FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

I need the journlaized inventory transactions under the methods : FIFO,

The accounts are : cash, cost of gold sold, merchandise inventory, and sales revenue.

The data table is here

|

Date |

Description |

Units |

Per Unit |

|

Jan 1 |

Inventory on hand |

5,000 |

$11 |

|

Jan 3 |

purchase |

9,000 |

$13 |

|

Jan 6 |

sale |

8,500 |

$23 |

|

Jan 15 |

purchase |

13,000 |

$15 |

|

Jan 22 |

sale |

12,000 |

$23 |

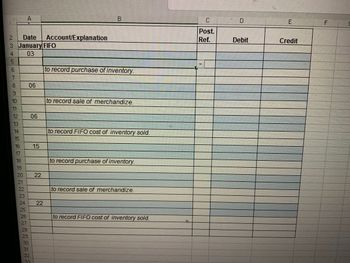

Transcribed Image Text:Certainly! Below is the transcription of the image content, formatted for an educational website. This is a template for recording financial transactions using the FIFO (First In, First Out) inventory accounting method.

---

### FIFO Inventory Accounting Template

| Date | Account/Explanation | Post. Ref. | Debit | Credit |

|------|----------------------------------------------------|------------|-------|--------|

| January | FIFO | | | |

| 03 | to record purchase of inventory. | | | |

| 06 | to record sale of merchandise. | | | |

| 06 | to record FIFO cost of inventory sold. | | | |

| 15 | to record purchase of inventory. | | | |

| 22 | to record sale of merchandise. | | | |

| 22 | to record FIFO cost of inventory sold. | | | |

**Explanation:**

This table is designed to help users record inventory transactions under the FIFO method, which assumes that the oldest inventory items are sold first. The template includes columns for the date, account/explanation, a posting reference, and the amounts to be debited or credited.

- **Date**: The day of the month when the transaction occurs.

- **Account/Explanation**: Brief description of the transaction.

- **Post. Ref.**: A space to add a reference number for posting purposes.

- **Debit/Credit**: Columns to enter the monetary amounts affected by the transactions.

In this template, transactions are listed for recording purchases and sales of inventory, as well as the cost of inventory sold under the FIFO method. Please ensure to fill in the debit and credit amounts according to the actual values from your specific transactions.

Expert Solution

arrow_forward

Step 1: Introduction:

FIFO is first in first out method of inventory management. Under this method, inventories which are purchased first will be sold out first. Ending inventory will always be from last purchase units.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cost of Goods Sold and the Periodic System Kanzu Company uses the periodic inventory system. Kanzu started the period with $10,000 in inventory. The Company purchased an additional $25,000 of merchandise, and returned $1,000 for a full credit. A physical count of inventory at the end of the period revealed that there was an ending inventory balance of $8,000 What was Kanzu's cost of goods sold during the period?arrow_forwardEnter the missing dollar amounts for the income statement for each of the following independent cases. (Hint: In Case B, work from the bottom up.) Net sales revenue Beginning inventory Purchases Goods available for sale Ending inventory Cost of goods sold Gross profit Expenses Pretax income (loss) $ Case A 11,000 4,880 10,210 $ 7,630 200 $ 1,760 $ Case B 6,560 15,200 11,030 $ 1,330 (530) $ Case C $ 3,910 9,430 13,340 $ 6,090 4,420 700 970arrow_forwardi need the answer quicklyarrow_forward

- I need help with question Carrow_forwardUsing the LIFO method, calculate the cost of ending inventory and cost of goods sold for Cale Corporation.arrow_forwardGiven the following: Numberpurchased Costper unit Total January 1 inventory 32 $ 4 $ 128 April 1 52 6 312 June 1 42 7 294 November 1 47 8 376 173 $ 1,110 a. Calculate the cost of ending inventory using the FIFO (ending inventory shows 53 units). b. Calculate the cost of goods sold using the FIFO (ending inventory shows 53 units).arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education