FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

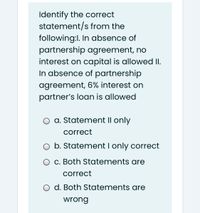

Transcribed Image Text:Identify the correct

statement/s from the

following:I. In absence of

partnership agreement, no

interest on capital is allowed II.

In absence of partnership

agreement, 6% interest on

partner's loan is allowed

O a. Statement II only

correct

O b. Statement I only correct

O c. Both Statements are

correct

O d. Both Statements are

wrong

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- S1: Forming a partnership requires two or more people agreeing partners Contributing all their personal properties. S2: Oral agreement partners are not allowed. * A. Statement 2 is true. B. Statement 1 is true. C. Both statements are false. D. Both statements are true. S1: A joint arrangement that is structured without a separate vehicle should be accounted as Joint Venture. S2: A joint arrangement that is structured without a separate vehicle should be accounted as Joint Operation? A. S2 True; S1 False B. Both statements are false C. s1 True; S2 False D. Both statements are true The interest of the retiring or withdrawing partner is usually measured by his capital balance before his retirement or withdrawal adjusted by the following adjustments except? A. profit or loss from the operation from the last closing date of the date of his retirement or withdrawal B. profit or loss after the date of the partner's withdrawal or retirement C. errors in net income in prior years D.…arrow_forwardWhich of the following apply to a partnership that consists solely of general partners? I. Double taxation of partnership profits. II. Limited partnership life. III. Active involvement in the firm by all the partners. IV. Unlimited personal liability for all partnership debts. Group of answer choices II and III only. II only. II, III, and IV only. I and II only. I, II, and IV only.arrow_forwardAssess the truth of this statement: One of the rules of debits and credits and account balances for a partnership is that increases in expense accounts are always debited to the expense account. This statement is true. O This statement is false. O There is not enough information to determine whether or not this statement is true. O This statement is not applicable to accounting concepts.arrow_forward

- PB3. LO 15.5 Match each of the following descriptions with the appropriate term related to partnership accounting. A. Each and every partner can enter into contracts on behalf of the partnership i. liquidation B. The business ceases operations. ii. capital deficiency C. How partners share in income and loss iii. admission of a new partner D. Adding a new partner by contributing cash iv. mutual agency E. A partner account with a debit balance v. income sharing ratioarrow_forwardA partnership agreement should include A. Provision for division of assets on dissolution O B. Investment for each partner O c. Withdrawals to be allowed each partner D. All of thesearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education