Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

How does reciprocal accounting differ?

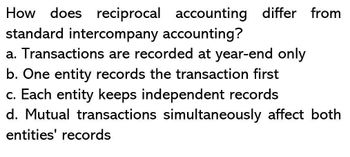

Transcribed Image Text:How does reciprocal accounting differ from

standard intercompany accounting?

a. Transactions are recorded at year-end only

b. One entity records the transaction first

c. Each entity keeps independent records

d. Mutual transactions simultaneously affect both

entities' records

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Standard Intercompany Accounting?arrow_forwardWhich of the following accounts is reciprocal account to the Investment inBranch account? A. Equity in Home OfficeB. None of the aboveC. Home Office capitalD. Branch Incomearrow_forwardWhich of the following is classified as current non-trade receivabke? A. Advances to affiliates B. Supplier's debit balances C. Accounts receivable D. Customers's credit balancearrow_forward

- Which of the following is not required to be disclosed under PAS 24? * A. A parent-subsidiary relationship when there were transactions between them during the period. B. The name of the parent of the entity’s associate C. Loans to officers D. A parent-subsidiary relationship when there were no transactions between them during the period.arrow_forwardWhich of the following is not a condition in identifying the contract with the customer as per IFRS 15? The entity and the customer have approved the contract and are committed to perform their contractual obligations It is certain that the entity will collect the consideration to which it is entitled Each party's rights with regard to the goods or services concerned can be identified The payment terms can be identified EN 2时 6 larrow_forwardA contract between one or more parties creates: a. the date that cash is paid by the customer b. enforceable rights and obligations for the parties c. revenue for recognition d. the fixed amount of payments for the good or servicearrow_forward

- Step 1 of the "five-step model" states that certain conditions must be satisfied before an entity can account for a contract with a customer. Which of the following is not one of these conditions? Oa The entity and the customer have approved the contract and are committed to perform their contractual obligations. O b. The payment terms can be identified. O citis certain that the entity will collect the consideration to which it is entitled. Od. Each party's rights about the goods or services concerned can be identified.arrow_forwardIn accordance with IFRS 15, customer loyalty awards on the goods or services sold, the transaction price received or receivable by the entity must be allocated between the goods or services sold and the customer loyalty awards redeemable in the future partly as revenue and partly as a liability. must be recognized in full as a liability. must be recognized in full as revenue. must be recognized in full as an expense.arrow_forwardProvide answerarrow_forward

- For PFRS 15 to apply, a contract with a customer should meet which of the following conditions? I. The contract has been approved by the parties to the contract. II. Each party's rights in relation to the goods or services to be transferred can be identified. III. The payment terms for the goods or services to be transferred can be identified. IV. The contract has commercial substance. V. It is probable that the consideration to which the entity is entitled to in exchange for the goods or services will be collected. A.I, III, IV and V B.I, II, III and IV C.I, II, III, IV and V D.I. II. III and Varrow_forwarddescribe general principles of revenue recognition and accrual accounting, specifi c revenue recognition applications (including accounting for long-term contracts, installment sales, barter transactions, gross and net reporting of revenue), and implications of revenue recognition principles for fi nancial analysisarrow_forwardMost agreements involving factoring of accounts receivable are made on a. O a. notification O b. market O c. non-market O d. non-notification O e. recourse basis.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub