Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

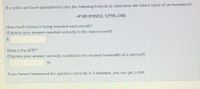

Transcribed Image Text:If a cell in an Excel spreadsheet uses the following formula to determine the future value of an investment:

=FV(0.0745/12, 12*30,-145)

How much money is being invested each month?

(Express your answer rounded correctly to the nearest cent!)

%$4

What is the APR?

(Express your answer correctly rounded to the nearest hundredth of a percent!)

%

If you haven't answered the question correctly in 3 attempts, you can get a hint.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Waiting periods. Fill in the number of periods for the following table,, using one of the three methods below: In (FV/PV) In (1 + r) a. Use the waiting period formula, n = b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. Present Value 760.13 Future Value $ 1,585.01 Interest Rate 3% Number of Periods years (Round to the nearest whole number.)arrow_forwardConsider the following asset with it's returns over the last 3 years. The arithmetic mean is 8% 1yr 2yr 3yr 8% 4% 6% What is the geometric mean? (Be sure to go out at least 4 decimal places.) Respuesta:arrow_forwardAssume that at the beginning of the year, you purchase an investment for $6,500 that pays $95 annual income. Also assume the investment's value has increased to $7,050 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places.arrow_forward

- Dont uplode image in answer, USE BAII Plus Financial Calculator to solve the TVM questions. $_____________You would like to start saving for retirement. Assuming you are now 22 years old and you want to retire at age 60, you have 38 years to watch your investment grow. You decide to invest in the stock market, which you expect it to earn about 6% per year into the future. You decide to invest $600 at the end of each month for the next 38 years (456 months). Calculate your accumulated investment at the end of 38 years. (Round to nearest whole dollar)arrow_forwardAnswer the given question with a proper explanation and step-by-step solution. Please provide the answer using the math tool otherwise I give the downvote. how long will it take $833.00 to accumulate to $1033.00 at 3% p.a. compounded quarterly? state your answer in years and months (from 0 to 11 ml tbs) the investment will take _____ years and ____ months to maturearrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- PV at 10% at the end of year 2. How do you get 0.82645? Do you use a calculator, if so, how do you work it out or written?arrow_forwardFind the future value of the following annuities. The first payment in these annuities is made at the end of Year 1, so they are ordinary annuities. (Notes: If you are using a financial calculator, you can enter the known values and then press the appropriate key to find the unknown variable. Then, without clearing the TVM register, you can "override" the variable that changes by simply entering a new value for it and then pressing the key for the unknown variable to obtain the second answer. This procedure can be used in many situations, to see how changes in input variables affect the output variable. Also, note that you can leave values in the TVM register, switch to Begin Mode, press FV, and find the FV of the annuity due.) Do not round intermediate calculations. Round your answers to the nearest cent. $600 per year for 10 years at 10%. $ $300 per year for 5 years at 5%. $ $600 per year for 5 years at 0%. $ Now rework parts a, b, and c assuming that payments are made…arrow_forwardYou want to make an investment that will yield a lump sum of $ 90,397 in 3 years. You will invest at a nominal rate of 18 %. How much do you need to invest today to reach the above future value? Record your answer as a dollar amount rounded to 2 decimal places , but do not include a dollar sign or any commas in your answer . For example , enter $ 12,327.24987 as 12327.25 .arrow_forward

- What is the IRR for a $1,075 investment that returns $190 at the end of each of the next 6 years?(Perform all calculations using 5 significant figures and round your answer to two decimal places): Answer: ____________%arrow_forward10arrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education