FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The 9B photo, thank you~

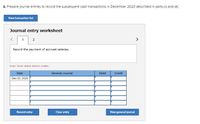

Transcribed Image Text:2. Prepare journal entries to record the subsequent cash transactions in December 2020 described in parts (c) and (e).

View transaction list

Journal entry worksheet

1

2

>

Record the payment of accrued salaries.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 02, 2020

Record entry

Clear entry

View general jourmal

Transcribed Image Text:The following information concerns the adjusting entries to be recorded on November 30, 2020, for Railink's year just ended.

a. The Office Supplies account started the year with a $4,800 balance. During 2020. the company purchased supplies at a cost of

$24,800, which was added to the Office Supplies account. The inventory of supplies on hand at November 30 had a cost of

$6,300.

b. An analysis of the company's insurance policies provided these facts:

Years of

Coverage Total Cost

$ 5,760

22,320

3,780

Policy

Date of Purchase

March 1, 2019

March 1, 2020

July 1, 2020

1

2

2

3

1

The total premium for each policy was paid in full at the purchase date, and the Prepaid Insurance account was debited for the full

cost. Appropriate adjusting entries have been made to November 30, 2019.

c. The company has 15 employees who earn a total of $4.800 in salaries for every working day. They are paid each Wednesday for

their work in the five-day workweek ending on the preceding Friday. All 15 employees worked November 23 to 27 inclusive. They

will be paid salaries for five full days on Wednesday. December 2, 2020.

d. The company purchased a building on July 1, 2020. The building cost $306.000 and is expected to have a $25,000 residual value

at the end of its predicted 30-year life.

e. Because the company is not large enough to occupy the entire building, it arranged to rent some space to a tenant at $3.100 per

month, starting on October 1, 2020. The rent was paid on time on October 1, and the amount received was credited to the Rent

Revenue account. However, the tenant has not paid the November rent. The company has worked out an agreement with the

tenant, who has promised to pay both November's and December's rent in full on December 15.

1. On October 1, the company also rented space to another tenant for $3.650 per month. The tenant paid five months' rent in advance

on that date. The payment was recorded with a credit to the Unearned Rent account.

Assume Railink uses the straight-line method to depreciate its assets. For the ease of calculations, assume that Salaries for November

30 is not considered for accrual purposes.

Requlred:

1. Use the information to prepare the annual adjusting entries as of November 30, 2020. (Do not round Intermedlate calculations.

Round your final answer to nearest whole dollar.)

View transaction list

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardted with McGraw-Hill CoX O Question 2 - chapter 16- proble X ezto.mheducation.com/ext/map/index.html?_con3Dcon&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-grou chapter 16 - problems i Saved Help Save & Exit Su 2 Lazare Corporation expects an EBIT of $30,800 every year forever. Lazare currently has no debt, and its cost of equity is 14%. The firm can borrow at 9%. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit $ sign in your response.) a. If the corporate tax rate is 35%, what is the value of the firm? Value of the firm b. What will the value be if the company converts to 50% debt? Value of the firm c. What will the value be if the company converts to 100% debt? Value of the firm Next > %24 %24 %24arrow_forwardx M Question 1-QUIZ - CH 17 - CX Chapter 5: Customers and Sal x o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H 17 i Saved 山☆ Help Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = K(x-772. 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement 0.1996 Frequency 3 0.2004 5 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements. Additionally, calculate the expected (i.e., average) loss per…arrow_forward

- u Online Cour X (78) Whats x M Your AccoL X M Inbox (2,74 X SP2021-AC X Answered: Ek My Home * CengageN X Bartleby Q x + D X A v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?inprogress=true FMovies | Watch M. BIO201 Connect 10. M Gmail > YouTube Fourth Homework O eBook Patents 6. MC.12.06 Instructions Chart Of Accounts General Journal 7. MC.12.07 Instructions 8. MCС.12.08 Mystic Pizza Company purchased a patent from Prime Pizza Plus on January 1, 2019, $72,000. The patent has a remaining legal life of 9 years. 9. МC.12.09 Required: 10. MC.12.10 Prepare the journal entries to record the acquisition and the amortization for 2019, assuming Mystic Pizza amortizes its patents using the 11. RE.12.01.BLANKSHEET straight-line method over the life of the asset. 12. RE.12.02 13. RE.12.03.BLANKSHEET 14. RE.12.04.BLANKSHEET 15. RE.12.05.BLANKSHEET 16. RE.12.06.BLANKSHEET 17. RE.12.07.BLANKSHEET 18. RE.12.08 O V I 12:52arrow_forwardStudents Home M Federal Financial Aid Program X Students Home Ch. 7 Hmwk: Invoices, Trade &X A Ch. 7 Hmwk Invoices, Trade & X A webassign.net/web/Student/Assignment-Responses/last?dep3D27277752 Apps M Gmail DYouTube Maps ... ... EReading list 7. [-/1 Points] DETAILS BRECMBC9 7.I1.010. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the net price factor (as a %) and net price (in $) by using the complement method. Round your answer to the nearest cent. List Price Trade Discount Rate Net Price Factor Net Price $3,499.00 35% $4 Need Help? Read It 8. [-/1 Points] DETAILS BRECMBC9 7.J1.014. MY NOTES ASK YOUR TEACHER PRACTICE ANOTHER Calculate the trade discount (in $) and trade discount rate (as a %). Round your answer to the nearest tenth of a percent. List Price Trade Discount Rate Trade Discount Net Price $4,500.00 $3,515.00 Need Help? 11:28 PM 71°F (岁 10/9/2021 P Type here to searcharrow_forwardQuestion list O Question 1 O Question 2 O Question 3 O Question 4 More Info N 1 2 3 4 5 6 7 8 9 10 To Find F Given P FIP 1.1200 1.2544 1.4049 1.5735 1.7623 1.9738 2.2107 2.4760 2.7731 3.1058 K 0.8929 0,7972 0.7118 0.6355 0.5674 0.5066 0.4523 0.4039 Most likely estimates for a project are as follows. 0.3606 0.3220 To Find P Given F PIF Choose the correct choice below. Determine whether the statement "This project (based upon the most likely estimates) is profitable." is true or false. ✔Click the icon to view the relationship between the PW and the percent change in parameter. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year False O True To Find F Given A FIA 1.0000 2.1200 3.3744 4.7793 6.3528 8.1152 10.0890 12.2997 14.7757 17.5487 To Find P Given A PIA 0.8929 1.6901 2.4018 3.0373 3.6048 4.1114 4.5638 4.9676 5.3282 5.6502 To Find A Given F AIF 1.0000 04717 0.2963 0.2092 0.1574 0.1232 0.0991 0.0813 0.0877 0.0570 To Find A Given P…arrow_forward

- Please do not give solution in image format thankuarrow_forwardM Question 1-QUIZ- CH 17-C X Chapter 5: Customers and Sal x + o.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.tulsacc.edu%2... H17 2 S Saved Exercise 17-42 (Algo) Taguchi Quality Loss Function (QLF) Analysis [LO 17-4] Flextronchip, an OEM manufacturer, has a fifth-generation chip for cell phones, with chip specification of 0.2 ± 0.0002 mm for the distance between two adjacent pins. The loss due to a defective chip has been estimated as $20. Required: 1. Compute the value of k, the cost coefficient in the Taguchi quality loss function (QLF), L(x) = (x-7)². 2. Assume that the quality control manager takes a sample of 100 chips from the production process. The results are as follows: Measurement Frequency 3 0.1996 0.1997 5 0.1998 15 0.1999 14 0.2000 35 0.2001 14 0.2002 6 0.2003 5 0.2004 3 a. & b. Use the appropriate Taguchi quality loss function, L(x), to calculate the estimated quality loss for each of the observed measurements.…arrow_forwardDocHub X D Unit 4 Project - TVM Calculator X b.com/claudiasirois1122/Xv7zYW5RnILBBINV2A9egx/unit-4-project-tvm-calculator-pdf?pg=6 > ✓Sign - O Ri + 4. Use the TVM Calculator to fill in the following table given that the APR is 6%. Round to 2 decimal places as needed. PV = PMT= FV = APR = Periods CHANGES = Compounding: CHANGES Principal Compounding Periods $1,000 D $1,000 $1,000 $1,000 $1,000 Annually Semiannually Monthly Weekly Daily 1 2 12 a. What did P represent in the compound interest formula? P = regular deposit amount 52 shift Amount after 1 year enter If we summarize the effect seen in the table, we see that more compoundings per year means that you will have more money in the account, but the amount of increase will eventually level off. Most banks publish the APY, or Annual Percentage Yield, instead of the APR to account for this effect. $1060 $1060.90 365 $1061.83 Extension 5. What are some financial goals that people save for? Some financial goals people save for are a…arrow_forward

- 2. Use the worksheet tab Problem 2 A-FV Retirement and Problem 2 B -PV Invest K File 6 7 ñ Paste K11 16 17 18 Book1 - Excel Clipboard Home Insert Calibri X Dr- Ready B I U 89- Draw Page Layout Formulas Data Review View == 28 M =100- Font 2 Return Rate 3 Investment Duration in Years 4 Amount Invested Future Investment Value fx One-Time Investment Scena Return Rate 9Investment Duration in Years 10 Monthly Payroll Deduction 11 Company Match 12 Monthly Investment 13 Current Balance 14 Future Investment Value 15 Sheet1 11 A A A- Retirement Plan Scenario Sheet2 Accessibility: Investigate D O AI 19 9 Return Rate = 5.500% 13 7500 Alignment 4.500% 35 500 50% 750 $10,000.00 19 D O Search General - $ % 9 68 28 Number Automate Help Acrobat Conditional Formatting W Format as Table Cell Styles - Styles Goal seek Future Savings Value at $20,000 Future Savings Value at $25,000 Insert Delete Format - Cells G O dating FS Sensitivity Retirement plan Goal Seek Solution by changing Return Rate-Goal seek…arrow_forwardNot a previously submitted question. Thank youarrow_forwardent II - Chapter 5 Saved Help Save & E 13 1.46853 0.68095 14 1.51259 0.66112 15 1.55797 0.64186 16 1.60471 0.62317 15.6178 10.63496 16.0863 10.95400 17.0863 11.29607 18.5989 11.93794 17.5989 11.63496 19.1569 12.29607 20.1569 12.56110 20.7616 12.93794 Monica wants to sell her share of an investment to Barney for $140,000 in 4 years. If money is wOrth 6% compounded semiannually, what would Monica accept today? Multiple Choice 110,517 $ 109.263 ( Prev 7 of 15 Next>arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education