FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

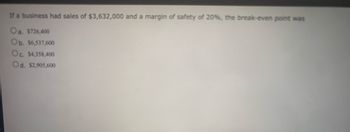

Transcribed Image Text:If a business had sales of $3,632,000 and a margin of safety of 20%, the break-even point was

Oa. $726,400

Ob. $6,537,600

Oc. $4,358,400

Od. $2,905,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardDean Company has sales of $76,000, and the break-even point in sales dollars is $47,120. Determine the company's margin of safety percentage. Round answer to the nearest whole number.fill in the blank 1 %arrow_forwardMatch the descriptions 1 through 5 with labels a through e on the CVP chart. Dollars $25,000 $20,000 $15,000 $10,000 $5,000 $0 1. Break-even point 2. Total sales line 3. Loss area 4. Profit area 5. Total costs line (b) 200 400 600 (c) (d) (a) (e) 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 Units produced and soldarrow_forward

- Margin of Safety The Rachel Company has sales of $550,000, and the break-even point in sales dollars is $368,500. Determine the company's margin of safety as a percent of current sales.arrow_forwardData on three unrelated companies are given in the following table. E (Click the icon to view the table.) Fill in the missing information in the preceding table. (Enter the capital turnover to two decimal places X.XX.) Osborne, Inc. Sales $ 114.000 Operating income $ 39,900 Total assets $ 71,250 Sales margin % Capital turnover Return on investment (ROI) Target rate of return. 10 % Residual incomearrow_forwarda. If Canace Company, with a break-even point at $368,000 of sales, has actual sales of $460,000, what is the margin of safety expressed (1) in dollars and (2) as a percentage of sales? Round the percentage to the nearest whole number. 1. $fill in the blank 1 2. fill in the blank 2% b. If the margin of safety for Canace Company was 45%, fixed costs were $1,935,450, and variable costs were 55% of sales, what was the amount of actual sales (dollars)?(Hint: Determine the break-even in sales dollars first.)$fill in the blank 3arrow_forward

- If this year Eloise Ltd. had sales of $750,000, fixed costs of $150,000, and variable costs of $350,000, what is the margin of safety in dollars?(round numbers within the calculations to 2 decimal places and choose the closest whole number) $400,000 $466,981 $450,000 $425,650arrow_forwardMason Corporation had $1,162,000 in invested assets, sales of $1,265,000, operating income amounting to $208,000, and a desired minimum return on investment of 14%. The profit margin for Mason Corporation is Oa. 17.9% b. 14.0% Oc. 91.9% Od. 16.4%arrow_forwardNonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education