Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:↑

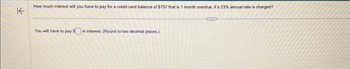

How much interest will you have to pay for a credit card balance of $757 that is 1 month overdue, if a 23% annual rate is charged?

You will have to pay $ in interest. (Round to two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The simple interest charged on a 11-month loan of $54,000 is $732. Find the simple interest rate. (Round your answer to one decimal place.)arrow_forwardYou wish to make 4 equal annual deposits into a savings account such that at the time of your last deposit there is $108,581 in the savings account. If the interest rate on the account is an annual nominal interest rate of 3.9% compounded daily, how much must the equal annual deposits be? Provide an exact answer to two decimal places. -Be sure to use the correct annual interest rate when determining the required annual deposit (i.e. you must use the effective annual interest rate) -Use 365 days for the number of days in a yeararrow_forwardYou deposit $ 70,565 in your account today. You make another deposit at t = 1 of $ 51,167 . How much will there be in your account at the end of year 2 if the interest rate is 19 percent p.a.? (Record your answer without a dollar sign, without commas and round your answer to 2 decimal places; that is, record $3,245.847 as 3245.85). Your Answer:arrow_forward

- Your credit card has a balance of $4500 and an interest rate of 22%. The credit card requires a minimum payment of 3%. What is your minimum payment? What is your interest for 1 month? What is your new balance?arrow_forwardIf you sign a discount note for $9,500 at a bank discount rate of 9% for 3 months, what is the effective interest rate (as a %)?arrow_forwardOnly type answer and give answer fastarrow_forward

- calculate the monthly finance charge for the credit card transaction. Know that it takes 10 days for a payment to be received and recorded and that the month has 30 days . Round to the nearest cent. $4000 balance, 16%, $2500 payment what was the previous balance and the adjusted balance?arrow_forwardYou borrow $1,000 from the bank and agree to repay the loan over the next year in 12 equal monthly payments of $90. However, the bank also charges you a loan initiation fee of $18, which is taken out of the initial proceeds of the loan. What is the effective annual interest rate on the loan, taking account of the impact of the initiation fee? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Use a financial calculator or Excel. Effective annual interest rate 1.49 %arrow_forwardIf you deposit $700 in a bank account that earns 5 percent per year, how much total interest will you have earned after the third year? (Do not round intermediate calculations. Round your answer to 2 decimal places. (e.g., 32.16)) Total Interest =arrow_forward

- If you want to have $3,172 in 37 months, how much money must you put in a savings account today? Assume that the savings account pays 11% and it is compounded monthly. Round to two decimal places (Ex. $000.00)arrow_forwardToday, you purchased $5300 on a credit card that charges an APR rate of 22.9 percent, compounded monthly. How long will it take you to pay off this debt assuming that you do not charge anything else and make regular monthly payments of $100?arrow_forwardIf you earn 5% per year on your bank account, how long will it take an account with $110 to double to $220? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education