FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

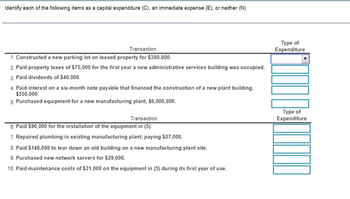

Identify each of the following items as a capital expenditure (C), an immediate expense (E), or neither (N).

question 42 attached in ss

thanks for help

appreicated

riwjgoihjwoi

wtiohw

Transcribed Image Text:Identify each of the following items as a capital expenditure (C), an immediate expense (E), or neither (N).

Transaction

1. Constructed a new parking lot on leased property for $300,000.

2. Paid property taxes of $75,000 for the first year a new administrative services building was occupied.

3. Paid dividends of $40,000.

4. Paid interest on a six-month note payable that financed the construction of a new plant building.

$550,000.

5. Purchased equipment for a new manufacturing plant, $6,000,000.

Transaction

6. Paid $90,000 for the installation of the equipment in (5).

7. Repaired plumbing in existing manufacturing plant, paying $27,000.

8. Paid $148,000 to tear down an old building on a new manufacturing plant site.

9. Purchased new network servers for $29,000.

10. Paid maintenance costs of $31,000 on the equipment in (5) during its first year of use.

Type of

Expenditure

Type of

Expenditure

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How does scholarships received & gifts and inheritances work in taxation? Also, what is section 529 plans? Lastly, what is life insurance proceeds in accounting?arrow_forwardThe amount that you contribute to your defined contribution plan matters more than the timing of the contributions O True O Falsearrow_forwardplease help me to solve this problemarrow_forward

- Which of the following statements is correct? Multiple Choice A contribution receivable should be recognized as an asset when the amount can be reasonably estimated AND the ultimate collection is reasonably assured. A contribution receivable should be recognized as an asset when the amount can be reasonably estimated OR the ultimate collection is reasonably assured. Bequests are accrued at the time the donor advises the NFPO of the gift. Government funding is recognized as contribution revenue as long as the government is the direct recipient of the good or service. Group Endsarrow_forwardOliver's Place is a nonprofit entity that cares for dogs until they are adopted. It uses fund accounting and uses a UCF, an RCF, and an EF. It charges its expenses to the care of animals program, special programs, and administrative expenses. Following are some of its transactions for its fiscal year. Prepare the journal entries needed to record these transactions, indicating the fund used for each entry and showing net asset classifications, where appropriate. 1. During the year, Oliver's Place received pledges of $80,000 without donor restrictions. It estimated that 95 percent of the pledges would be collected in cash. 2. It received the following gifts from various donors: a. Donor A made a gift of common stock that had a fair value of $16,000. Donor A stated that the gift could be used for any purpose. b. Donor B made a cash gift of $4,000, stipulating that it could be used only for a new program to take calm dogs to visit elderly people. c. Donor C made a gift of common stock that…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education