ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

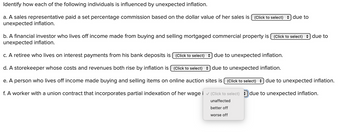

Transcribed Image Text:Identify how each of the following individuals is influenced by unexpected inflation.

a. A sales representative paid a set percentage commission based on the dollar value of her sales is (Click to select) due to

unexpected inflation.

b. A financial investor who lives off income made from buying and selling mortgaged commercial property is (Click to select) due to

unexpected inflation.

c. A retiree who lives on interest payments from his bank deposits is (Click to select) due to unexpected inflation.

d. A storekeeper whose costs and revenues both rise by inflation is [ (Click to select)) due to unexpected inflation.

e. A person who lives off income made buying and selling items on online auction sites is (Click to select) due to unexpected inflation.

f. A worker with a union contract that incorporates partial indexation of her wage i ✓ (Click to select) due to unexpected inflation.

unaffected

better off

worse off

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question 3 Evaluate how each of these individuals will be affected by an unanticipated inflation of 15% per annum a. A pensioned lecturer b. A store attendant c. A unionized automobile assembly-line worker d. A heavily indebted farmer e. A retired manager whose current income comes from interest on government bondsarrow_forwardEconomists widely agree that the Consumer Price Index understates the true U.S. inflation rate. a. True b. Falsearrow_forwardWhich of the following groups would most likely be harmed by inflation? Group of answer choices spenders workers retirees none of the above Older people often reminisce about the “good old days” when prices were much lower. This is misplaced nostalgia primarily because in the “good old days” Group of answer choices prices were not really that low wages were much lower also When interest rates fall, investment expenditures by businesses Group of answer choices decrease increasearrow_forward

- Which of the following are likely consequences of rising inflation? Check all that apply. Savers wanting to save less and borrowers wanting to borrow more Savers wanting to save more and borrowers wanting to borrow less A misallocation of resources A distorted price-signaling mechanism Suppose the real interest rate (IR) is 3.5% and the inflation rate is 3.5%, and then the nominal or market interest rate is_______ . Crystal considers investing in the green energy industry and compares the following two options: 1. One-year bonds issued by Air Wizard, a producer of wind turbines based in the United States, that pay a nominal interest rate of 7% 2. One-year bonds issued by Sun Waters, a producer of solar water heaters based in Australia, that pay a nominal interest rate of 9.8% A thorough study has shown that the economic situation and prospects in the United States and Australia are very similar. Nevertheless, Crystal decides to…arrow_forwardConsider the following: Price Index in 2017 86 Price Index in 2018 100 Price Index in 2019 108 Price Index in 2020 120 Price Index in 2021 146 a. The base year is 2018 b. Calculate the inflation rate from 2018 to 2019. 8 % (Enter your response as a percentage rounded to two decimal places.) c. Calculate the inflation rate from 2019 to 2020. 11.11 % (Enter your response as a percentage rounded to two decimal places.) d. Assume the cost of a market basket in 2018 is $2,137.0. (Enter your responses rounded to one decimal place.) Calculate the cost of the same basket of goods and services in 2017. Calculate the cost of the same basket of goods and services in 2021.arrow_forwardIf consumers purchase fewer of those products that increase most in price and more of those products that increase less in price as compared to the CPI bas changes in the CPI, overstate the true rate of inflation are totally unrelated to the true rate of inflation. reflects the increase in quality bias understate the true rate of inflation accurately reflect the true rate of inflationarrow_forward

- It has been argued that inflation and unemployment are both good and bad. Explain. Are government efforts to control inflation and brings unemployment to Zero well advised? Explain. Please put the website linkarrow_forward1) Whether you gain or lose during a period of inflation depends on: a) how the price increases affect government purchases of goods. b) whether the economy is expanding or contracting. c) whether you save or not. d) whether your income rises faster or slower than prices of the things you buy. 2) A real wage that does not keep pace with inflation implies: a) a decrease in purchasing power. b) a decrease in nominal wages. c) a decrease in nominal wages after inflation. d) an increase in the inflation adjusted real wage.arrow_forwardEvaluate how each of the following individuals would be affected by unanticipated inflation: (a) A department store clerk, a heavily indebted farmer A private pensioner The governmentarrow_forward

- Suppose that Lauren is a savvy investor and expects inflation to equal 7 per cent in 2020, but, in fact, prices rise by only 4 per cent. How would this unexpectedly low inflation rate affect her in the following circumstances? a The federal government cuts income tax. b She has a fixed-rate mortgage home loan. c She is a casual worker with no labour contract in place. d She has invested in Treasury bonds.arrow_forwardThe table below shows the annual change in the average nominal wage and inflation rate since 2008. a. Compute the percentage change in real income for each year shown in the table. Instructions: In part a, round your answers to two decimal places. In parts b and c, enter your answers as a whole number. If entering a negative number, include a minus sign. Percentage Changes in Nominal Income and Prices Year 2008 2009 2010 2011 2012 2013 Annual Inflation Rate (percent) 3.92% -0.36 1.66 3.24 2.11 1.48 Annual Nominal Wage Growth (percent) 0.34% -1.24 -0.76 1.4 2.76 2.28 Annual Real Wage Growth (percent) (0.39) x % (0.88) ♥ 2.42 x 9.87 x b. Of the years listed above, the paycheck of the average worker declined in 2 c. Of the years listed above, the purchasing power of the average worker declined in of the six years. 4 of the six years. d. The average real income of households can increase whether the nominal wage increases or decreasesarrow_forwardThe relationship between the inflation rate and the unemplotment rate is it a micro or macro decison? explain whyarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education