FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

1. How much was this businesses inventory sold for in the year ended December 31, 2022?

2. On the december 31, 2022 balance sheet , this businesses beginning inventory balance was more than its ending inventory balance. True or false?

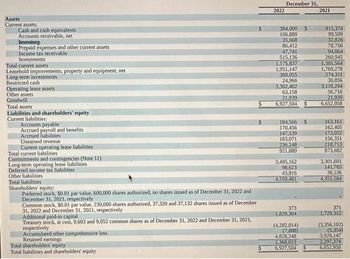

Transcribed Image Text:Assets

Current assets:

Cash and cash equivalents

Accounts receivable, net

Inventory

Prepaid expenses and other current assets

Income tax receivable

Investments

Total current assets

Leasehold improvements, property and equipment, net

Long-term investments

Restricted cash

Operating lease assets

Other assets

Goodwill

Total assets

Liabilities and shareholders' equity

Current liabilities:

Accounts payable

Accrued payroll and benefits

Accrued liabilities

Unearned revenue

Current operating lease liabilities

Total current liabilities

Commitments and contingencies (Note 11)

Long-term operating lease liabilities

Deferred income tax liabilities:

Other liabilities

Total liabilities

Shareholders' equity:

Preferred stock, $0.01 par value, 600,000 shares authorized, no shares issued as of December 31, 2022 and

December 31, 2021, respectively

Common stock, 50.01 par value, 230,000 shares authorized, 37,320 and 37,132 shares issued as of December

31, 2022 and December 31, 2021, respectively

Additional paid-in capital

Treasury stock, at cost, 9,693 and 9,052 common shares as of December 31, 2022 and December 31, 2021,

respectively

Accumulated other comprehensive loss

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

2022

December 31,

384,000 $

106,880

35,668

86,412

47,741

515,136

1,175,837

1,951,147

388,055

24,966

3,302,402

63,158

21,939

6,927,504

184,566

170,456

147,539

183,071

236,248

921,880

3,495,162

98,623

43,816

4,559,481

373

1,829,304

(4,282,014)

(7,888)

$

4,828,248

2,368,023

6,927,504 $

2021

815,374

99,599

32,826

78,756

94,064

260,945

1,381,564

1,769,278

274,311

30,856

3,118,2941

56,716

21,939

6,652,958

163,161

162,405

173,052

156,351

218,713

873,682

3,301,601

141,765

38,536

4,355,584

371

1,729,312

(3,356,102)

(5,354)

3,929,147

2,297,374

6,652,958

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 13, please answer the following question, thanksarrow_forwardA čompany uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 9, 2021, for $57,000 and then sells this inventory on account on March 7, 2021, for $74,000. Record the transactions for the purchase and sale of the inventory. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list EX: ...... Record the purchase of inventory on account. 2 Record the sale of inventory on account. Record the cost of inventory sold. Credit Note : journal entry has been entered %3D View general journal Clear entry Record entryarrow_forwardPlease help mearrow_forward

- need to enter the beginning balances in the summary and record the April transactions using a perpetual inventory system. include margin explanations for the changes in revenues and expenses please answer in text with workings and stepsarrow_forwardIf a company has goods in transit at the end of the year that were shipped FOB shipping point, how should these goods be accounted for on the company's books at the end of the year? a.The goods should be included in the inventory value at the end of the year. b.Half of the value of the goods in transit should be included in the inventory value at the end of the year. c.The goods should be excluded from the inventory value at the end of the year. d.The goods should be considered held for sale on consignment at the end of the year.arrow_forwardGarrow_forward

- help mearrow_forwardWhispering Winds Supply Company reports net income of $141,600 in 2023. The ending inventory did not include goods valued at $10,620 that Whispering Winds Supply had consigned to Staples. (For question answer please scroll far right) (1) What impact will this error have on the income statement for 2023? If ending inventory is ✓by $ (2) (3) What is the correct net income for 2023? The correct net income is $ 2 On the balance sheet, both inventory and retained earnings will be cost of goods sold will be What impact will this error have on the balance sheet at December 31, 2023? by $ and netarrow_forwardA company uses the periodic inventory method and the beginning inventory is overstated by $9,000 because the ending inventory in the previous period was overstated by $9,000. The amounts reflected in the current end of the period balance sheet are Assets Owner’s Equity Understated Understated Overstated Correct Overstated Overstated Correct Correctarrow_forward

- D C Prepare adjusting entry for inventory. BE5.6 (LO 4), AP At year-end, the perpetual inventory records of Litwin Company showed merchandise inventory of $98,000. The company determined, however, that its actual inventory on hand was $95,700. Record the necessary adjusting entry. Prepare closing entries for accounts.arrow_forwardUSE THE BELOW INCOME STATEMENT AND INFORMATION TO ANSWER THE NEXT FOUR QUESTIONS AND COMPLETE THE INCOME STATEMENT. Net Sales Cost of Goods Sold Selling Expenses Administrative Expenses Interest Expenses Other Expenses Income before Taxes Income Tax Expenses Net Income ● ● MY Company Income Statement December 31, 2018 (Amounts in thousands) Use the following ratio data to complete FS Company's income statement. Inventory turnover is 4 (beginning inventory was $895: ending inventory was $758). Inventory turnover = cost of goods sold / Average inventory Rate of Return on Sales is 0.15 O $10,500 (a) $2,561 $458 (b) $554 $2,046 (c) (d)arrow_forwardPrepare a multiple-step income statement for November.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education