Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

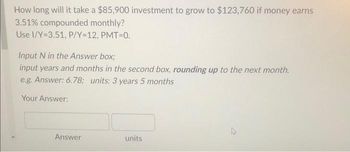

Transcribed Image Text:How long will it take a $85,900 investment to grow to $123,760 if money earns

3.51% compounded monthly?

Use I/Y=3.51, P/Y=12, PMT=0.

Input N in the Answer box;

input years and months in the second box, rounding up to the next month.

e.g. Answer: 6.78; units: 3 years 5 months

Your Answer:

Answer

units

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Determine the doubling time using P=24 000, Interest=5, Compounding Frequency=semi annually,Time= 20 yearsarrow_forwardHow long will it take $300 to accumulate to $800 at j12 = 7%? Assume that the practical method of accumulation is in effect. (Be sure to use linear interpolation.) Answer: 14 5 X years, 5 months and 29 Note: Carry four decimal places through all calculations. Your answers should be integers. X daysarrow_forwardThe following investment requires table factors for periods beyond the table. Using Table 11-1, create the new table factor, rounded to five places, and calculate the compound amount (in $, rounded to the nearest cent.) Time Nominal Interest New Table Compound Principal Period (years) Rate (%) Compounded Factor Amount $17,000 29 annually $ Need Help? Read Itarrow_forward

- Sdarrow_forwardHow much will $3,000 invested at the end of each year grow to in 4 years, assuming an interest rate of 11% compounded annually? Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, and PVA of $1). Multiple Choice $13,663 $14,129 О $12,729 $13,200arrow_forwardi need the answer quicklyarrow_forward

- You put $53,330 into an investment account that earns 10.6% compounded semi- annually for the first 8 years; and 7.3% compounded monthly for the next 2 years. In your rough work, it may be helpful to draw a timeline. Input all calculator values, show dollar amounts with 2 decimals, ex.: 1234.56 Part 1: How much will be in the investment account after the first 8 years? N= 1/Y = P/Y = PV = FV = 1.325 53330 I A A A Aarrow_forwardAssume today is January 1 and you plan to invest $4,000 today in an account earning interest of 6% compounded semi-annually. You would like to calculate the amount your investment will grow to three years from now.Question: What should be the correct "n" and "i" to use for factor table purposes in order to answer your question?arrow_forwardIf an investment of $1147.00 earned interest of $252.00 at 7.5% compounded quarterly, for how many years and months was the money invested? State youin years and months (from 0 to 11 months) Need only handwritten solution only (not typed one).arrow_forward

- General Instruction: Use Yellow paper for your computation and answer. Task 1. Compute the interest of the following: 1. P25,000 at 6% simple interest for 1 year. 2. P30,000 at 9.5% simple interest for 90 days. 3. P60,000 at 12.5% simple interest for 2 years and 6 months.arrow_forwardSuppose an individual makes an initial investment of $1,400 in an account that earns 7.0%, compounded monthly, and makes additional contributions of $100 at the end of each month for a period of 12 years. After these 12 years, this individual wants to make withdrawals at the end of each month for the next 5 years (so that the account balance will be reduced to 50). (Round your answers to the nearest cent) (a) How much is in the account after the last deposit is made? (b) How much was deposited? 1 (e) What is the amount of each withdrawal? (0) What is the total amount withdrawn? - 3 Need Help?arrow_forwardHow long vwill it take an investment to triple if it earns: a.9.4% compounded annually? (Do not round your Intermedlate calculatlons and round your answer to the nearest month.) will triple in Tyears and months. b. 8.4% compounded quarterly? (Da not round your Intermedlate colculations and round your answer to the nearest month.) Will triple in Tyears and months. utarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education