Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Home Page - JagApp

Week 15 - Homework #9 (100 points) i

ווח

ezto.mheducation.com

M Question 6 - Week 15 - Homework #9 (100 points) - Connect

Saved

+1 (415) 413-1032

O from your iPhone

20

20

6

points

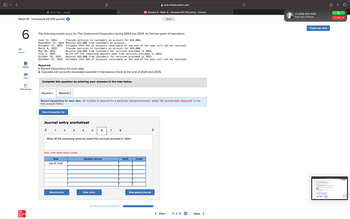

The following events occur for The Underwood Corporation during 2024 and 2025, its first two years of operations.

June 12, 2024

September 17, 2024

December 31, 2024

March 4, 2025

May 20, 2025

July 2, 2025

October 19, 2025

December 31, 2025

Provide services to customers on account for $41,000.

Receive $25,000 from customers on account.

Estimate that 45% of accounts receivable at the end of the year will not be received.

Provide services to customers on account for $56,000.

Receive $10,000 from customers for services provided in 2024.

Write off the remaining amounts owed from services provided in 2024.

Receive $45,000 from customers for services provided in 2025.

Estimate that 45% of accounts receivable at the end of the year will not be received.

eBook

Print

References

Mc

Graw

Hill

Required:

1. Record transactions for each date.

2. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Record transactions for each date. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the

first account field.)

View transaction list

Journal entry worksheet

< 1 2 3 4 5

6

7 8

Write off the remaining amounts owed from services provided in 2024.

Note: Enter debits before credits.

Date

July 02, 2025

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

< Prev

6 of 9

Next >

Check my work

6

←

Transcribed Image Text:Home Page - JagApp

Week 15 - Homework #9 (100 points) i

ווח

ezto.mheducation.com

M Question 6 - Week 15 - Homework #9 (100 points) - Connect

Saved

+1 (415) 413-1032

O from your iPhone

20

20

6

points

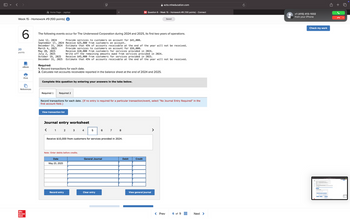

The following events occur for The Underwood Corporation during 2024 and 2025, its first two years of operations.

June 12, 2024

September 17, 2024

December 31, 2024

March 4, 2025

May 20, 2025

July 2, 2025

October 19, 2025

December 31, 2025

Provide services to customers on account for $41,000.

Receive $25,000 from customers on account.

Estimate that 45% of accounts receivable at the end of the year will not be received.

Provide services to customers on account for $56,000.

Receive $10,000 from customers for services provided in 2024.

Write off the remaining amounts owed from services provided in 2024.

Receive $45,000 from customers for services provided in 2025.

Estimate that 45% of accounts receivable at the end of the year will not be received.

eBook

Print

References

Mc

Graw

Hill

Required:

1. Record transactions for each date.

2. Calculate net accounts receivable reported in the balance sheet at the end of 2024 and 2025.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Record transactions for each date. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the

first account field.)

View transaction list

Journal entry worksheet

< 1 2 3 4

5

6 7 8

LO

Receive $10,000 from customers for services provided in 2024.

Note: Enter debits before credits.

Date

May 20, 2025

General Journal

Debit

Credit

Record entry

Clear entry

View general journal

< Prev

6 of 9

Next >

Check my work

←

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Home Page - JagApp Week 15 - Homework #9 (100 points) i ווח ezto.mheducation.com M Question 6 - Week 15 - Homework #9 (100 points) - Connect Saved +1 (415) 413-1032 O from your iPhone 20 20 6 points The following events occur for The Underwood Corporation during 2024 and 2025, its first two years of operations. June 12, 2024 September 17, 2024 December 31, 2024 March 4, 2025 May 20, 2025 July 2, 2025 October 19, 2025 December 31, 2025 Provide services to customers on account for $41,000. Receive $25,000 from customers on account. Estimate that 45% of accounts receivable at the end of the year will not be received. Provide services to customers on account for $56,000. Receive $10,000 from customers for services provided in 2024. Write off the remaining amounts owed from services provided in 2024. Receive $45,000 from customers for services provided in 2025. Estimate that 45% of accounts receivable at the end of the year will not be received. eBook Print References Mc Graw Hill Required:…arrow_forwardHome Page - JagApp Week 15 - Homework #9 (100 points) i ווח ezto.mheducation.com M Question 6 - Week 15 - Homework #9 (100 points) - Connect Saved +1 (415) 413-1032 O from your iPhone 20 20 6 points The following events occur for The Underwood Corporation during 2024 and 2025, its first two years of operations. June 12, 2024 September 17, 2024 December 31, 2024 March 4, 2025 May 20, 2025 July 2, 2025 October 19, 2025 December 31, 2025 Provide services to customers on account for $41,000. Receive $25,000 from customers on account. Estimate that 45% of accounts receivable at the end of the year will not be received. Provide services to customers on account for $56,000. Receive $10,000 from customers for services provided in 2024. Write off the remaining amounts owed from services provided in 2024. Receive $45,000 from customers for services provided in 2025. Estimate that 45% of accounts receivable at the end of the year will not be received. eBook Print References Mc Graw Hill Required:…arrow_forwardHome Page - JagApp Week 15 - Homework #9 (100 points) i 5 ווח ezto.mheducation.com ← Check my work M Question 5 - Week 15 - Homework #9 (100 points) - Connect Saved +1 (415) 413-1032 O from your iPhone On October 1, 2024, Ogneva Corporation loans one of its employees $40,000 and accepts a 12-month, 9% note receivable. Calculate the amount of interest revenue Ogneva will recognize in 2024 and 2025. 10 points Year Interest Revenue 2024 2025 eBook Print References Mc Graw Hill Aarrow_forward

- CengageNOWv2 | Online teachir x CengageNOWv2 |Online teach x v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator.. eBook Show Me How A Calculator Premium Anmortization On the first day of the fiscal year, a company issues an $8,000,000, 11%, five-year bond that pays semiannual interest of $440,000 ($8,000,000 x 11% x V=), receiving cash of $8,308,869. Journalize the first interest payment and the amortization of the related bond premium. Round to the nyarest dollar. If an amount box does not require an entry, leave it blank. Interest Expense X Premium on Bonds Payable / Cash Feedbark Bonds Payable is always recorded at face value. Any diferencein issue price s reflected in a premium or discount account. The straight-line method of amortization provides equal amounts of amortization over the ife of the bond, 000arrow_forwardווח M Question 11 - Week 11 - Homework #7 (100 points) - Connect Week 11 - Homework #7 (100 points) i 11 ezto.mheducation.com b) Success Confirmation of Question Submission | bartleby Saved Help Save & Exit Submit 00 8 points A company pays its employees $5,600 every two weeks ($400/day). The current two-week pay period ends on December 26, 2024, and employees are paid $5,600. The next two-week pay period ends on January 9, 2025, and employees will be paid $5,600. Record the adjusting entry on December 31, 2024. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) eBook Print References Mc Graw Hill View transaction list Journal entry worksheet 1 Record the adjusting entry on December 31, 2024. Note: Enter debits before credits. Date December 31, 2024 General Journal Debit Credit Record entry Clear entry View general journal Check my work 10 0 Carrow_forward&external_browser%3D0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question-group ter 8 homework i Saved Help Save & Exit Sub Check my wor Samuelson and Messenger (SAM) began 2021 with 200 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 100 units were purchased on January 8 for $28 each and another 200 units were purchased on January 19 for $30 each. Sales of 125 units and 100 units were made on January 10 and January 25, respectively. There were 275 units on hand at the end of the month. SAM uses a periodic inventory system. Required: 1. Calculate ending inventory and cost of goods sold for January using FIFO. 2. Calculate ending inventory and cost of goods sold for January using average cost. oped Complete this question by entering your answers in the tabs below. ook Required 1 Required 2 rint Calculate ending inventory and cost of goods sold for January using FIFO. rences Cost of Goods…arrow_forward

- Home Page - JagApp Week 15 - Homework #9 (100 points) i 10 1 points eBook Print References ווח ezto.mheducation.com M Question 1 - Week 15 - Homework #9 (100 points) - Connect Saved +1 (415) 413-1032 O from your iPhone At the end of the first year of operations, Mayberry Advertising had accounts receivable of $20,000. Management of the company estimates that 10% of the accounts will not be collected. What adjusting entry would Mayberry Advertising record to establish Allowance for Uncollectible Accounts? (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Mc Graw Hill View transaction list Journal entry worksheet 1 Record the adjusting entry for Allowance for Uncollectible Accounts. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Record entry Clear entry View general journal Check my work ←arrow_forwardMc Graw Hill M Question 5 - Week 11 - Homework #7 (100 points) - Connect Week 11 - Homework #7 (100 points) 110 ezto.mheducation.com bSuccess Confirmation of Question Submission | bartleby Saved 10 5 points eBook Fighting Irish Incorporated pays its employees $3,360 every two weeks ($240/day). The current two-week pay period ends on December 28, 2024, and employees are paid $3,360. The next two-week pay period ends on January 11, 2025, and employees are paid $3,360. Required: 1. Record the adjusting entry on December 31, 2024. 2. Calculate the 2024 year-end adjusted balance of Salaries Payable (assuming the balance of Salaries Payable before adjustment in 2024 is $0). Print Complete this question by entering your answers in the tabs below. References Required 1 Required 2 Calculate the 2024 year-end adjusted balance of Salaries Payable (assuming the balance of Salaries Payable before adjustment in 2024 is $0). Ending balance hwo to ss on macbook - Google Search Help Save & Exit…arrow_forwardHome Page - JagApp Week 15 - Homework #9 (100 points) i ווח ezto.mheducation.com M Question 4 - Week 15 - Homework #9 (100 points) - Connect Saved +1 (415) 413-1032 O from your iPhone 4 10 points Sanders Incorporated is a small brick manufacturer that uses the direct write-off method to account for uncollectible accounts. At the end of 2024, its balance for Accounts Receivable is $35,000. The company estimates that of this amount, $4,000 is not likely to be collected in 2025. In 2025, the actual amount of bad debts is $3,000. Record, if necessary, an adjusting entry for estimated uncollectible accounts at the end of 2024 and the actual bad debts in 2025. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list eBook Print References Mc Graw Hill Journal entry worksheet 1 2 Record the adjusting entry for estimated uncollectible accounts at the end of 2024. Note: Enter debits before credits. Date…arrow_forward

- Home Page - JagApp Week 15 - Homework #9 (100 points) i 7 10 points ווח ezto.mheducation.com M Question 7 - Week 15 - Homework #9 (100 points) - Connect Saved +1 (415) 413-1032 O from your iPhone A company has the following adjusted balances on December 31, 2024: Accounts Receivable = $75,000; Service Revenue = $400,000; Allowance for Uncollectible Accounts $5,000; Cash = $20,000. = Required: Calculate net accounts receivable. eBook Net accounts receivable Print References Mc Graw Hill Check my work 6 01010 ←arrow_forwardQuestion is attached in the screenshot greatly appreciate the help 13ylp14y1pl4hp2lhtplhpt3lh3ptlh35bzarrow_forwardRBYIYQQG7VOi1dyHlw/formResponse This is a required question Constantine Corporation has net income of P11.44 million and net revenue of P80 million in 2012. Its assets are P14 million at the beginning of the year and P18 million at the end of the year. What are Constantine's asset turnover and profit margin? * Choose This is a required question Boe Company has owners' equity of P400,000 and net income of P66,000. It has a payout ratio of 20% and a rate of return on assets of 15%. How much did Boe pay in cash dividends, and what were its average assets? * Choose This is a required question Plano Corporation reported net income P24,000; net sales P400,000; and average assets P600,000 for 2012. What is the 2012 profit margin ratio? * Choose This is a required question Back Next Never submit passwords through Google Forms. This form was created inside of Philippine Christian University. Report Abuse Google Formsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education