FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

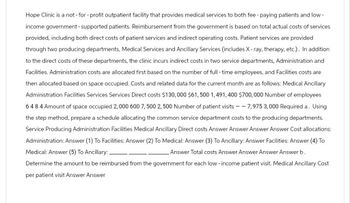

Transcribed Image Text:Hope Clinic is a not-for-profit outpatient facility that provides medical services to both fee - paying patients and low-

income government - supported patients. Reimbursement from the government is based on total actual costs of services

provided, including both direct costs of patient services and indirect operating costs. Patient services are provided

through two producing departments, Medical Services and Ancillary Services (includes X-ray, therapy, etc.). In addition

to the direct costs of these departments, the clinic incurs indirect costs in two service departments, Administration and

Facilities. Administration costs are allocated first based on the number of full-time employees, and Facilities costs are

then allocated based on space occupied. Costs and related data for the current month are as follows: Medical Ancillary

Administration Facilities Services Services Direct costs $130,000 $61,500 1,491,400 $700,000 Number of employees

64 8 4 Amount of space occupied 2,000 600 7,500 2,500 Number of patient visits -- 7,975 3,000 Required a. Using

the step method, prepare a schedule allocating the common service department costs to the producing departments.

Service Producing Administration Facilities Medical Ancillary Direct costs Answer Answer Answer Answer Cost allocations:

Administration: Answer (1) To Facilities: Answer (2) To Medical: Answer (3) To Ancillary: Answer Facilities: Answer (4) To

Medical: Answer (5) To Ancillary:

Answer Total costs Answer Answer Answer Answer b.

Determine the amount to be reimbursed from the government for each low-income patient visit. Medical Ancillary Cost

per patient visit Answer Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 2aarrow_forwardS1. Accountarrow_forwardA Record the gross charges for patient services, all charged to Patient Accounts Receivable, amounting $1,675,000. B Record the estimated contractual adjustments for patient services with third-party payors amounting $405,000. C Record the hospital estimated implicit price concessions would total $35,000. D Charity services, not included in transaction 1, would amount to $66,000 had billings been made at gross amounts. E Other revenues received in cash were parking lot, $20,000; cafeteria, $35,000; gift shop, $5,000. F Record the cash gifts restricted by the donor for programs amounting $32,000 for the year. G Record the $50,000 technician salaries supporting the program. H Record the reclassification of assets in satisfaction of program restrictions. I Mortgage bond payments amounted to $50,000 for principal and $28,000 for interest. Assume unrestricted resources are used. J During the year, the hospital received, in cash, unrestricted…arrow_forward

- Which one of the following costs is most likely to be deductible? Group of answer choices Fines paid for dumping toxic waste into a City of Denver park. Bribes to a city health inspector to ensure an “A” rating to a restaurant. The telephone bill for the headquarters of an illegal stolen car parts organization. Advertising costs for a Colorado marijuana dispensary.arrow_forwardWhat is certificate of need regulation? The process of granting "permission" for healthcare professionals to practice None of these State programs that require providers to submit annual budgets The approval required by many states before a new healthcare facility can be constructedarrow_forwardAssume that the entity is a private not-for-profit hospital. During Year 2, the hospital has two portfolios: patients with insurance and patients without insurance. Work with a standard charge of $2 million is done for the first group and work with a standard charge of $1 million is done for the second group. Insurance companies have contracts that create explicit price concessions. The hospital believes it has a 60 percent chance of collecting $1.5 million and a 40 percent chance of collecting $1.3 million. Because of the high cost of health care, uninsured patients receive a variety of implicit price concessions. The hospital believes it has a 70 percent chance of collecting $300,000 and a 30 percent chance of collecting $200,000. The hospital reported exchange revenue of $3 million and a provision for bad debt (a contra revenue account) of $1.2 million to drop the reported balance to the expected collection amount. Assume the hospital wants to use the most likely amount where…arrow_forward

- ACC5200/Summer21/Chapter 7: Homework Problems 1. Customer profitability analysis Worley Company buys surgical supplies from a variety of manufacturers and then resells and delivers these supplies to hundreds of hospitals. Worley sets its prices for all hospitals by marking up its cost of goods sold to those hospitals by 8%. For example, if a hospital buys supplies from Worley that had cost Worley $100 to buy from manufacturers, Worley would charge the hospital $108 to purchase these supplies. For years, Worley believed that the 8% markup covered its selling and administrative expenses and provided a reasonable profit. However, in the face of declining profits Worley decided to implement an activity-based costing system to help improve its understanding of customer profitability. The company broke its selling and administrative expenses into five activities as shown below: Total Activity 4,000 deliveries Total Cost Activity Cost Pool (Activity Measure) Customer deliveries (Number of…arrow_forward3. St. Joseph’s Hospital began operations in December 2023 with patient service revenues totaling $980,000 (based on customary rates) for the month. Of this, $207,000 is billed to patients, representing their insurance deductibles and copayments. The balance is billed to third-party payors, including insurance companies and government health care agencies. St. Joseph’s estimates that 20 percent of these third-party payor charges will be deducted by contractual adjustment. The hospital’s fiscal year ends on December 31. Required: Prepare the journal entries for December 2023. Assume 15 percent of the amounts billed to patients will be reduced through implicit price adjustments. Prepare the journal entries for 2024 assuming the following: $102,000 is collected from the patients during the year, and $9,800 of price adjustments are granted to individuals. Actual contractual adjustments total $157,000. The remaining receivable from third-party payors is collected. Note: For all…arrow_forwardO. Accountarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education