ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

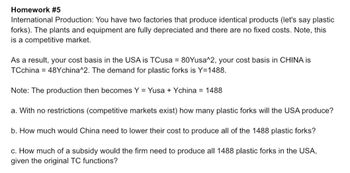

International Production: You have two factories that produce identical products (let's say plastic forks). The plants and equipment are fully depreciated and there are no fixed costs. Note, this is a competitive market.

As a result, your cost basis in the USA is TCusa = 80Yusa^2, your cost basis in CHINA is

TCchina = 48Ychina^2. The demand for plastic forks is Y=1488.

Note: The production then becomes Y = Yusa + Ychina = 1488

a. With no restrictions (competitive markets exist) how many plastic forks will the USA produce?

b. How much would China need to lower their cost to produce all of the 1488 plastic forks?

c. How much of a subsidy would the firm need to produce all 1488 plastic forks in the USA, given the original TC functions?

Transcribed Image Text:Homework #5

International Production: You have two factories that produce identical products (let's say plastic

forks). The plants and equipment are fully depreciated and there are no fixed costs. Note, this

is a competitive market.

As a result, your cost basis in the USA is TCusa = 80Yusa^2, your cost basis in CHINA is

TCchina 48Ychina^2. The demand for plastic forks is Y=1488.

Note: The production then becomes Y = Yusa + Ychina = 1488

a. With no restrictions (competitive markets exist) how many plastic forks will the USA produce?

b. How much would China need to lower their cost to produce all of the 1488 plastic forks?

c. How much of a subsidy would the firm need to produce all 1488 plastic forks in the USA,

given the original TC functions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Straker Industries estimated its short-run costs using a U-shaped average variable cost function of the form AVC = a + bQ + cQ2 and obtained the following results. Total fixed cost (TFC) at Straker Industries is $1,000. DEPENDENT VARIABLE: AVC R-SQUARE F-RATIO P-VALUE ON F OBSERVATIONS: 35 0.8713 108.3 0.0001 VARIABLE PARAMETER ESTIMATE STANDARD ERROR T-RATIO P-VALUE INTERCEPT 43.40 13.80 3.14 0.0036 Q −2.80 0.90 −3.11 0.0039 Q2 0.20 0.05 4.00 0.0004 If Straker Industries produces 12 units of output, what is estimated short-run marginal cost (SMC)? a. $28.04 b. $62.60 c. $32.40 d. $33.33arrow_forwardQ. The Ali Baba Co. is the only supplier of a particular type of Oriental carpet. The estimated demand for its carpets is Q = 112,000 – 500P + 5M Where Q = number of carpets, P = price of carpets (dollars per unit), and M = consumers’ income per capita. The estimated average variable cost function for Ali Baba’s carpets is AVC = 200 – 0.012Q + 0.000002Q2 Consumer’s income per capita is expected to be $20,000 and total fixed cost is $100,0000. a. How many carpets should the firm produce to maximize profit? b. What is the profit-maximizing price of carpets? c. What is the maximum amount of profit that the firm can earn selling carpets? d. Answer parts a through c if consumers’ income per capita is expected to be $30,000 instead Please answer d only.arrow_forwardA company manufactures Products A, B, and C. Each product is processed in three departments: I, II, and III. The total available labor-hours per week for Departments I, II, and III are 1020, 1080, and 900, respectively. The time requirements (in hours per unit) and the profit per unit for each product are as follows. Product A Product B Product C Dept. I 2 1 2 Dept. II 3 1 2 Dept. II 2 2 1 Profit $18 $12 $15 If management decides that the number of units of Product B manufactured must equal or exceed the number of units of products A and C manufactured, how many units of each product should the company produce to maximize its profit?arrow_forward

- You have charged your client $8,650 on a cost plus percentage purchase of two sofas, two lounge chairs, and three occasional tables. If the occasional tables were 30% of the total client cost, and all cost the same amount, what was the net price of these tables at a 15% markup? Explain.arrow_forwardWhat is the implied total cost of selling 500 units at the given market price of $550, as shown by the following graph?arrow_forwardA certain company has a selling price of for their product of 1500-3/4x dollars per unit and fixed costs of $800 and variable costs of 1/4x+1210 dollars per unit, where x is the total number of units produced. A.) FInd the Break even point? B.) When will the company make profit? C.) What is the make profit and the corresponding production level?arrow_forward

- Given the following functions for shoe factory in Ohio: fi: Qa=2(90-P) 1 P==Qs 4 Where Q is quantity and P is price. fz given is the Marginal Cost for the shoe factory but this producer often dumps left over materials such as glues and dyes directly into the sewer effecting ground water in the nearby town. An expert in the field discovered that the marginal damage is a constant $9. 1. What is the social marginal cost (show all working)? 2. What is the new equilibrium when pollution damage is taken into consideration for this market? 3. What is the total surplus when accounting for the damages? (Evaluate at the SMC level) - Draw the diagram and label. 4. What is the Deadweight loss for the pollution in the event that the producers do not pay for the damages? (Identify the DWL on your diagram) 5. What is the Total Social Surplus taking damages into account?arrow_forwardQ. The Ali Baba Co. is the only supplier of a particular type of Oriental carpet. The estimated demand for its carpets is Q = 112,000 – 500P + 5M Where Q = number of carpets, P = price of carpets (dollars per unit), and M = consumers’ income per capita. The estimated average variable cost function for Ali Baba’s carpets is AVC = 200 – 0.012Q + 0.000002Q2 Consumer’s income per capita is expected to be $20,000 and total fixed cost is $100,0000. a. How many carpets should the firm produce to maximize profit? b. What is the profit-maximizing price of carpets? c. What is the maximum amount of profit that the firm can earn selling carpets? d. Answer parts a through c if consumers’ income per capita is expected to be $30,000 instead.arrow_forwardThe total profit equation for the firm is p =-500-25x-10x^2 -4xy-5y^2+15y ;x +y =100 .where x and y represents output levels.Us8ng substitution method determine the profit maximizing output levels for x and y .arrow_forward

- The estimated short-run cost function of a Japanese beer manufacturer is C(q) = 0.6q Average cost before the tax is minimized at a quantity of q = 1.8 + 900 q At what positive quantity does the average cost function reach its minimum? If a $700 per-unit tax is applied to the firm, at what positive quantity is the after-tax average cost minimized? units. (Enter your response rounded to three decimal places.)arrow_forwardBoth answer is 30.931 Please show your work!!!!!arrow_forwardGlobal Corp. sells its output at the market price of $13 per unit. Each plant has the costs shown below Units of Output Total Cost ($) 0 8 1 11 2 17 3 26 4 38 5 53 6 71 7 92 What is the breakeven quantity? Enter 0 if total profit is always negative. Please specify your answer as an integer. What is the breakeven revenue? Enter 0 if total profit is always negative. Please specify your answer as an integer. What is the profit at each plant when operating at its optimal output level? Please specify your answer as an integer. How many units of output should each plant produce? Please specify your answer as an integer.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education