FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

I

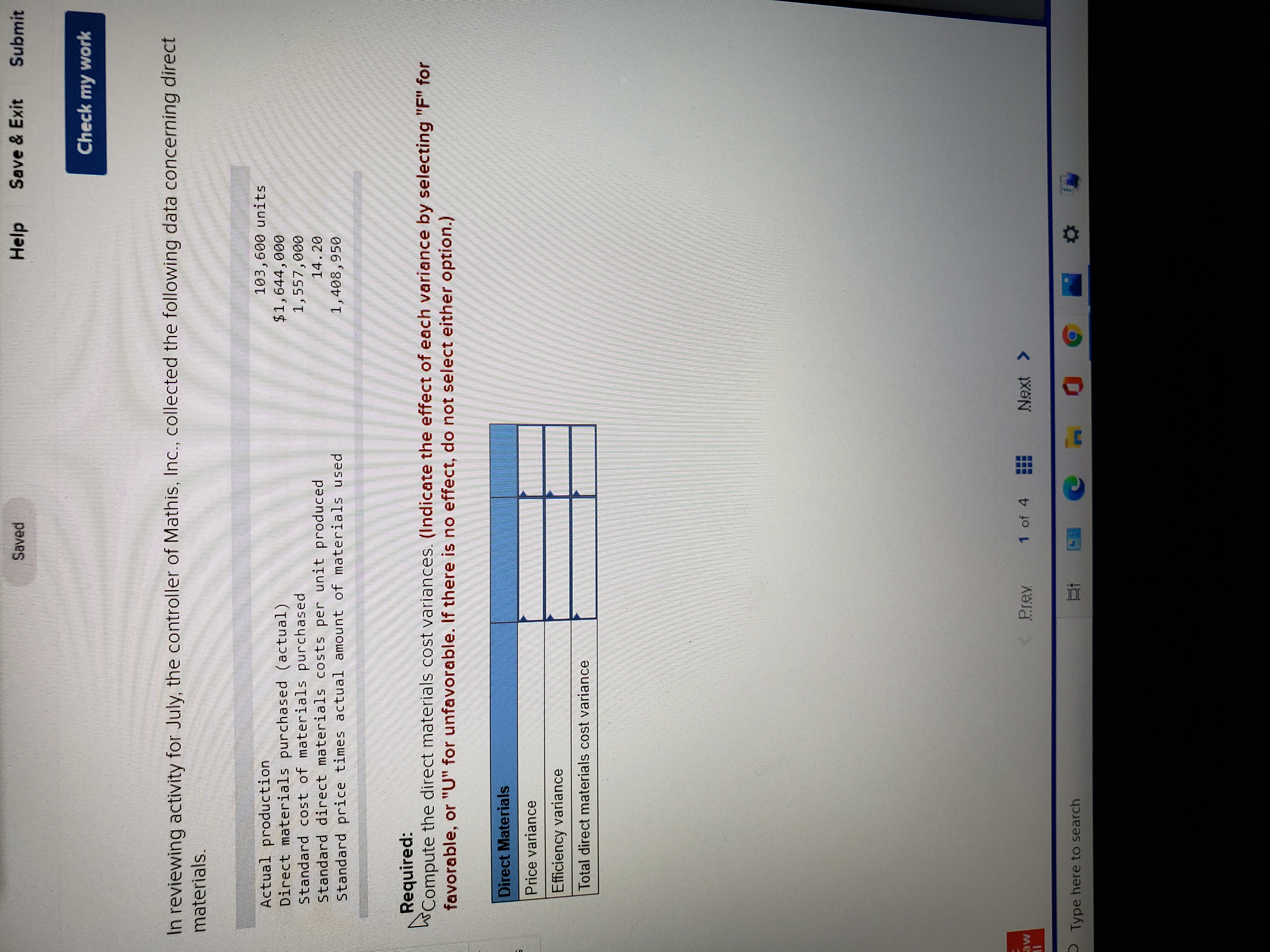

In reviewing activity for July, the controller of Mathis, Inc., collected the following data concerning direct materials.

| Actual production | 103,600 | units | |

| Direct materials purchased (actual) | $ | 1,644,000 | |

| 1,557,000 | |||

| Standard direct materials costs per unit produced | 14.20 | ||

| Standard price times actual amount of materials used | 1,408,950 | ||

Required:

Compute the direct materials cost variances. (Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following data relate to direct materials costs for February: Materials cost per yard: standard, $1.91; actual, $2.03 Yards per unit: standard, 4.60 yards; actual, 4.97 yards Units of production: 9,500 The direct materials quantity variance is O a. $6,713.65 favorable b. $7,135.45 unfavorable O c. $6,713.65 unfavorable O d. $7,135.45 favorablearrow_forwardA company provided the following direct materlals cost Information. Compute the total direct materials variance. Standard costs assigned: Direct materials standard cost ( 419,000 units @ $4.00/unit) $ 1,676,000 Actual costs: Direct materials costa incurred (417,750 units @ $4..20/unit) $ 1,754,550 Multiple Choice $5,000 Favorable. $78,550 Unfavorable. $83,550 Unfavorable. $78,550 Favorable. $83,550 Favorable.arrow_forwardPlease help mearrow_forward

- The standard direct material cost per unit for Willis Group was $152 (= $38 per gallon × 4 gallons per unit). During the period, actual direct materials costs amounted to $2,020,690, materials used totaled 55,475 gallons, and 13,270 units were produced. Required: Compute the direct materials price and efficiency variances for the period. Note: Indicate the effect of each variance by selecting "F" for favorable, or "U" for unfavorable. If there is no effect, do not select either option.arrow_forwardPlease do not give solution in image formatarrow_forwardBrooks Company uses a standaed conting nystem. The following information pertains to direct materials for the month of June: Standard price per h Actual purchase price per h. Quanity punchased Quaity used Sandard quantity allowed for actual output Actual output SI5.00 S14.50 3,150 be. 2,980 he. 3,000 he. 1,000 unita Brooks Company reports its material price variances at the time of purchase. What is the journal entry to recond material purchases? O Materials 47,250 Materials Price Variance 1,575 Accounta Payable 45,675 O Materials 47,165 Materials Price Variance 1,490 Accounts Payable 45,675 OMateriala 47,175 Materials Price Variance 1,500 Accounts Payable 45,675 O Materials 44,100 Materials Price Variance 1,575 Accounts Payable 45,675arrow_forward

- sarrow_forwardFlingen Inc. reveals the following information in their annual report for FY 2021 Selected Income Statement Items: Sales $10,500,000 Cost of goods sold $5,500,000 Pretax earnings $650,000 Selected Balance Sheet Items: Merchandise inventory $800,000 Total assets $2,500,000 Upper management plans to cut cost of goods sold by 4.5% for the coming year but retain the same sales and weeks of inventory. What is the return on assets estimated to be for 2022? Group of answer choices 33.7% 32.1% 36.8% 34.1%arrow_forwardMyers Corporation has the following data related to direct materials costs for November: actual costs for 4,700 pounds of material at $5.30 per pound; and standard costs for 4,410 pounds of material at $6.20 per pound. What is the direct materials price variance? a. $4,230 favorable b. $1,798 favorable c. $1,798 unfavorable d. $4,230 unfavorablearrow_forward

- Hw.18.arrow_forwardPlease help me with show all calculation thankuarrow_forwardThe following data relate to a product manufactured by Kent Corporation: Direct material standard: 3.5 square feet at $2.50 per square foot Direct material purchased & used: 33,000 square feet at $2.60 per square foot Manufacturing activity: 9,600 units completed SHOW ALL COMPUTATIONS Compute price variance, quantity variance, direct material variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education