribution margin rather than operating income as the bottom line.d. is sometimes used for financial reporting purposes.e. none of the above.Use the following information for Questions 9 and 10.O’Brien, Inc.’s, 2013 contribution margin income statement shows thefollowing:Sales @ $10 per unit . . . . . . . . . . . . . $ 160,000Less: Variable expense . . . . . . . . . . . (128,000)Contribution margin. . . . . . . . . . . . . . $ 32,000Less: Fixed expenses . . . . . . . . . . . . (44,000)Operating income (loss) . . . . . . . . . . . $ (12,000)arrow_forward

- 6. Once the break-even point is reached, which of the following statements is true? A) Variable expenses will remain constant in total. The contribution margin ratio begins to decrease. Operating income will increase by the unit contribution margin for each additional B) C) item sold. D) The total contribution margin changes from negative to positive. 7. The break-even in units sold will decrease if there is an increase in which of the following? A) Total fixed expenses. B) Selling price. C) Unit sales volume. D) Unit variable expenses. 8. Which of the following is normally included in product cost under the variable costing method? A) Prime cost and all conversion cost. B) Direct materials cost, direct labour cost, but not manufacturing overhead cost. Direct materials cost, direct labour cost, and variable manufacturing overhead cost. C) D) Prime cost but not conversion cost. 9. Regarding job-order costing and process costing: A) Job-order costing is better in the long run B) Are both…arrow_forwardPlease help me with this accounting homework question, I am having so much trouble.arrow_forwardIn a sales mix situation, at any level of units sold, net income will be higher if more fixed expenses are incurred. more higher contribution margin units are sold than lower contribution margin units. more lower contribution margin units are sold than higher contribution margin units. weighted-average unit contribution margin decreases.arrow_forward

- Please explain this statement thoroughly. "To estimate what the profit will be at various levels of activity, multiply the number of units to be sold above or below the break-even point by the unit contribution margin."arrow_forwardSales Variable costs Cost of goods sold Operating expenses Total variable Contribution margin Fixed costs Cost of goods sold Operating expenses Total fixed Net income (loss) Continue LA $ Eliminate LA Net Income Increase (Decrease)arrow_forwardIf sales volume increases and all other factors remain constant, then the: O contribution margin ratio will increase. O margin of safety will increase. break-even point will decrease. O net operating income will decrease.arrow_forward

- If an organization wants to make a profit, it must generate more sales revenue than the total costs it incurs. This relation can be expressed using which of the following profit equations? O a. Operating income = [(Sales price per unit - Variable cost per unit) x #units sold] - Fixed cost O b. Operating income = [Sales price per unit - Fixed cost per unit) x # units produced] -Variable cost Oc Operating income Sales revenue - Total variable costs - Discretionary costs O d. Operating income - Sales revenue - Committed costs - Fixed costsarrow_forwardThere would be a difference between the absorption operating income and variable operating income, if: Select one: O O a. There was an increase in period costs. b. A company sold less than the number of units produced in a given period. c. A company used the contribution margin statement instead of the conventional income statement. d. There was no beginning or ending inventories.arrow_forwardEach of a company's two product lines has a different contribution margin ratio . If the company's total sales remain the same but the sales mix shifts toward selling more of the product with the higher contribution ratio , which of the following is true ? O a Fixed cost will be constant . . the breakeven point will decrease . Ocall of the answers are true . d the average contribution margin ratio will increase . O e operating income will increasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education