FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

can you fix the Additional Paid-in Capital-PS and treasure stocks?

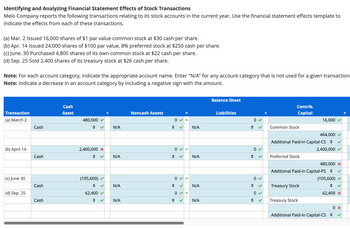

Transcribed Image Text:**Identifying and Analyzing Financial Statement Effects of Stock Transactions**

Melo Company reports the following transactions relating to its stock accounts in the current year. Use the financial statement effects template to indicate the effects from each of these transactions.

- **(a) Mar. 2:** Issued 16,000 shares of $1 par value common stock at $30 cash per share.

- **(b) Apr. 14:** Issued 24,000 shares of $100 par value, 8% preferred stock at $250 cash per share.

- **(c) June. 30:** Purchased 4,800 shares of its own common stock at $22 cash per share.

- **(d) Sep. 25:** Sold 2,400 shares of its treasury stock at $26 cash per share.

**Note:** For each account category, indicate the appropriate account name. Enter "N/A" for any account category that is not used for a given transaction.

**Note:** Indicate a decrease in an account category by including a negative sign with the amount.

**Table: Financial Effects on Balance Sheet and Contributed Capital**

| Transaction | Cash Asset | + | Noncash Assets | = | Liabilities | + | Contrib. Capital | + |

|---------------|------------|----|----------------|----|-------------|---|------------------|---|

| **(a) March 2** | 480,000 | ✓ | 0 | = | 0 | ✓ | 16,000 | ✓ |

| Cash | | | N/A | | N/A | | Common Stock | ✓ |

| | | | | | | | 464,000 | ✓ |

| | | | | | | | Additional Paid-in Capital-CS | ✓ |

| **(b) April 14** | 2,400,000 | ✗ | 0 | = | 0 | ✓ | 2,400,000 | ✓ |

| Cash | | | N/A | | N/A | | Preferred Stock | ✓ |

| | | | | | | | 480,000 | ✗ |

| | | | | |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- D4) 2. In what ways stock indices are useful to investors? What are the reasons for the rise of index funds and exchange traded funds (ETFs)?arrow_forwardExplain the role of speculators in determining the price of a security on the stock marketarrow_forwardHow can we raise the capital specification for shadow banks and depository institutions and make them counter-cyclical?arrow_forward

- How is each type of risk used in the capitalbudgeting process?arrow_forwardIs the market for all stocks equally efficient? Explain.arrow_forwardD6) Finance How would you use cash flow discount method and comparable method (aka relative value method) to estimate the intrinsic value of these two stocks? Discuss the pros and cons of the two methods. Use Macy and Nordstorm company as an example.arrow_forward

- What are Capital Markets, and how do bonds markets fit into the definition of Capital Markets?arrow_forwardWhen you are buying shares of an exchange traded fund (ETF) you purchase your shares at which price? *** OA. Average between the Bid and Ask Price OB. NAV (Net Asset Value) OC. Bid Price O D. Ask Price OE. More information is needed to answer this questionarrow_forwardIf you buy Treasury stock, what happens to your assets and equity when you sell it?arrow_forward

- Describe precisely one way that you would test if a particular stock market is strong-form efficient.arrow_forward. The cash flow of a long stock and long put strategy is equal to the cash flow from a long call strategy. True or False can i also get some explantation please?arrow_forwardDo investors generally prefer dividends or share repurchases? Support your answer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education