Concept explainers

The DecorIdeas Company manufactures hand-crafted natural wood display

cupboards. Currently the company makes only one size of display cupboard, which is

60-inch height, 48-inch width, and 19-inch depth; and has 6 shelves. The final

product consists of a routed, sanded, assembled, and stained oak wood cupboard.

Direct materials include oak shelving wood and hickory plywood backing board.

Other materials, such as wood screws, sand paper, stain, wood glue, and packaging,

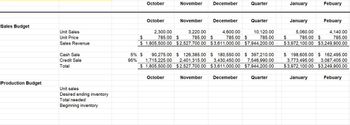

are treated as indirect materials. DecorIdeas is preparing budgets for the fourth

quarter ending December 31, 2022.

For each requirement below prepare budgets by month for October, November, and

December, and a total budget for the quarter. The previous year’s sales (2021/22) for

the corresponding period were:

October

November

December

January

February

2,000

2,800

4,000

4,400

3,600

display cupboards

display cupboards

display cupboards

display cupboards

display cupboards

The company expects the above volume of display cupboard sales to increase by 15%

for the period October 2022 – February 2023. The budgeted selling price for 2022 is

$785.00 per display cupboard. The company expects 5% of its sales to be cash

(COD) sales. The remaining 95% of sales will be made on credit. Prepare a Sales

Budget for DecorIdeas.

2. The company desires to have finished goods inventory on hand at the end of each

month equal to 15 percent of the following month's budgeted unit sales. On

September 30, 2022, there were 450 display cupboards on hand. (Note, an estimate of

sales in January is required in order to complete the production budget for

December). Prepare a Production budget.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

How is the desired closing inventory calculated?

How is the desired closing inventory calculated?

- Coastal Cycles makes three models of electric bicycles: E20, E35, and E60. The models differ by the size of the battery and the quality of the components. The bicycles are produced in two departments. The Assembly Department purchases components from vendors and assembles them into bicycles. The models E20 and E35 are complete and ready for sale after completing the assembly process. The model E60 undergoes further process in Customization Department, which is actually just a small area in the same building as the Assembly Department. Conversion costs in both the Assembly Department and Customization Department are based on the number of units produced. There are never any work-in-process inventories. Data for production in November are shown in the following table. Total E20 E35 E60 Units produced 11,500 4,500 4,000 3,000 Materials cost $ 8,590,000 $ 2,250,000 $ 3,040,000 $ 3,300,000 Conversion costs Assembly…arrow_forwardWaterway Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours x (54,000 + 10,200)]. Estimated annual manufacturing overhead is $1,573,108. Thus, the predetermined overhead rate is $16.34 or ($1,573,108 +96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models. The company's managers identified six activity cost pools and related…arrow_forwardEdlie Accessories (EA) makes travel bags, both for sale under their own label ("Branded") and for other resellers to put their label on the bags ("Private-Label"). The bags sold through the two channels are similar, but they differ slightly in the quality of materials and detail in the manufacturing process. The manufacturing plant at EA has two departments. Department A-101 was the original manufacturing facility and many of the machines are original. Department A-102 is new, with state-of-the-art equipment. The new equipment facilitates the additional care taken with the Branded product. The following information presents financial results for the two models from last year: Sales revenue Direct material Direct labor Manufacturing overhead Department A-101 Department A-102 Total overhead Private Label Branded Total $1,328,000 170,400 110,400 $ 784,000 $544,000 232,000 160,000 402,400 270,400 $ 217,600 269,120 $ 486,720 The product costing system at EA allocates manufacturing overhead…arrow_forward

- Watertime inc. manufactures old fashioned grandfather clocks. The production utilizes a highly automated assembly line. The firm has identified two cost categories: direct materials and conversion costs. During the production process each clock moves first through the Assembly Department, where materials are added and the clock is assembled, then through the Testing Department, where the clock is inspected for quality control. All direct materials are added at the beginning of the production process but conversion costs are allocated evenly throughout production. Spartans Inc. uses weighted-average costing. Data for Department A for June 2020 are: Beginning WiP Inventory 320 units Direct Materials (100% complete) Conversion (35% complete) Units started during June 750 units Ending WiP Inventory June 30 300 units Direct…arrow_forwardHomer Manufacturing produces different models of 22-calibre rifles. The manufacturing costs assigned to its economy model rifle before and afterinstalling JIT are given in the following table. Cell workers do all maintenance and are also responsible for moving materials, cell janitorial work, and inspecting products. Janitorial work outside the cells is still handled by the Janitorial Department. In both the pre- and post-JIT setting, 10,000 units of the economy model are manufactured. In the JIT setting, manufacturing cells are used to produce each product. The management of Homer Manufacturing reported a significant decrease in manufacturing costs for all of its rifles after JIT was installed. It also reported less inventory-related costs and a significant decrease in lead times. Accounting costs also decreased because Homer switched from a job-order costing system to a process-costing system. Before After…arrow_forwardRelevant information and assumptions: The DecorIdeas Company manufactures hand-crafted natural wood displaycupboards. Currently the company makes only one size of display cupboard, which is60-inch height, 48-inch width, and 19-inch depth; and has 6 shelves. The finalproduct consists of a routed, sanded, assembled, and stained oak wood cupboard.Direct materials include oak shelving wood and hickory plywood backing board.Other materials, such as wood screws, sand paper, stain, wood glue, and packaging,are treated as indirect materials. DecorIdeas is preparing budgets for the fourth quarter ending December 31, 2022. Prepare budgets by month for October, November, and December, and a total budget for the quarter. The previous year’s sales (2021/22) for the corresponding period were:October 2,000 display cupboardsNovember 2,800 display cupboardsDecember 4,000 display cupboardsJanuary 4,400 display cupboardsFebruary 3,600 display cupboardsThe company expects the above volume of display…arrow_forward

- Sonimad Sawmill, Inc. (SSI), purchases logs from independent timber contractors and processesthem into the following three types of lumber products:1. Studs for residential construction (e.g., walls and ceilings)2. Decorative pieces (e.g., fireplace mantels and beams for cathedral ceilings)3. Posts used as support braces (e.g., mine support braces and braces for exterior fencesaround ranch properties)These products are the result of a joint sawmill process that involves removing bark from thelogs, cutting the logs into a workable size (ranging from 8 to 16 feet in length), and then cuttingthe individual products from the logs, depending upon the type of wood (pine, oak, walnut, ormaple) and the size (diameter) of the log. The studs are sold as rough-cut lumber after emerging from the sawmill operation without fur-ther processing by SSI. Also, the posts require no further processing. The decorative pieces must be planed and further sized after emerging from the SSI sawmill. This…arrow_forwardCombat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi-purpose dry chemical at 480 PSI. The commercial model is a low-volume (10,200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PSI. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or [1.5 hours × (54,000 + 10,200)]. Estimated annual manufacturing overhead is $ 1,585,316. Thus, the predetermined overhead rate is $ 16.46 or ($ 1,585,316 ÷ 96,300) per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is $19 per unit for both the home and the commercial models.The company’s managers identified six activity cost pools and related…arrow_forwardO Hedwig Optical makes three models of binoculars: Travel, Sport, and Pro. The models differ by the size of the casing and the quality of the optics. The binoculars are produced in two departments. The Assembly Department purchases components from vendors and assembles them into binoculars. The Travel and Sport models are complete and ready for sale after completing the assembly process. The Pro model undergoes further processing in the Calibration Department, which is actually just a small area in the same building as the Assembly Department. Conversion costs in both the Assembly Department and Calibration Department are based on the number of units produced. There are never any work-in-process inventories. Data for production in January are shown in the following table: Units produced Materials cost Conversion costs Assembly Calibration Total conversion costs Travel Sport Pro Total 35,000 $ 1,645,000 Cost Per Unit $ 440,000 44,400 $ 484,400 Travel 17,500 Sport 13,125 4,375 $ 305,000…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education