ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

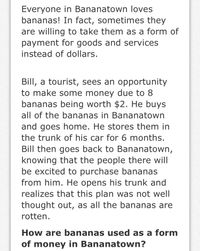

Transcribed Image Text:Everyone in Bananatown loves

bananas! In fact, sometimes they

are willing to take them as a form of

payment for goods and services

instead of dollars.

Bill, a tourist, sees an opportunity

to make some money due to 8

bananas being worth $2. He buys

all of the bananas in Bananatown

and goes home. He stores them in

the trunk of his car for 6 months.

Bill then goes back to Bananatown,

knowing that the people there will

be excited to purchase bananas

from him. He opens his trunk and

realizes that this plan was not well

thought out, as all the bananas are

rotten.

How are bananas used as a form

of money in Bananatown?

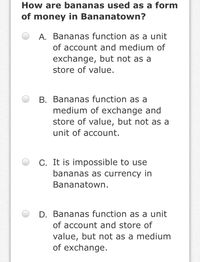

Transcribed Image Text:How are bananas used as a form

of money in Bananatown?

A. Bananas function as a unit

of account and medium of

exchange, but not as a

store of value.

B. Bananas function as a

medium of exchange and

store of value, but not as a

unit of account.

C. It is impossible to use

bananas as currency in

Bananatown.

D. Bananas function as a unit

of account and store of

value, but not as a medium

of exchange.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Currency is different from money in that currency______ A)is a note representing the worth of actual money B) is universally the same everywhere cannot be C)duplicated or counterfeit D) is not a means of paymentarrow_forwardGive typing answer with explanation and conclusionarrow_forwardYou're using prices to determine which apple is best (obviously Honeycrisp). What is the use of money in this context? -store of value -unit of account -discount sharing -medium of exchangearrow_forward

- Imagearrow_forwardUsing the information below compute the M2 money supply. The M2 money supply is $ Using the information below compute the M2 money supply. Category Currency and coin held by the public Checking account balances Traveler's checks Savings account balances Small denomination time deposits Money market deposit accounts in banks Noninstitutional money market fund shares The M2 money supply is $ Amount $200 $1,900 $10 $3,400 $5,000 $1,000 $2,000arrow_forwardMoney/Banking/The Quantity of Money Theory (Chapter 14) 1.1 What are the four functions of money? Explain each in your own words. Can something be considered money if it does not fulfill all four functions? 1.2 Using the five criteria in the textbook, explain how U.S. currency is suitable to use as a medium of exchange. 1.3 Suppose that you decide that you no longer want to hold currency, and deposit all of your currency holdings to your checking account. What is the immediate or initial impact of this transaction on M1 and M2?arrow_forward

- Celine, another manager at a different branch of MillerBank in a different region of the country, faces a reserve requirement of 10%. She has excess reserves 0f $1000. What’s the maximum amount that she could increase the money supply? a.500 dollars b.1000 dollars c.10000 dollars d.100 dollars e.2000 dollarsarrow_forwardpart-c: Suppose I live in a hypothetical country, Pandesia, where there is 100% reserve banking. I deposit $1,000 in a checking account at the 1st National Bank of Pandesia. Using the T-account (ie: assets on the left and liabilities on the right), explain whether / how my deposit changes the money supply in Pandesia. DON'T ANSWER PART C Just use part c to answer D part-d: Now suppose the Central Bank of Pandesia (CBP) decides that after centuries of 100% reserve banking, it is time for a change and decide to switch the Pandesian banking system to fractional reserve banking. To begin with, board of governors at the CBP agree on a required reserve ratio of 10%. How does my deposit of $1,000 at the 1st National Bank of Pandesia impact the money supply in Pandesia after this change? Explain by using the T-account. part-e: Next suppose that Pandesian economy enters a recession. To fight against the unemployment created by the recession, CBP decides to expand the Pandesian money supply.…arrow_forwardConsider the three functions of money discussed in class: medium of exchange, unit of account, and store of value. Choose one function and describe what it means. What would economic transactions be like without this function? Would life be better or worse?arrow_forward

- If raw whole eggs of uniform size were used as money, which of the following functions of money would be the hardest for this to satisfy? Select one: a. store of value b. unit of account c. medium of exchange d. certificate of goldarrow_forwardProblems and aplicarion q7arrow_forwardsuppose the required reserve ratio is 11%. How much additional money can BBB lend out at a maximum? suppose the required reserve ratio is lowered to 8%. What is the Maximum amount of additional money that BBB can lend out? Is this different than the maximum amount of new money BBB can create by itself? 3. suppose the required reserve ratio is raised to 15%. What is the maximum amount of additional money BBB can lend out?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education