FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1:27

AA

HWCH 24

Fee revenue

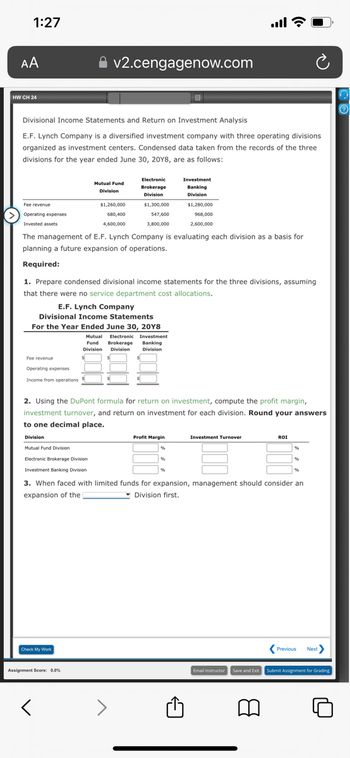

Divisional Income Statements and Return on Investment Analysis

E.F. Lynch Company is a diversified investment company with three operating divisions

organized as investment centers. Condensed data taken from the records of the three

divisions for the year ended June 30, 20Y8, are as follows:

Operating expenses

Invested assets

Fee revenue

Operating expenses

Income from operations

v2.cengagenow.com

Division

Mutual Fund Division

Electronic Brokerage Division

Investment Banking Division

Mutual Fund

Division

The management of E.F. Lynch Company is evaluating each division as a basis for

planning a future expansion of operations.

Required:

Check My Work

$1,260,000

680,400

4,600,000

1. Prepare condensed divisional income statements for the three divisions, assuming

that there were no service department cost allocations.

E.F. Lynch Company

Divisional Income Statements

For the Year Ended June 30, 20Y8

Assignment Score: 0.0%

く

Electronic

Brokerage

Division

$1,300,000

547,600

3,800,000

Mutual Electronic

Electronic Investment

Fund

Brokerage Banking

Division Division Division

2. Using the DuPont formula for return on investment, compute the profit margin,

investment turnover, and return on investment for each division. Round your answers

to one decimal place.

Investment

Banking

Division

$1,280,000

968,000

2,600,000

Profit Margin

all?

%

Investment Turnover

3. When faced with limited funds for expansion, management should consider an

expansion of the

Division first.

ROI

a

%

Previous Next>

Email Instructor Save and Exit Submit Assignment for Grading

CO

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vertical Analysis Two income statements for Upward Company follow: Upward Company Income Statements For the Years Ended December 31 20Y5 20Y4 Fees earned $924,000 $784,000 Operating expenses 545,160 478,240 Income from operations $378,840 $305,760 a. Prepare a vertical analysis of Upward Company's income statements. Enter percents as whole numbers. Upward Company Income Statements For the Years Ended December 31 20Y5 Amount 20Y5 Percent 20Y4 Amount 20Y4 Percent Fees earned $924,000 100 % $784,000 100 % 545,160 0X % 478,240 X % Operating expenses X % $305,760 X % Income from operations $378,840arrow_forwardSegment Revenue Vertical Analysis Newton Corporation is one of the world's largest entertainment companies that includes Gravity films, Apple Broadcasting, Gravity News, the GR, and various satellite properties. The company provided revenue disclosures by its major product segments in the notes to its financial statements as follows: a. Using the revenue disclosures by major product segment listed below, provide a vertical analysis of the product segment revenues. Round all percents to one decimal place. For a Recent Year Major Product Segments (in millions) Percent (%) Cable Network Programming $23,925 Television 8,338 Filmed Entertainment 5,154 Direct Broadcast Satellite Television 4,483 Total revenues of major segments $41,900 %arrow_forwardRequired: The following data pertain to three divisions of Nevada Aggregates, Incorporated. The company's required rate of return on invested capital is 10 percent. Note: Round "Capital turnover" answers to 2 decimal places.arrow_forward

- Divisional Income Statements and Return on Investment Analysis E.F. Lynch Company is a diversified investment company with three operating divisions organized as investment centers. Condensed data taken from the records of the three divisions for the year ended June 30, 20Y8, are as follows: Mutual FundDivision ElectronicBrokerageDivision InvestmentBankingDivision Fee revenue $1,010,000 $1,060,000 $1,030,000 Operating expenses 492,000 390,400 727,600 Invested assets 3,700,000 3,100,000 2,100,000 The management of E.F. Lynch Company is evaluating each division as a basis for planning a future expansion of operations. Required: Question Content Area 1. Prepare condensed divisional income statements for the three divisions, assuming that there were no service department cost allocations. E.F. Lynch CompanyDivisional Income StatementsFor the Year Ended June 30, 20Y8 MutualFundDivision ElectronicBrokerageDivision InvestmentBankingDivision Fee…arrow_forwardPROVIDE Answer with calculationarrow_forwardAdrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $2,650 in child care expenses so that she would be able to work. Of this amount, $780 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $2,200 from her jewelry business. In addition, she received child support payments of $21,400 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forward

- Vertical analysis Two income statements for Cornea Company follow: Cornea Company Income Statements For the Years Ended December 31 20Υ9 20Y8 Fees earned $1,640,000 $1,300,000 Expenses (869,200) (715,000) Net income $770,800 $585,000 Required: a. Prepare a vertical analysis of Cornea Company's income statements. Cornea Company Income Statements For the Years Ended December 31 20Y9 20Y8 Amount Percent Amount Percent Fees earned $1,640,000 % $1,300,000 % Expenses (869,200) % (715,000) Operating income $770,800 % $585,000 % b. Does the vertical analysis indicate a favorable or an unfavorable trend? Favorable varrow_forwardComparative data on three companies in the same service industry are given below: Required: 2. Fill in the missing information. (Round the "Turnover" and "ROI" answers to 2 decimal places.) A B C Sales $5,267,000 $1,630,000 Net Operaring Income $737,380 $260,800 Average operating assets $2,290,000 $2,570,000 Margin 6% Turnover 1.60 Return on Investment (ROI) 8%arrow_forwardSolve this problemarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education