ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

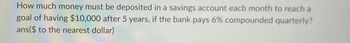

Transcribed Image Text:How much money must be deposited in a savings account each month to reach a

goal of having $10,000 after 5 years, if the bank pays 6% compounded quarterly?

ans($ to the nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Assume that you deposited $750 in an account 5 years ago with 12% annual interest rate. How much money do you get in that account now?Use Compound interest only and check your answer with interest table.arrow_forwardA series of equal semi-annual payments of $1,500 for 3 years is equivalent to what present amount at an interest rate of 12%, compounded annually? (All answers are rounded to nearest dollars.)arrow_forwardTyped plz and asap thanksarrow_forward

- jerry bought a house for $400,000 and made an $80,000 down payment. the rest of the cost was paid with a 30 year loan. payments were paid monthly. the nominal annual interest rate was 6% after 10 years he sold the house and paid the remainder of the loan balance. A- what was his monthly loan payment? B- what was the loan payoff amount?arrow_forwardComplete solution pleasearrow_forwardCompute the effective annual rate of interest (a) for 6% compounded monthly; (b) at which $1100 will grow to $2000 in seven years compounded monthly. Please write to text formet answerarrow_forward

- You want to borrow $1500 at 8% and you are willing to pay $210 in simple interest.How long can you keep the moneyarrow_forwardSuppose you take out a car loan of $15,000 with an interest rate of 15% compounded monthly. You will pay off the loan over 36 months with equal monthly payments.(a) What is the monthly interest rate?(b) What is the amount of the equal monthly payment?(c) What is the interest payment for the 15th payment?(d) What is the total interest paid over the life of the loan?arrow_forwardScott deposited $1,000 at the end of every month into an RRSP for 8 years. The interest rate earned was 4.50% compounded semi-annually for the first 4 years and changed to 4.75% compounded monthly for the next 4 years. What was the accumulated value of the RRSP at the end of 8 years?arrow_forward

- 2.5 To purchase a new truck, you borrow $42,000. The bank offers an interest rate of 7.5% compounded monthly. If you take a 5-year loan and you will be making monthly payments, what is the total amount that must be paid back? a. What is the number of time periods (n) you should use in solving this problem? b. What rate of interest (i), per period of time, should be used in solving this problem?arrow_forwardTyped plz and Asap thanksarrow_forwardJim Duggan made an investment of $10,000 in a savings account 10 years ago. This account paid interest of 5 1/2% for the first 4 years and 6 1/2% interest for the remaining 6 years. The interest charges were compounded quarterly. How much is this investment worth now?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education