I need help with the following questions referring to the image below.

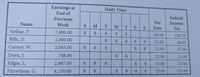

Highridge homes has the following payroll information for the week ended Feburary 21:

Taxable earnings for Social Security are based on the first $118,500. Taxable earnings for Medicare are based on all earnings. Taxable earnings for federal and state

Required

1. Complete the payroll register. The Social Security tax rate is 6.2 percent, and the Medicare tax rate is 1.45 percent. Begin payroll checks with No. 2080.

2. Prepare a general

3. Assuming that the firm has transferred funds from its regular bank account to its special payroll bank account and that this entry has been made, prepare a general journal entry to record the payment of wages.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- The purpose of this assignment is to evaluate the impact of a financial analysis on administrative decisions in a health care organization. Review Northwestern Memorial HealthCare's "Consolidated Financial Report" (Years Ended August 31, 2019 and 2018), and answer the following prompts. Discuss the importance of and need for a financial analysis within a health care organization. Explain the relationship between a health care organization's financial plan and debt policy to its strategic plan. Assess the financial position of Northwestern Memorial HealthCare in 2019 as compared to 2018. Give specific examples of areas where improvement is needed or areas that should be of concern in terms of financial viability. Based upon these observations, make recommendations that management should consider from a strategic standpoint (i.e., strategic budgeting methods).arrow_forwardCompare and contrast the role and preparation of a master budget in a company's financial planning process, and discuss how it can be used to coordinate the activities of different departments and improve decision-making.arrow_forwardAssume your home is assessed at $250,000. You have a $241,000 loan for 25 years at 6 percent. Your property tax rate is 1.4 percent of the assessed value. In year one, you would pay $15,665 in mortgage interest and $3,500 in property tax (1.4 percent on $250,000 assessed value). What is the total deduction you can take on your federal income tax return?arrow_forward

- Please answer quickly and coarrow_forwardCurrent liabilities Total assets Retained earnings The following data are for the A, B, and C Companies: Variables Current assets A $150,000 $ 60,000 $300,000 Company B $170,000 $ 50,000 $280,000 C $180,000 $ 30,000 $250,000 $ 60,000 $ 80,000 $ 90,000 Earnings before interest and taxes $ 70,000 $ 60,000 $ 50,000 Market price per share $ 20.00 $ 18.75 $ 16.50 Number of shares outstanding 9,000 9,000 9,000 Book value of total debt Sales $ 30,000 $430,000 $ 50,000 $ 80,000 $400,000 $200,000 REQUIRED: A. B. Using MS Excel, compute the Z score for each company. According to the Altman model, which of these firms is most likely to experience financial failure?arrow_forwardcreate a response to the followig The fixed budget is continual and constant, and under any given circumstances this budget will never change. A fixed budget is not flexible, and a fixed budget is very straightforward. When we look at the value of a fixed budget does not fluctuate based on increases or decreases in revenue, or if there is an increase in operating costs. The fixed budget’s value is determined once it is assigned to the balance sheet without change. A fixed budget will be assigned for a precise time that is shown in the organization’s budget plan (Van Baal &Meltzer 2016). The fixed budget does not show any unpredictability based on the organization’s activity (Van Baal &Meltzer 2016). When we look at a flexible budget, there is a huge difference. A flexible budget is defined as a budget based on the static budget assumptions but adjusted to reflect realized volume (Reiter & Song 2021). A flexible budget can and will be changed to meet the needs of the…arrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardThe Free Cash Flow model has the following advantage over the Dividend Growth model: In the case of variable growth, it does not require the calculation of any horizon value. It can be applied even if growth rates are unknown. It can be applied to companies with variable growth in the initial years that eventually settle down to a fixed rate of growth for the long term. It can be applied to divisions of companies. O It does not require any forecasting.arrow_forwardMary is trying to qualify for a home loan but her lender tells her that her debt-to-income ratio is too high for FHA standards. What can Mary do to qualify for an FHA loan? О Transfer some of her existing debt to one or more credit cards. О Take out an equity line of credit to pay for the down payment. О Pay off one or more of her existing loans, such as a car loan or credit card debt. Decrease her credit score.arrow_forward

- What is the relative tax advantage of corporate debt if the corporate tax rate is Tc=0.21 , the personal tax rate on interest is TpD=0.37 , but all equity income is received as capital gains and escapes tax entirely ( TpE=0 )? How does the relative tax advantage change if the company decides to pay out all equity income as cash dividends that are taxed at 20%? Note: Do not round intermediate calculations. Round your answers to 4 decimal places.arrow_forwardOA OB ts is CORRECT about a Business Income Coverage Form? It must be written on a Special Form It provides coverage for losses that occur up to 30 days after the policy expires. It provides coverage for income interruption at any location owned by the insured. It provides coverage for income interruption from physical damage only at the location describearrow_forwardMr. X is a factory worker. He works in a factory from 8 am to 5 pm. He gets interval from 1 pm to 2 pm for rest and meal. He has been working in this factory for more than two decades. Now he wants to take voluntary retirement from his service. After termination of service, he will get gratuity, allowances and any other compensation. Now, write the answer of following questions. What is gratuity? How will gratuity be counted to pay Mr. X during his retirement? Write with example. ii.arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.