FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

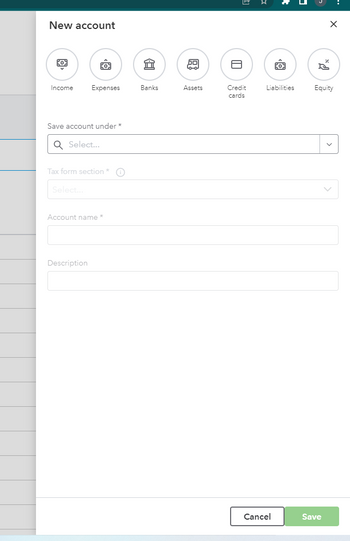

How do I create a new fixed asset account with an account type: Fixed Asset, detail type: Machinery & Equipment, name: Equipment and track deprecciation of this asset in QuickBooks? When I go to the Chart of Accounts to create a new account, I get the attached photo. There's no where to check the "track

Transcribed Image Text:New account

KO

Income Expenses Banks

Save account under *

Q Select...

Tax form section *

Select...

Account name *

E

Description

50

60

Assets

W

Credit

cards

»

Cancel

Po

Liabilities

X

Equity

Save

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Remodeling and rehabilitation: Can usually be undertaken by the property manager without consulting the owner or asset manager Are most likely categorized as operating expenses Are preventative measures undertaken to prevent a loss in value Are expected to add value to the property if undertakenarrow_forwardI need the answer as soon as possiblearrow_forwardFor each account listed, identify the category in which it would appear on a classified balance sheet. Use the following categories: Current Assets; Long-term Investments; Property, Plant, and Equipment; Intangible Assets; Current Liabilities; Long-term Liabilities; and Owner's Equity. If the item does not belong on the classified balance sheet, put an X. Account Category а. Land (used in operations) b. Accumulated Depreciation-Equipment c. Reed, Capital d. Service Revenue е. Investment in Starbucks Corporation (to be held long-term) f. Accounts Receivable g. Equipment h. Buildings i. Notes Payable (due in 10 years) j. Unearned Revenue k. Cash I. Accounts Payable m. Prepaid Rent n. Reed, Withdrawals o. Land (held for investment purposes) p. Depreciation Expensearrow_forward

- Please answer the following question Must choose from the following LIST OF ACCOUNTS: Accounts Payable Accounts Receivable Accumulated Amortization - Copvrights Accumulated Amortization - Customer Database Accumulated Amortization - Customer lists Accumulated Amortization - Development Costs Accumulated Amortization - Franchises Accumulated Amortization - Licences Accumulated Amortization - Patents Accumulated Amortization - Software Accumulated Amortization - Trademarks Accumulated Depreciation Accumulated Impairment Losses - Copyrights Accumulated Impairment Losses - Goodwill Accumulated Impairment Losses - Licences Accumulated Impairment Losses - Patents Accumulated Impairment Losses - Trade Names Accumulated Impairment Losses - Trademark Administrative Expenses Advances to Employees Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Bank Loans Buildings Cash Common Shares Cost of Goods Sold Depreciation Expense Equipment Gain on Disposal…arrow_forward1. What are the two main characteristics of intangible assets? 2. Why does the accounting profession make a distinction between internally created intangibles and purchased intangibles? 3. What are the factors to be considered in estimating the useful life of an intangible asset? 4. What is the nature of research and development cost? 5. Indicate the proper accounting form the following items. Organization Cost Advertising Cost Operating Lossesarrow_forwardDiscussionarrow_forward

- Depreciation under Diminishing Balance Method is calculated on? A. Scrap Value B. Book Value C. Cash Account D. Repair I will downvote for sure if u answer Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardI asked this question just earlier and received an inadequate answer that was not thorough or complete. I need to know the exact order of Assets and how they are recorded. Example I know Current Assets are listed first in order of Liquidity. I though Long Term Assets were next. So now I am confused. I am pasting the answer the prior individual gave me. Please make any corrections and be as clear as possible with terminology and provide examples. So I need a complete list of how Assets are recorded what they are called and examples of each type of Asset."Yes, There is a proper order of listing assets, current assets comes first in the order of liquidity and the comes the long term investment, fixed assets, intangibles.Tangibles and intangles assets are covered under Long term assets."arrow_forwardWhich of the following accounts would be classified as a fixed (property, plant and equipment asset)? Group of answer choices equipment accounts receivable cash accounts payablearrow_forward

- The following is an example of a contra account: Select one: Equipment Equipment expense Accounts payable Accumulated depreciationarrow_forwardI need help with a case problem. I don't know how to record these entries. 1. Monthly depreciation on the assets: $60 for the Music Instruments, $40 for the Furniture, and $35 for the Computers 2. Music supplies expense 3.The office supplies expensearrow_forwardIf a business has several types of long-lived assets such as equipment, buildings, and trucks, there should be only one accumulated depreciation account. there should be separate accumulated depreciation accounts for each type of long-lived asset. all the long-lived asset accounts will be recorded in one general ledger account. there is no need for an accumulated depreciation account. a Ob Oc Odarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education