FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

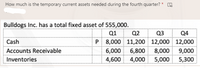

Transcribed Image Text:How much is the temporary current assets needed during the fourth quarter? *

Bulldogs Inc. has a total fixed asset of 555,000.

Q1

Q2

Q3

Q4

Cash

P 8,000 11,200

12,000 12,000

Accounts Receivable

6,000 6,800

8,000

9,000

Inventories

4,600

4,000

5,000

5,300

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Q4 Libscomb Technologies' annual sales are $6,743,847 and all sales are made on credit, it purchases $3,304,291 of materials each year (and this is its cost of goods sold). Libscomb also has $535,216 of inventory, $1,475,000 of accounts receivable, and $1,400,000 of accounts payable. Assume a 365 day year. What is Libscomb’s Receivables Period (in days)?arrow_forward► CRC Inc. is buying new equipment that has the following cash flows: Year Cash Flow O-$17.7 What is the NPV if the interest rate is $6%? O $482.24 D -$537.78 0 -$500 O $22.44 1 $100 2 $200 3 $250arrow_forwardQuestion 2 Consider a 100,000 sqf office building with the following cash flows: The gross rent in year 1 is $30/sqf/year and the rents are expected to grow at 2% per year. The operating expenses in the first year are $5/sqf/year and are expected to increase at 3% per year. There are no capital expenditures. All cash flows are in arrears. The discount rate for the property is 9%. a. What is the value of the building if the building will be held and rented indefinitely? What is the cap rate at time 0? b. What is the value of the building if the building is sold at the end of 10 years at a 8% cap rate? What is the cap rate at time 0?arrow_forward

- With the following information, fill in the bank given using the specified format. (For example: 40 days) Days of working capital is _______ Annual Sales Revenue $3,650,000 Accounts Payable 300,000 Accounts Receivable 400,000 Cash 35,000 Mortgage 95,000 Equipment 200,000 Short-term Loan 100,000 Goodwill 75,000 Inventory 500,000arrow_forwardHi There, I need ask a favor... How to calculate "Current Liabilites" if I only know, these following data : - Cash and Equivalents : $ 100.00 - Fixed Assets : # 283.50 - Sales : $ 1,000.00 - Net Income : $ 50.00 - Quick Ratio : 2.0 x - Current Ratio : 3.0 x - DSO : 40 Days - ROE : 12% Thank youarrow_forwardM6arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education