Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

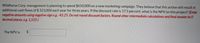

Transcribed Image Text:Wildhorse Corp. management is planning to spend $650,000 on a new marketing campaign. They believe that this action will result in

additional cash flows of $ 323,000 each year for three years. If the discount rate is 17.5 percent, what is the NPV on this project? (Enter

negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0

decimal places, e.g. 1,525.)

The NPV is

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Pls helps me all parts or kindly skiparrow_forwardOriole Company is considering an investment that will return a lump sum of $820,000, 6 years from now. Click here to view the factor table 1. Table 2 Table 3 Table 4 What amount should Oriole Company pay for this investment to earn an 7% return? (For calculation purposes, use 5 decim displayed in the factor table provided, e.g. 5.24571. Round answer to 2 decimal places, e.g. 25.25.) Oriole Company should pay 4 $arrow_forwardMasego Pty Ltd considers buying a Truck as the business expands. They are considering between buying Truck Y or Truck Z. They will be spending P140 000 on Truck Y and P160 000 on Truck Z. The discounting factor for the above trucks is 16%. The cash inflows and outflows are shown below: Truck Y Truck Z Net cash flow Net cash flow Year 0 (140000) (160000) 1 50000 85000 2 60000 90000 3 50000 75000 4 40000 65000 a) Calculate the payback period for each truck. Explain which truck the business should buy and why. b) Calculate the discounted payback for each truck. c) Determine the Net Present Value for each truck. d) Calculate the profitability index for each truck. e) Describe five advantages of the NPV method of capital budgeting.arrow_forward

- BOYDZ Condiments is a spice-making firm. Recently, it developed a new process for producing spices. The process requires new machinery that would cost $1,618,338, have a life of five years, and would produce the cash flows shown in the following table. Year Cash Flow 1 $442,372 2 -254,300 3 779,920 4 998,420 5 591,480 What is the NPV if the discount rate is 16 percent? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) NPV is $_______arrow_forwardWhat excel function do I use? Or is there a equation? I tried referring to the other answer on bartleby but it is wrongarrow_forwardEf 608.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education