FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

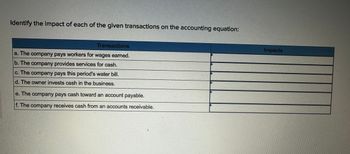

Transcribed Image Text:Identify the impact of each of the given transactions on the accounting equation:

Transactions

a. The company pays workers for wages earned.

b. The company provides services for cash.

c. The company pays this period's water bill.

d. The owner invests cash in the business.

e. The company pays cash toward an account payable.

f. The company receives cash from an accounts receivable.

Impacts

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- what the effect to asset, liability and owner's equity if the company purchases office equipment by casharrow_forwardFinancial statement users assess a business liquidity and solvency to see whether a business is generating enough cash to pay its debts True Falsearrow_forwardwhich of the following is an operating avtivity? A. billing customers for services rendered but not yet paid for B. paying off a loan to the bank C. purchasing equipment for cash D. receiving cash investments from ownersarrow_forward

- Explain accrual basis accounting, and when to recognize revenues and expenses and how it differs from cash accounting. Provide a detailed example of a business that may use cash accounting.arrow_forwardUnder the accrual basis of accounting - if cash has been received before the revenue has been earned, which of the following journal entries should be recorded? A) Debit Cash, Credit Unearned Revenue. B) Debit Cash, Credit Sales Revenue. C) Debit Unearned Revenue, Credit Cash. D) Debit Cash, Credit Accounts Receivable.arrow_forwardWhat accounts are considered temporary? Describe the process to close these temporary accounts? list the steps in the accounting cycle and describe the importance of each step ? What is liquidity? What is solvency? How are these evaluated in a business ?arrow_forward

- Could anyone explain this question? indicate the financial statement on which the account’s balance should be found. Also, if the account is shown on a company’s balance sheet, indicate if it should appear in the asset section, liability section, retained earnings section, income section, or stockholders’ equity section. Accounts Receivable Note Receivable Discount on Note Receivable Bank Service Charge Expense Bad Debts Expense Sales Return Liability Interest Revenue Allowance for Doubtful Accounts Cash Over/ Short Interest Receivable Sales Returns and Allowancesarrow_forwardWhich of the following describe the Salaries payable account? (Check all that apply.)Which of the following describe the Salaries payable account? (Check all that apply.) Multiple select question. It is reported on the income statement. It is a liability account. It reports amounts owed to employees. It is increased with a debit. It is reported on the balance sheet. It is increased with a credit.arrow_forwardaccounting records the impact of a business event when it occurs, regardless of whether the transaction affected casharrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education