FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

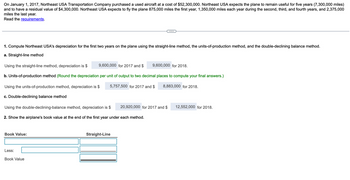

Transcribed Image Text:On January 1, 2017, Northeast USA Transportation Company purchased a used aircraft at a cost of $52,300,000. Northeast USA expects the plane to remain useful for five years (7,300,000 miles)

and to have a residual value of $4,300,000. Northeast USA expects to fly the plane 875,000 miles the first year, 1,350,000 miles each year during the second, third, and fourth years, and 2,375,000

miles the last year.

Read the requirements.

1. Compute Northeast USA's depreciation for the first two years on the plane using the straight-line method, the units-of-production method, and the double-declining balance method.

a. Straight-line method

Using the straight-line method, depreciation is $

9,600,000 for 2017 and $

9,600,000 for 2018.

b. Units-of-production method (Round the depreciation per unit of output to two decimal places to compute your final answers.)

Using the units-of-production method, depreciation is $

5,757,500 for 2017 and $

8,883,000 for 2018.

c. Double-declining balance method

Using the double-declining-balance method, depreciation is $

2. Show the airplane's book value at the end of the first year under each method.

Book Value:

Less:

Book Value

20,920,000 for 2017 and $ 12,552,000 for 2018.

Straight-Line

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help with this questionarrow_forwardThe following transactions occurred during 2025. Assume that depreciation of 10% per year is charged on all machinery and 5% per year on buildings, on a straight-line basis, with no estimated salvage value. Depreciation is charged for a full year on all fixed assets acquired during the year, and no depreciation is charged on fixed assets disposed of during the year. Jan. 30 Mar. 10 Mar. 20 May 18 June 23 A building that cost $139,920 in 2008 is torn down to make room for a new building. The wrecking contractor was paid $5,406 and was permitted to keep all materials salvaged. Date Machinery that was purchased in 2018 for $16,960 is sold for $3,074 cash, f.o.b. purchaser's plant. Freight of $318 is paid on the sale of this machinery. A gear breaks on a machine that cost $9,540 in 2017. The gear is replaced at a cost of $2,120. The replacement does not extend the useful life of the machine but does make the machine more efficient. A special base installed for a machine in 2019 when the…arrow_forwardDepreciation for Partial Periods Malone Delivery Company purchased a new delivery truck for $36,000 on April 1, 2019. The truck is expected to have a service life of 10 years or 180,000 miles and a residual value of $3,000. The truck was driven 12,000 miles in 2019 and 20,000 miles in 2020. Malone computes depreciation expense to the nearest whole month. Required: 1. Compute depreciation expense for 2019 and 2020 using the following methods: (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020 2. For each method, what is the book value of the machine at the end of 2019? At the end of 2020? (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020arrow_forward

- Do not give answer in imagearrow_forwardDepreciation for Partial Periods Storm Delivery Company purchased a new delivery truck for $69,000 on April 1, 2019. The truck is expected to have a service life of 10 years or 150,000 miles and a residual value of $3,000. The truck was driven 8,000 miles in 2019 and 20,000 miles in 2020. Storm computes depreciation expense to the nearest whole month. For each method, what is the book value of the machine at the end of 2019? At the end of 2020? (Round your answers to the nearest dollar.) Double-declining-balance method 2019 $ fill in the blank 13 2020 $ fill in the blank 14 Activity method 2019 $ fill in the blank 15 2020 $ fill in the blank 16arrow_forwardUnits-of-activity Depreciation A truck acquired at a cost of $250,000 has an estimated residual value of $15,500, has an estimated useful life of 35,000 miles, and was driven 3,200 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. (a) The depreciable cost (b) The depreciation rate %24 per mile (c) The units-of-activity depreciation for the yeararrow_forward

- Depreciation by Three Methods; Partial Years Razar Sharp Company purchased equipment on July 1, 2014, for $69,660. The equipment was expected to have a useful life of three years, or 5,400 operating hours, and a residual value of $2,160. The equipment was used for 1,000 hours during 2014, 1,900 hours in 2015, 1,600 hours in 2016, and 900 hours in 2017. Required: Determine the amount of depreciation expense for the years ended December 31, 2014, 2015, 2016, and 2017, by (a) the straight-line method, (b) units-of-output method, and (c) the double-declining-balance method. Note: FOR DECLINING BALANCE ONLY, round the multiplier to four decimal places. Then round the answer for each year to the nearest whole dollar. a. Straight-line method Year Amount 2014 $fill in the blank 1 2015 $fill in the blank 2 2016 $fill in the blank 3 2017 $fill in the blank 4 b. Units-of-output method Year Amount 2014 $fill in the blank 5 2015 $fill in the blank 6 2016 $fill in the blank…arrow_forwardK Depreciation Norton Systems acquired two new assets. Asset A was research equipment costing $19,000 and having a 3-year recovery period. Asset B was duplicating equipment having an installed cost of $56,000 and a 5-year recovery period. Using the MACRS depreciation percentages, prepare a depreciation schedule for each of these assets. Complete the depreciation schedule for asset A below: Recovery Year 1 ... Depreciation (Round to the nearest dollar.) edit: 0 Qu Quarrow_forwardDepreciation for Partial Periods Bean Delivery Company purchased a new delivery truck for $42,000 on April 1, 2019. The truck is expected to have a service life of 5 years or 120,000 miles and a residual value of $3,000. The truck was driven 8,000 miles in 2019 and 16,000 miles in 2020. Bean computes depreciation expense to the nearest whole month. Required: 1. Compute depreciation expense for 2019 and 2020 using the following methods: (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020 2. For each method, what is the book value of the machine at the end of 2019? At the end of 2020? (Round your answers to the nearest dollar.) a. Straight-line method 2019 2020 b. Sum-of-the-years'-digits method 2019 2020 c. Double-declining-balance method 2019 2020 d. Activity method 2019 2020 $arrow_forward

- Units-of-activity Depreciation A truck acquired at a cost of $515,000 has an estimated residual value of $27,500, has an estimated useful life of 65,000 miles, and was driven 6,500 miles during the year. Determine the following. If required, round your answer for the depreciation rate to two decimal places. (a) The depreciable cost (b) The depreciation rate (c) The units-of-activity depreciation for the year per milearrow_forwardSubject:arrow_forwardCurrent Attempt in Progress Swifty Ltd. purchases equipment on January 1, year 1, at a cost of £367,780. The asset is expected to have a service life of 12 years and a residual value of £35,500. (a) Compute the amount of depreciation for each of years 1 through 3 using the straight-line depreciation method. (Round answers to 0 decimal places, e.g. 5,125.) Depreciation for Year 1 Depreciation for Year 2 Depreciation for Year 3 eTextbook and Media Save for Later £ E £ Attempts: 0 of 3 used Submit Answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education