Target Corporation believed it could increase the company’s profits by closing its stores in Canada. Other companies have also tried to improve their financial performance by downsizing. In November 2017, General Electric announced it would begin a downsizing operation that would result in their exiting businesses that were using over $20 billion in assets in the next one to two years. In January 2018, Newell Brands, the company whose products include Tupperware, Sharpie pens, Elmer’s Glue, and Rawlings sports products, announced it would be reducing its product offerings to the extent that it would close half of its facilities and reduce its revenues by 20 percent.

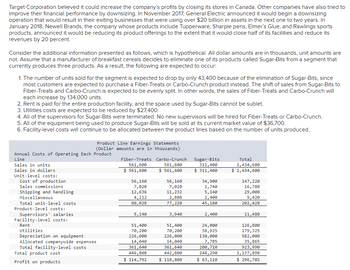

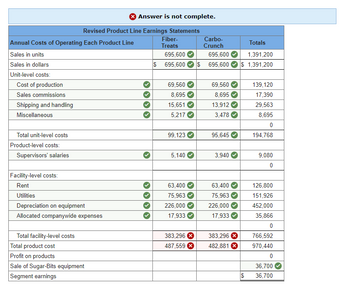

Consider the additional information presented as follows, which is hypothetical. All dollar amounts are in thousands, unit amounts are not. Assume that a manufacturer of breakfast cereals decides to eliminate one of its products called Sugar-Bits from a segment that currently produces three products. As a result, the following are expected to occur:

-

The number of units sold for the segment is expected to drop by only 43,400 because of the elimination of Sugar-Bits, since most customers are expected to purchase a Fiber-Treats or Carbo-Crunch product instead. The shift of sales from Sugar-Bits to Fiber-Treats and Carbo-Crunch is expected to be evenly split. In other words, the sales of Fiber-Treats and Carbo-Crunch will each increase by 134,000 units.

-

Rent is paid for the entire production facility, and the space used by Sugar-Bits cannot be sublet.

-

Utilities costs are expected to be reduced by $27,400.

-

All of the supervisors for Sugar-Bits were terminated. No new supervisors will be hired for Fiber-Treats or Carbo-Crunch.

-

All of the equipment being used to produce Sugar-Bits will be sold at its current market value of $36,700.

-

Facility-level costs will continue to be allocated between the product lines based on the number of units produced.

I am unable to get the total facility-level costs to add up properly. I'm not sure why as there are no other line items that should be required. Because this isn't adding up, the rest will be wrong as well.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

how did you get 695,600.00

how did you get 695,600.00

- Leland Industries is a producer of bakery and snack goods in Western Canada and are considering expending into Eastern Canada. The expansion is estimated to cost $10,000,000 for a new production facility. This project is in the same line of business as the firm's current operations and is therefore not expected to alter the risk of the firm. The most recent balance sheet is provided below. Leland Industries Balance Sheet As at Dec 31, 2021 Assets Liabilities Accounts Payable Other Current Liabilities $ Cash & Marketable Securities 425,000 300,000 Accounts Receivable $ 400,000 425,000 Inventories 500,000 Total Current Liabilities 725,000 Total Current Assets $ 1,325,000 Net Fixed Assets 18,000,000 LT Debt * 6,500,000 Preferred Stock ** 2,500,000 Common Stock*** 3,000,000 Retained Earnings 6,600,000 Total Liabilities & Total Assets $ 19,325,000 Owners Equity $ 19,325,000 Notes to financial statements: * The 5% semi-annual coupon bonds have a face value of $1,000, were issued 5 years ago…arrow_forwardLafayette Corp. is considering eliminating its mountain bike division, which reported an operating loss for the recent year of $6,000. The division sales for the year were $1,044,000 and the variable costs were $863,000. The fixed costs of the division were $187,000. If the mountain bike division is dropped, 30% of the fixed costs allocated to that division could be eliminated. The impact on operating income for eliminating this business segment would be: Multiple Choice $181,000 decrease $181,000 increase $124,900 decrease $56,100 decrease $50,100 decreasearrow_forwardBlue Corporation is a manufacturing company which has decided to introduce a new line of merchandise on January 25, 2019. The company has experienced significant revenue and earnings growth in recent years and anticipates future growth to decline slightly, yet remain consistent with the strong industry average (10-15% annual revenue growth). Blue has incurred certain patent costs and considerable attorney fees, in addition to survey costs, management studies, salaries, insurance, and quality inspections. Given the three alternative methods for handling research and experimental expenditures, which method(s) would be most appropriate for Blue Corporation? Explain Why? How should Blue Corporation’s manufacturing expenditures be reported?arrow_forward

- CarniTrin is a manufacturer of Carnival costumes in a highly competitive market. The company's management team is seeking guidance on the use of financial performance measures to identify the key drivers of the company's financial performance and develop a strategy to improve it. The following data relate to the company for the year 2022: In its clothing division, the company has $6,000,000 invested in assets. After-tax operating income from sales of clothing in 2022 is $900,000. Income for the clothing division has grown steadily over the last few years. The cosmetics division has $14,000,000 invested in assets and an after-tax operating income in 2022 of $1,900,000. The weighted-average cost of capital for CarniTrin is 10% and the 2021’s after-tax return on investment for each division was 15%. The general manager of CarniTrin has asserted that in the future, managers should have their compensation structure aligned with their performance measures with no fixed salaries. However,…arrow_forwardOn October 5, 2023, Diamond in the Bramble Recruiting Group Inc's board of directors decided to dispose of the Blue Division. A formal plan was approved. Diamond derives approximately 70% of its income from its human resources management practice. The Blue Division gets contracts to perform human resources management on an outsourced basis. The board decided to dispose of the division because of unfavourable operating results. Net income for Diamond was $89,320 for the fiscal year ended December 31, 2023 (after a charge for tax at 30% and after a writedown for the Blue assets). Income from operations of the Blue Division accounted for $3,920 (after tax) of this amount. Because of the unfavourable results and the extreme competition, the board believes that it cannot sell the business intact. Its final decision is to auction off the office equipment. The equipment is the division's only asset and has a carrying value of $24,000 at October 5, 2023. The board believes that proceeds from…arrow_forwardHorizon Corporation manufactures personal computers. The company began operations in 2012 and reported profits for the years 2012 through 2019. Due primarily to increased competition and price slashing in the industry, 2020’s income statement reported a loss of $20 million. Just before the end of the 2021 fiscal year, a memo from the company’s chief financial officer (CFO) to Jim Fielding, the company controller, included the following comments:If we don’t do something about the large amount of unsold computers already manufactured, our auditors will require us to record a write-down. The resulting loss for 2021 will cause a violation of our debt covenants and force the company into bankruptcy. I suggest that you ship half of our inventory to J.B. Sales, Inc., in Oklahoma City. I know the company’s president, and he will accept the inventory and acknowledge the shipment as a purchase. We can record the sale in 2021 which will boost our loss to a profit. Then J.B. Sales will simply…arrow_forward

- The Heinrich Tire Company recalled a tire in its subcompact line in December 2024. Costs associated with the recall were originally thought to approximate $55 million. Now, though, while management feels it is probable the company will incur substantial costs, all discussions indicate that $55 million is an excessive amount. Based on prior recalls in the industry, management has provided the following probability distribution for the potential loss: Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Loss Amount Probability $ 45 million 20% $35 million 50% $ 25 million 30% An arrangement with a consortium of distributors requires that all recall costs be settled at the end of 2025. The risk-free rate of interest is 8%. Required: 1. & 2. By the traditional approach to measuring loss contingencies, what amount would Heinrich record at the end of 2024 for the loss and contingent liability? For the remainder of this…arrow_forwardPlease help mearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education