FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

How much is the Doubtful accounts expense for 2019?

A. 47,000

B. 62,000

C. 63,500

D. 65,000

What is the net amount of

A. 873,000

B. 886,500

C. 900,000

D. 1,000,000

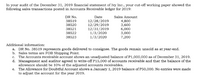

Transcribed Image Text:In your audit of the December 31, 2019 financial statement of Ivy Inc., your cut-off working paper showed the

following sales transactions posted in Accounts Receivable ledger for 2019:

DR No.

Date

Sales Amount

12/28/2019

12/29/2019

12/31/2019

1/3/2020

1/3/2020

38519

4,800

3,600

38520

38521

38522

6,000

3,000

7,200

38523

Additional information:

a. DR No. 38519 represents goods delivered to consignee. The goods remain unsold as at year-end.

b. Sales terms are FOB Shipping Point.

c. The Accounts receivable account shows an unadjusted balance of P1,000,000 as of December 31, 2019.

d. Management and auditor agreed to write-off P15,000 of accounts receivable and that the balance of the

allowance should be 10% of the adjusted accounts receivables.

The Allowance for Doubtful Account shows a January 1, 2019 balance of P50,000. No entries were made

to adjust the account for the year 2019.

е.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- At what amount will accounts receivable for Anderson Company be reported on the balance sheet if the gross receivable balance is $52,000 and the allowance for doubtful accounts is estimated at 4% of gross receivables? Select one: A. $28,200 B. $49,920 C. $52,960 D. $47,000arrow_forwardWhich option below correctly indicates how an unfavourable balance of the bank account in the general ledger at 31 May 2021 should be dealt with when doing a bank reconciliation? Select one: a. By debiting the bank reconciliation statement as at 31 May 2021 b. By crediting the bank statement for May 2021 c. By crediting the bank reconciliation statement as at 31 May 2021 d. By debiting the bank statement for Please don't provide solution image based thnkuarrow_forward3. From the following information relating to Bank Şobar, prepare Income Statement for the year ended 31st March 2020. Show the calculations separately. (PREPARED SHEDULES) Particulars Interest on overdraft Establishment Interest on bill discounted R.O 550,000 70,000 300,000 Rent Salaries 25,000 15,000 Interest on savings Printing and stationery Interest on fixed deposits Commission Interest on loan Interest on Borrowing Interest on cash credit Administration's fees Postage and telegram Maintenance expenses General Reserve 80,000 5,900 55,000 90,000 45,000 42,000 275,000 7,000 2,500 8,400 50,000 30.000 Loan Additional information: 1. Provide OMR 50,000 for doubtful debts 2. Provide OMR 120,000 for taxation 3. Rebate on bills discounted on 31-03-20 OMR 60,000 4. Dividend proposed to pay OMR 30,000 5. Last year Profit OMR 100,000arrow_forward

- Are 1 year certificates of deposit recorded on bank reconciliation?arrow_forwardProblem Solving. Required: 1. Prepare a properly classified bank reconciliation statement for each of the problems given below.2. Prepare the necessary adjusting journal entries on the company’s book for book reconciling items.arrow_forwardAfter the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $743,691 and Allowance for Doubtful Accounts has a balance of $20,139. What is the net realizable value of the accounts receivable? Select the correct answer. $723,552 $20,139 $763,830 $743,691arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education