Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

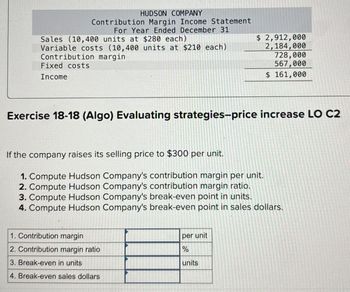

Transcribed Image Text:HUDSON COMPANY

Contribution Margin Income Statement

For Year Ended December 31

Sales (10,400 units at $280 each)

Variable costs (10,400 units at $210 each)

Contribution margin

Fixed costs

Income

$ 2,912,000

2,184,000

728,000

567,000

$ 161,000

Exercise 18-18 (Algo) Evaluating strategies-price increase LO C2

If the company raises its selling price to $300 per unit.

1. Compute Hudson Company's contribution margin per unit.

2. Compute Hudson Company's contribution margin ratio.

3. Compute Hudson Company's break-even point in units.

4. Compute Hudson Company's break-even point in sales dollars.

1. Contribution margin

2. Contribution margin ratio

3. Break-even in units

4. Break-even sales dollars

per unit

%

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (10,500 units at $225 each) Variable costs (10,500 units at $180 each) Contribution margin Fixed costs Income $ 2,362,500 1,890,000 472,500 369,000 $ 103,500 Exercise 5-18 (Algo) Evaluating strategies-price increase LO C2 If the company raises its selling price to $240 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars. 1. Contribution margin 2. Contribution margin ratio 3. Break-even in units 4. Break-even sales dollars per unit % unitsarrow_forwardHudson Company reports the following contribution margin income statement. \table[[\table[[HUDSON COMPANY], [Contribution Margin Income Sta], [For Year Ended December 3]],], [\table [[Sales units at $225 each)], [Variable costs units at $180 each)], [Contribution margin], [Fixed costs]],\table[[$2,160,000arrow_forwardA company has following details for this yearDetails Total sales($) Total cost($) Details Total sales($) Total cost($)Year ended 31/12/2018 35,78,998 25,89,709Year ended 31/12/2019 48,90,742 31,67,984 Calculate P/V ratio, Fixed cost, break even sales, Margin of safety 2018/2019, Variable cost 2018/2019and percent of fixed cost 2018/2019arrow_forward

- CVP Analysis, *What IT?" AnalysisKevin Co. projected contribution-format income statement for the upcoming month is shownBelow Sales (500 units) $10000Variable expenses. 4000Contributions margin. 6000Fixed expenses. 1000Net operating income. 5000Required:a.) Compute the breakeven point in units.b) Compute the breakeven paint in dollars.c.) If the company wishes to earn a monthly target profit of $10,000, how many units must be sold each month?d.) Compute the company's margin of safety. State your answer in both dollar and percentage terms,e.) The company's manager thinks that adding a salaried sales staff member at a cost of 52,000 per month will increase sales by $4,000 per month. If he is correct, what will be the net dollar advantage or disadvantage of making this change?t.) Refer to the original data, the company's manager believes that a new production process will improve profitability. He plans to add new machinery that will cut variable expenses…arrow_forwardSubject: acountingarrow_forwardpls help asaparrow_forward

- Save & Exit Submit The BX68490 company has provided its contribution format income statement for a given month. Sales (7,200 units) Variable expenses Contribution margin Fixed expenses $338,400 194,400 144,000 103,500 Net operating income $ 40,500 If the BX68490 company sells 7,100 units next month, how much would its net operating income expected to be next month? (Do not round intermediate calculations.) Multiple Choice $40,500 $39,979 17,650 56 MAR tv 14arrow_forwardDeterminant Company is a price−taker and uses a target−pricingapproach. Refer to the following information: Production volume 602,000 units per year Market price $34 per unit Desired operating income 17% of total assets Total assets $13,800,000 What is the target full product cost in total for the year? Assume all units produced are sold. Question content area bottom Part 1 A. $13,800,000 B. $18,122,000 C. $2,346,000 D.$ 102, 340arrow_forwardWildhorse Company has the following information available for September 2022. Unit selling price of video game consoles Unit variable costs Total fixed costs Units sold $470 $329 $50,760 600arrow_forward

- Required information Use the following information for the Exercises below. (Algo) [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (10,300 units at $375 each) Variable costs (10,300 units at $300 each) Contribution margin Fixed costs Income Exercise 18-18 (Algo) Evaluating strategies-price increase LO C2 If the company raises its selling price to $400 per unit. 1. Compute Hudson Company's contribution margin per unit. 2. Compute Hudson Company's contribution margin ratio. 3. Compute Hudson Company's break-even point in units. 4. Compute Hudson Company's break-even point in sales dollars. 1. Contribution margin 2. Contribution margin ratio 3. Break-even point 4. Break-even sales dollars $ 3,862,500 3,090,000 772,500 600,000 $ 172,500 per unit % unitsarrow_forwarddo not ive answer image formetarrow_forwardHanshabenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub